Reflections to Contemplate…

“An ensemble of exceptional individuals without personal discipline will ultimately and inevitably fail. Character triumphs over talent.”

-James Kerr Legacy

A Bird’s-Eye View from Above

Looming on the horizon last week was a wave of inflation data, ranging from CPI and PPI to Import and Export Prices along with Insights from the New York Fed and the University of Michigan Survey. In a twist of fate, the previously prevailing disinflationary trends of 2023 have now dissipated, ushering in an upward shift in inflation expectations. This development places the Federal Reserve in a tight spot, as their previous stance on disinflationary patterns could now be put to the test. In the absence of reassuring evidence following the last Fed meeting, uncertainty looms over the policymakers, leaving a significant question mark as to the sustainability of the disinflationary landscape. Persisting market sentiments continue to drive rate cut expectations farther into the year, transitioning from an initial projection of six to seven cuts down to two to three. Despite this reset in rate outlooks, the S&P500 holdings still reflect a robust upward momentum with a year-to-date gain surpassing 6%. Another significant highlight was the disappointing retail sales data, which

The Market Landscape: Striking a Balancing Act Amidst Mixed Returns

Notable trends in news stories on Stock Market Bubbles and the Neutral Fed Funds Rate

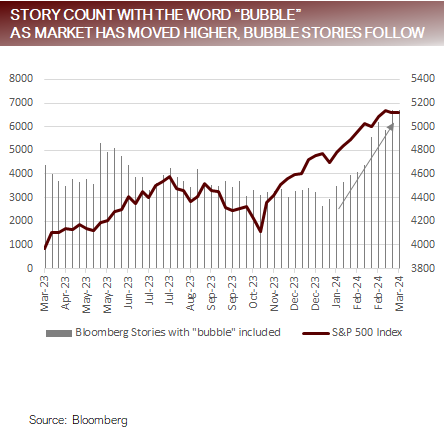

There has been a notable uptick in two topics covered in the media: Stock Market Bubbles & Neutral Fed Funds Rate.

Stock Market Bubbles

The basic premise most of the discourse surrounds is the influence of the Magnificent 7 on equity market performance since the equity market low in October 2023, which has lifted the index over 24% from that low point. Dating back further to the low in October 2022, the market has seen a lift of over 43% from that low point.

While comparisons range from tulips in 1637 to the NASDAQ in 2000, the conclusion of most who look at these issues highlights differences. The predominant dissimilarity is that the companies

Focus Point: Sector Rotation Update

Leadership is tilting towards defensives and inflation hedging sectors.

Exploring the Dynamics of Stock Market Bubbles and Neutral Rates

Unveiling the Earnings Growth Phenomenon

The companies propelling the surge in the S&P500 are not merely riding a speculative wave but are grounded in solid earnings growth. It’s not a whimsical speculative craze tied to unrealistic future promises but a sound foundation of financial performance.

Ray Dalio’s Bubble Analysis

Ray Dalio recently dissected the notion of a market bubble in a LinkedIn article. By evaluating various critical indicators, he concluded that the equity markets appear “frothy but not bubbly.” This insightful analysis provides a nuanced perspective on the current market sentiment.

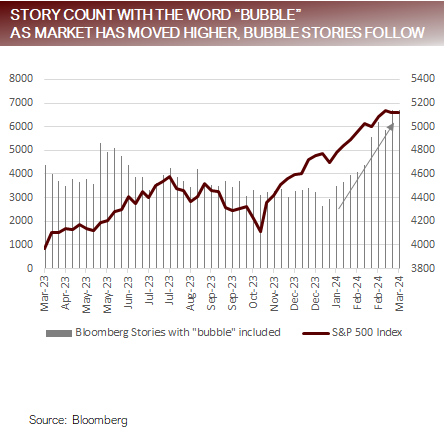

The Impact of Neutral Fed Funds Rate

The Federal Reserve Bank of St. Louis delved into the concept of the Neutral Interest Rate, the short-term interest rate when the economy hits full employment and stable inflation. Their findings suggest a potential upward shift in the Neutral Interest Rate post-pandemic due to enhanced productivity and increased public debt.

This shift may indicate a migration of the Neutral Interest Rate from the 2.0% to 2.5% range observed over the past decade, potentially increasing by 0.5% to 1.00%. This adjustment leaves the Fed with a shorter path to returning to a neutral stance.

Stock market bubbles and higher neutral rates signal investor skepticism of the rally’s durability

Exploring the Upside Surprises in Auto Insurance and Housing

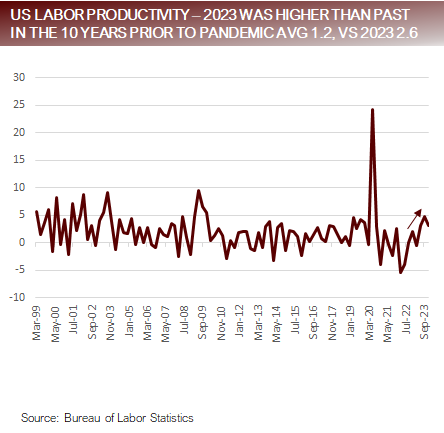

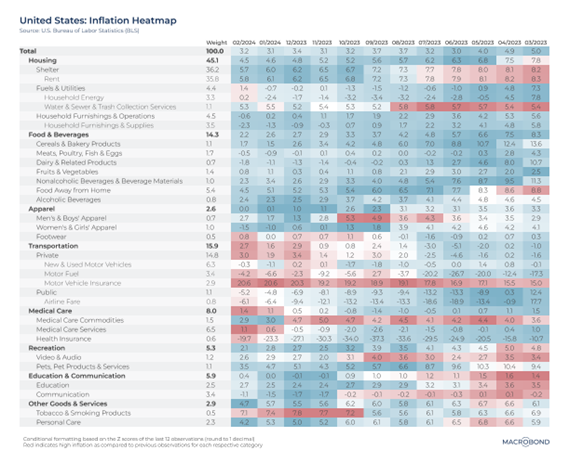

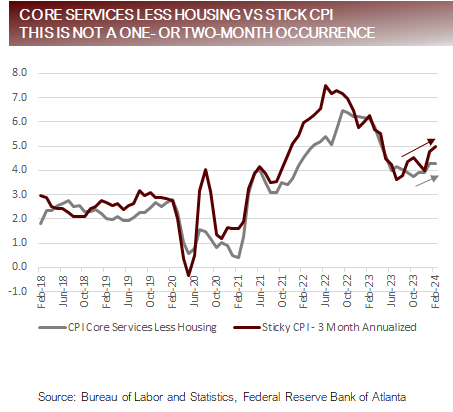

The recent Consumer Price Index (CPI) figures have shown a slight uptick, raising concerns. The stagnant nature of CPI, hovering between 3.0% and 3.7% since June 2023, poses challenges in observing tangible progress, which is a cause for consideration.

Another significant indicator, CPI Core Services Less Housing, recorded at 4.30%, has been on an upward trajectory since October, rebounding from a low of 3.75%. This key metric is closely monitored by the Federal Reserve for insights on trends and economic stability.

Decoding the Economic Landscape: A Tale of Inflation, Retail Sales, and Consumer Sentiment

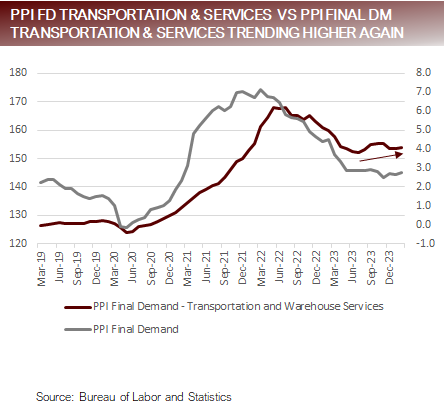

A PPI Paradox: Misses and Margins

- The latest Producer Price Index (PPI) figures have stirred up a storm, with Final Demand coming in at a surprising 1.6%, surpassing the anticipated 1.2% by a significant margin. This unexpected surge was largely fueled by the dwindling disinflationary influences in Transportation and Warehousing Services.

- Attempting to decipher the disinflationary narrative, market pundits were quick to point fingers at a fictitiously calculated Shelter component, accounting for over half of the rise in the Consumer Price Index (CPI). Additionally, a quarter of this uptick was attributed to fluctuations in auto insurance rates.

Stalling Progress on Inflation

Progress on inflation has hit a roadblock, with recent data showing a trend of upwards movement in key indices since the summer/fall of 2023.

Retail Sales: A Downturn Emerges

Retail Sales Slide

- Retail Sales saw a modest increase of 0.6%, falling short of the market’s expectations of 0.8%, with revision figures showing a decline from -0.8% to -1.1% for the prior period.

- Various factors have been propelling Retail Sales over the past year, but signs of faltering momentum are becoming apparent. These include:

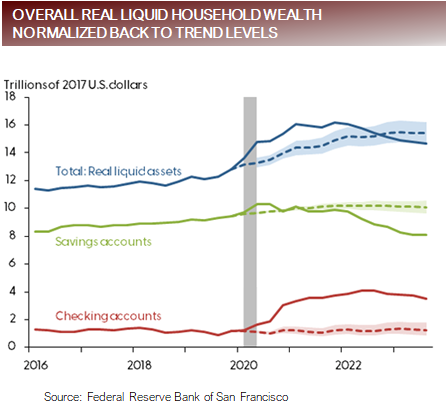

- – Dwindling fiscal-fueled pandemic savings, which peaked close to $2.5 trillion before settling at less than $500 million.

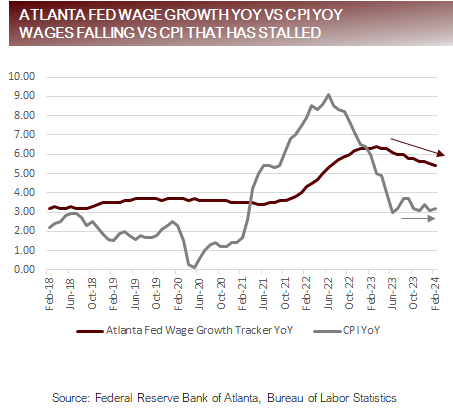

- – Shrinking real wage growth, exemplified by data from the Atlanta Fed Wage Growth Tracker, which dropped from 6.1% to 5.4% while CPI YoY surged from 3.0% to 3.2% over the last year. This dwindling wage growth juxtaposed with rising pricing pressures is a clear indication that consumers are feeling the squeeze on their wallets.

- – The deceleration in personal savings drawdowns, with the current Personal Savings as a Percentage of Disposable Income hovering at 3.8% post-pandemic, after hitting a low of 2.7% in June 2022. The sudden drop in savings was previously tied to a robust labor market and significant cash reserves, underpinning consumer confidence.

US Consumers on the Brink: Savings Increase While Spending Wanes

Consumer Behavior Amid Economic Uncertainty

Consumers are saving less. With the recent uptick in unemployment, coupled with a host of indicators signaling a cooling labor market, and the dwindling of fiscal-fueled pandemic savings, consumers may start increasing their savings, potentially drawing away from spending.

Impact of Diminishing Liquid Assets

Recent research from the Federal Reserve Bank of San Francisco suggests that liquid assets, crucial for funding spending, have been diminishing. These levels are nearing pre-pandemic predictions, indicating that as liquid funds deplete, consumers might restrain their spending.

Factors Leading to a Possible Slowdown in US Consumer Consumption

FAQ: What Could Influence Markets Beyond Expectations?

-

The resiliency in the US economy surprised many last year. The strength came from a multitude of factors that collectively bolstered the economy and financial markets.

-

Some lesser-discussed factors that fueled 2023 may not provide the same momentum in 2024.

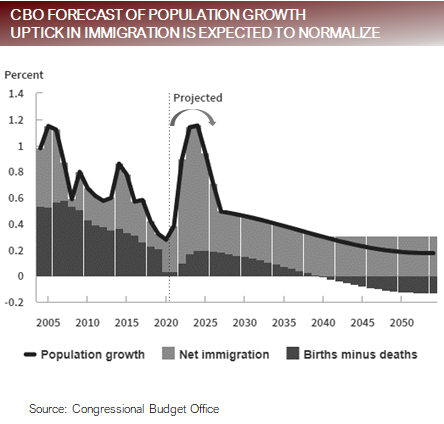

- Immigration: The influx of immigrants significantly contributed to the economy, but projections suggest a decline in immigration trends that may impact economic momentum.

- Source

- Fiscal Support: The current Fiscal Deficit as a % of GDP is -6.4%, a historically high level outside a recession or war. Such massive deficits result in a growing national debt.

Decoding the Financial Puzzle: A Deep Dive into Market Trends

Unveiling Market Volatility

- Won’t matter until suddenly it does. As the day of reckoning approaches each time there is a spike in rates, bond vigilantes will gain the upper hand and drive market volatility.

-

Some factors that provided tailwinds in 2023 may prove to be less powerful in 2024 (possible negatives), while new opportunities may provide potential for upside (possible positives).

-

Possible Negative Surprise: Deterioration in financial conditions

- Financial conditions are the loosest they’ve been since the immediate aftermath of the pandemic in 2021. Although they can stay loose a while longer, historically when financial conditions reach these levels, they rarely stay there for longer than six months.

-

Possible Positive Surprise: Resurgence of growth from international developed markets

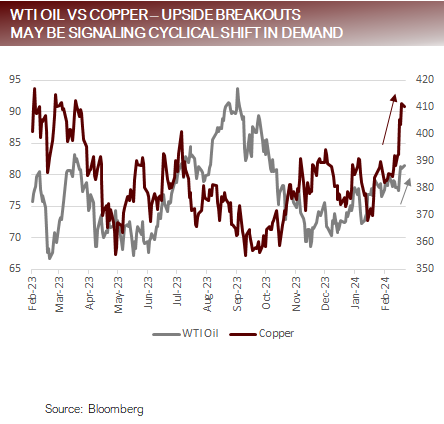

- Copper and Oil have both recently broken out and have done so in unison with international manufacturing PMIs bottoming, which may be signaling a turning point for international developed markets.

-

Possible Negative Surprise: Deterioration in financial conditions

There are hidden factors such as immigration and clues such as commodities that signal changes

Sector Rotation Update: Leadership tilting towards defensives and inflation hedges

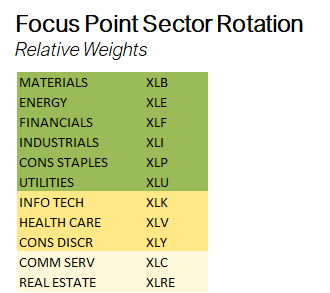

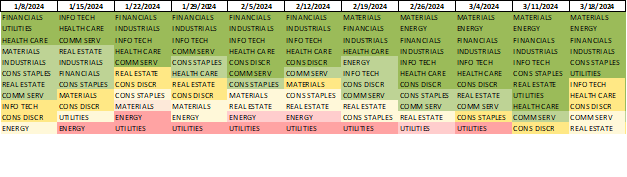

- The Focus Point Sector Rotation Model is a combined trend following and mean reversion model that utilizes seven factors to analyze daily price data on sectors to determine the strength of upward trends.

- Last year’s leadership sectors of Info Tech, Comm Services, and Consumer Discretionary continue their trends down the depth charts as their technicals deteriorate for another week.

- Defensive and more traditional inflation hedge sectors have moved into leadership positions and are exhibiting positive short-term upward trend signals.

Piecing Together the Puzzle

- The delicious cocktail of factors shaping the financial landscape has the potential to surprise investors in unforeseen ways. By dissecting potential positives and negatives, market participants can navigate the turbulent waters ahead with a newfound sense of clarity and understanding.

The Federal Reserve Navigates Challenging Economic Waters

- The market was served early in the year that consisted of disinflationary forces, above trend growth and a strong labor market that supported a resilient consumer has been replaced with a foul-tasting brew of stubborn inflation, continued above-trend growth and a weakening labor market that is calling into question the ongoing strength of the consumer.

The Federal Reserve’s Delicate Balancing Act

- The Fed emphasized after its last Open Market Committee Meeting that they need to see additional data to support the disinflationary trends to gain “confidence” that inflation was headed back to the targeted range, which would guide them to embark on an easing cycle in 2024.

Ripples in the Financial Waters

- The markets have been well behaved so far, as expectations for rate cuts have been slashed from 6 or 7 to 2 or 3. However, we’ve noted that when the 10-year crossed 450 last summer, the equity markets reacted poorly. With the 10-year hovering at 430 and a Fed meeting looming this week, there’s not much daylight between here and 450.

Shifting Fortunes Await a Federal Decision

- The coming week’s outcome likely hinges on the Fed statement, press conference and new Summary of Economic Projections, which will either serve to calm nervous markets or take agitate them.

For more news, information, and analysis, visit the ETF Building Blocks Channel.

DISCLOSURES AND IMPORTANT RISK INFORMATION

Performance data quoted represents past performance, which is not a

The Unyielding Defense of Intellectual Property Rights by Focus Point LMI LLC

Focus Point LMI LLC

Protecting Proprietary Content

The text, images, and other materials contained on any product, service, report, email, or website by Focus Point LMI LLC are proprietary and serve as valuable intellectual property and copyrighted content under the umbrella of Focus Point LMI LLC. Unauthorized reproduction is a direct challenge to the copyrights and proprietary rights.

Strict Copyright Enforcement

All illegal use of material is viewed as a deliberate violation of the copyright and other intellectual property rights of Focus Point LMI LLC. While the company commits to providing accurate and relevant information, no ironclad guarantee can ensure the absolute accuracy and completeness of the shared information.

Analyzing Financial Information Services With a Critical Eye

In-depth Analysis of Liability and Data Sourcing

Officers, employees, and stakeholders are absolved of any liability related to claims or damages stemming from the use of Information Services. The services are for the benefit of subscribers alone. Data compilation involves industry giants like The Federal Reserve, Bloomberg, Barclays Indices, CBRE Inc., IHS Markit, and MSCI Inc.. MSCI Inc. and related parties disclaim all warranties regarding data accuracy and completeness. Content Providers are not liable for any damages resulting from the use of the Content.

Interpreting Market Insights and Performance Projections

Analysts’ opinions conveyed in this communication are subject to change. Past performance is not indicative of future outcomes. Various factors such as market conditions, regulations, and business trends can influence performance levels.

Deciphering Complex Investment Data: An Investor’s Guide

FOCUS POINT LMI LLC DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE.

Focus Point LMI LLC, its affiliates, officers, or employees, and any third-party data provider shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Focus Point LMI LLC publication, and they shall not be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information or opinions contained Focus Point LMI LLC publications even if advised of the possibility of such damages.

The Challenges of Interpreting Investment Tools

Over time, which could change the status of the information in this publication. Using any graph, chart, formula, model, or other device to assist in making investment decisions presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves and market participants using such devices can impact the market in a way that changes their effectiveness.

Guiding Principles for Investors

Focus Point LMI LLC believes no individual graph, chart, formula, model, or other device should be used as the sole basis for any investment decision. Focus Point LMI LLC or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.