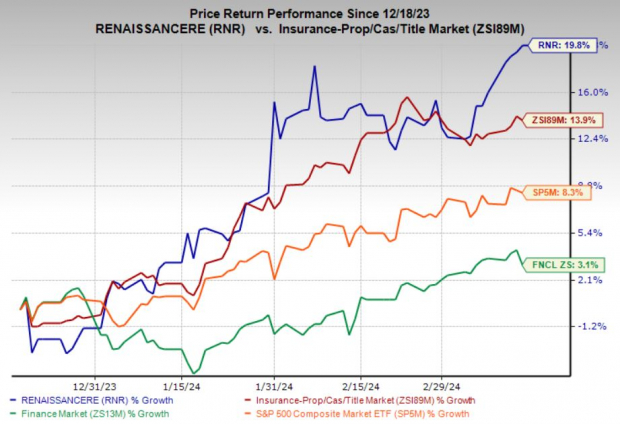

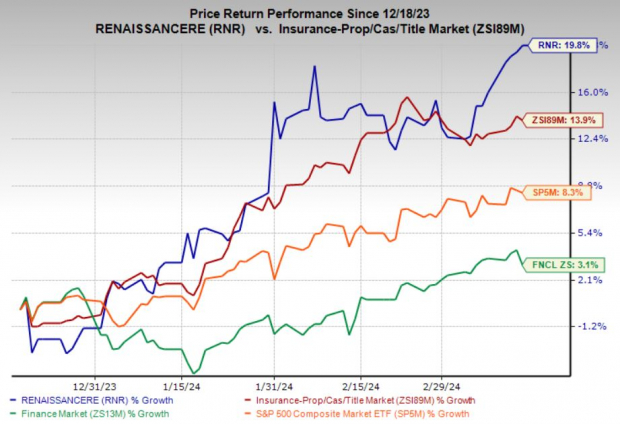

In the world of finance, where uncertainty reigns supreme, RenaissanceRe Holdings Ltd. has emerged as a beacon of growth and stability. Over the last three months, the company’s stock (RNR) has skyrocketed by an impressive 19.8%, surpassing the industry’s 13.9% surge. Nestled in Pembroke, Bermuda, RenaissanceRe is a stalwart provider of reinsurance and insurance solutions across domestic and international markets. Thanks to stellar performances in its Casualty and Specialty segments, the company currently boasts a market cap of $12.5 billion.

Surpassing the finance sector’s growth of 3.1% and the S&P 500 Index’s 8.3% rise, RenaissanceRe has positioned itself as a powerhouse in the industry. With burgeoning premiums, robust net investment income, and improved underwriting results, the company’s performance is on an upward trajectory. Its proactive approach to inorganic growth, coupled with the persistent demand for property and casualty reinsurance services, has been pivotal in propelling RenaissanceRe to its current status as a Zacks Rank #3 (Hold) entity.

Image Source: Zacks Investment Research

The Momentum Puzzle: Can RNR Keep the Ball Rolling?

With the gears of growth in full motion, let’s delve into the specifics to shed light on the company’s future trajectory. The Zacks Consensus Estimate for RenaissanceRe’s full-year 2024 earnings currently stands at a robust $34.35 per share, reflecting a 2.8% uptick over the past 60 days. Boasting five upward estimate revisions during this period without any downward movement, the company carries forward its streak of outperforming earnings expectations, with an average positive surprise of 24.8% over the past four quarters.

Looking ahead, the consensus forecast for full-year 2024 revenues looms large at nearly $11.1 billion, signaling a substantial 27.7% surge from the previous year. Projections echo significant growth in both premiums earned and investment income, bolstering the top-line performance of RenaissanceRe in the days to come.

The forecast models paint a promising picture, with anticipated year-over-year increments of around 21% in net premiums earned and a staggering 23% in net investment income for 2024. The strategic acquisitions of Validus Re, AlphaCat, and the Talbot Treaty reinsurance business from AIG have not only expanded the global footprint of RenaissanceRe’s property and casualty reinsurance arm but are also poised to enhance profitability substantially.

Amidst this backdrop of flourishing operations, RenaissanceRe demonstrates a commendable ability to generate substantial cash from its activities, facilitating strategic investments and shareholder value enhancement. Noteworthy is the company’s uptrend in net cash flow from operations, soaring by 19.2% to $1.9 billion in 2023 from the preceding year. Furthermore, the company’s unwavering commitment to shareholders is evidenced by its recent dividend hike of 2.6%, marking the 29th consecutive year of dividend increases.

The Tightrope of Risks

However, amidst the jubilation of growth prospects, caution flags are raised on the horizon. Rising operating costs and a sizeable debt load leading to increased interest expenses pose looming challenges for RenaissanceRe. Forecasts hint at a near 29% surge in total expenses year-over-year for the current fiscal year, potentially exerting pressure on the bottom line. Furthermore, the escalation in debt levels from $1.2 billion in late 2022 to nearly $2 billion as of December 31, 2023, warrants a vigilant gaze. Nonetheless, with a methodical and strategic action plan in place, the company is fervently pursuing its long-term growth trajectory.

The Gems in the Haystack

Venturing into the broader finance space unveils some hidden treasures beyond RenaissanceRe. Prime among them are stocks like Ryan Specialty Holdings, Inc., Root, Inc., and Brown & Brown, Inc., each adorned with a Zacks Rank #2 (Buy) at present. These promising entities beckon investors seeking to ride the wave of financial growth and market resilience.

Cast your gaze towards Ryan Specialty Holdings, with a Zacks Consensus Estimate for 2024 full-year earnings showing a robust 28.3% year-over-year surge. Root, Inc., on the other hand, displays a 23.1% improvement in full-year 2024 earnings estimates, with a notable uptick in revenue forecasts. As for Brown & Brown, the scene is equally promising, with expectations of $3.29 per share for full-year 2024 earnings, marking a substantial 17.1% year-over-year growth.

In the realm of stocks, where fortunes ebb and flow, these choices hold the promise of securing lucrative returns for astute investors. The dynamic interplay between market forces and company-specific strategies sets the stage for a captivating narrative of resilience and growth in the financial landscape.

7 Best Stocks for the Next 30 Days

Embark on a journey with our experts as they unveil the elite stocks from a pool of 220 Zacks Rank #1 Strong Buys. These handpicked gems display unparalleled potential for early price escalations, promising an average annual gain surpassing the market by more than 2X since 1988. A treasure trove awaits those who seek the wisdom of the market’s keenest observers.

Comprehensive Analysis of RenaissanceRe Holdings Ltd. (RNR) – Free Stock Report

Unlock the Potential of Brown & Brown, Inc. (BRO) – Free Stock Report

Discover the Growth Story of Root, Inc. (ROOT) – Free Stock Report

Unleashing the Potential of Ryan Specialty Holdings Inc. (RYAN) – Free Stock Report

Read the Full Article on Zacks.com Here

Explore More at Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.