Reliance Steel & Aluminum Co. RS has inked a deal to acquire all outstanding equity interests and related real estate assets of American Alloy Steel, Inc. As part of the agreement, American Alloy’s five service centers and a plate fabrication business in the United States, along with its joint venture in Canada, will become part of the Reliance Steel family.

A Strategic Vision

The move is set to revitalize and energize Reliance Steel’s value-added processing abilities in key areas such as burning, cutting, rolling, and bevelling. Furthermore, American Alloy, with the previous year’s net sales totaling approximately $310 million, is expected to augment Reliance Steel’s product portfolio with specialty carbon steel plates and introduce new production capabilities.

This acquisition sets the stage for comprehensive collaboration, allowing the entity to explore unparalleled potential for growth while significantly expanding its product and service offerings in North America.

Future Steps

The transaction is anticipated to close within the next 60 days, subject to regulatory approval and customary closing conditions. Impressively, the current American Alloy team, including its management, is expected to remain in place following the closure of the acquisition.

Market Performance

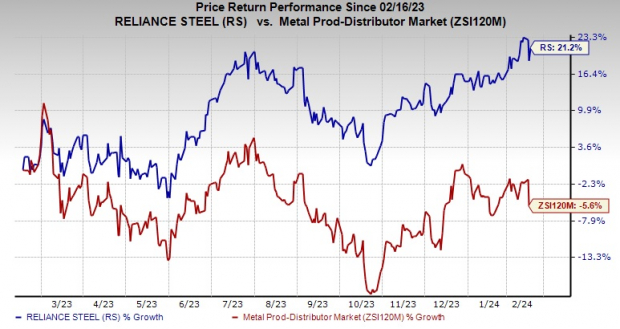

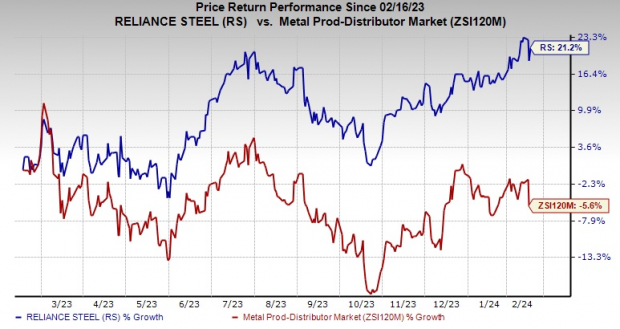

Over the past year, shares of Reliance Steel have surged by a staggering 21.2%, outperforming its industry which has seen a decline of 5.6%.

Image Source: Zacks Investment Research

Positive Indicators

Reliance Steel currently carries a Zacks Rank #2 (Buy). The company is well-poised to benefit from the acquisition, enhancing its prospects and performance in the months to come.

Investment Recommendations

Furthermore, other key picks in the basic materials space include United States Steel Corporation (X), Carpenter Technology Corporation (CRS), and Alpha Metallurgical Resources Inc. (AMR). These entities have been evaluated favorably in terms of their potential to deliver solid returns to investors.

United States Steel carries a Zacks Rank #1 (Strong Buy), having outperformed the Zacks Consensus Estimate in the last four quarters. Carpenter Technology, also carrying a Zacks Rank #1, has surpassed the Zacks Consensus Estimate in three of the past four quarters, with a notable average earnings surprise. Additionally, Alpha Metallurgical Resources has seen upward revisions of its current-year earnings, displaying strong potential with a Zacks Rank #1.

Independent Insights

The strategic acquisition of American Alloy offers a significant growth opportunity for Reliance Steel, driving it closer towards achieving a breakthrough in the market. Analysts and experts acknowledge the vast potential entwined with this acquisition, presenting it as an investment that can yield substantial returns in the foreseeable future.

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report