Gary Hershorn/Corbis News via Getty Images

Restaurant stocks and investors find themselves paddling in the same boat, seeking to navigate forward in response to the ups and downs of the larger economic climate.

The Consumer Price Index for January signaled a 3.9% year-over-year increase in the core rate, surpassing the +3.7% the economists had foreseen, and mirroring the +3.9% pace from December. While the food at home category grew a mere 1.2% from a year ago, food away from home surged by 5.1% in the same month. On a two-year basis, food away from home CPI growth decelerated slightly in January from the pace in December, but maintained a robust 13.7% increase.

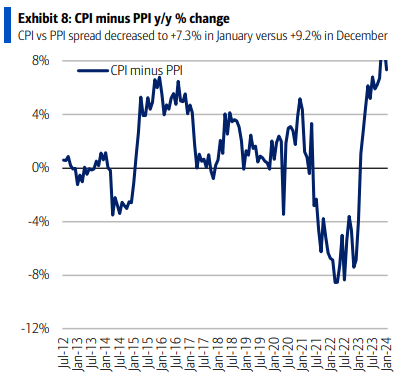

What’s even more noteworthy for the restaurant sector is the substantial spread between CPI and the producer price index, which remains at 7.3 percentage points (as seen in the chart below from Bank of America).

The significant gap between CPI and PPI could potentially boost margins for certain restaurant companies, contingent on their pricing power and existing commodity hedges. Analysts are of the opinion that if the CPI-PPI spread continues to be relatively wide, there could be additional earnings surprises in the restaurant sector in the future.

Amid fluctuations, the restaurant sector has witnessed striking rises of certain stars. Shake Shack (NYSE:SHAK) has ascended 33% year-to-date. The chain reported a 21.4% rise in system-wide sales in Q4 to reach $442.1M. Same-shack sales were up by 2.8% from a year ago during the quarter, surpassing the consensus expectation of +2%. On the expense side, costs for food and paper decreased to 29.1% of sales from 29.5% a year ago, while labor costs lessened to 28.5% of sales compared to 28.9% from the previous year. Occupancy-related expenses ebbed to 7.7% of sales from 7.9%, with total expenses at 100.5% of sales in Q4 versus 102.6% a year ago. Shack-level operating profit amounted to $54.6M, or 19.8% of Shack sales compared to 19.0% a year ago.

Other remarkable gainers in the restaurant sector this year include FAT Brands (FAT) with a +48% surge, Kura Sushi (KRUS) with a +37% rise, CAVA Group (CAVA) up by +29%, Wingstop (WING) soaring by +26%, First Watch Restaurant Group (FWRG) with a +22% increase, Potbelly (PBPB) climbing by +20%, and Texas Roadhouse (TXRH) advancing by +21%.

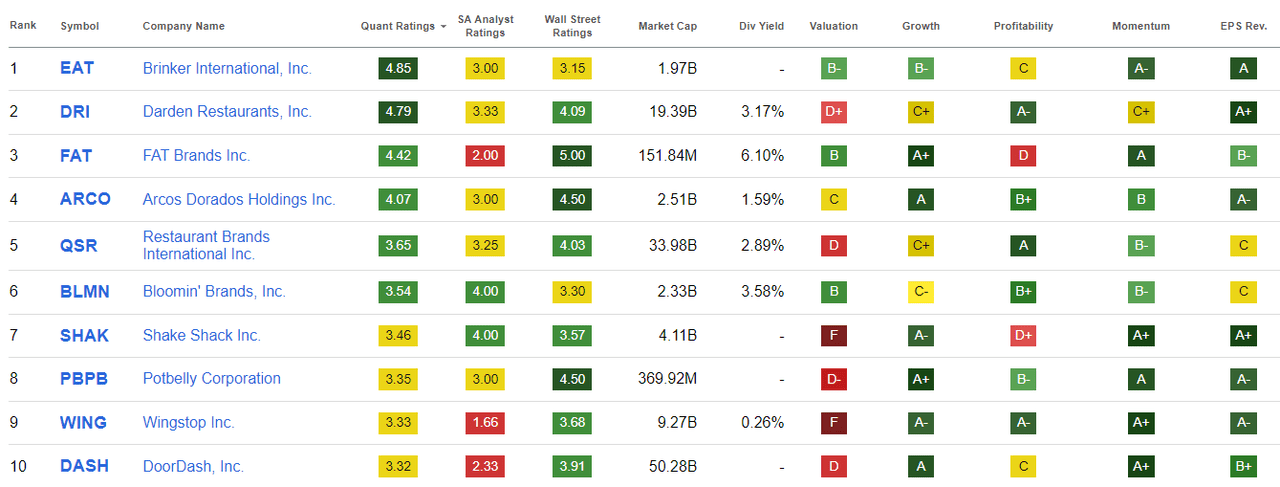

Stocks in the restaurant sector that have garnered positive attention from Seeking Alpha analysts of late include Domino’s Pizza (DPZ), Jack in the Box (JACK), Red Robin Gourmet Burgers (RRGB), and Yum! Brands (YUM). Brinker International (EAT) and Darden Restaurants (DRI) lead the rankings for attractive stocks in the restaurant sector based purely on quantitative analysis.

IPO watch: Dunkin’ Donuts, fresh off producing one of the Super Bowl’s most socially discussed commercials, could return to public trading as part of Inspire Brands in the future, according to sources familiar with the matter. Private equity firm Roark Capital is reported to have held preliminary discussions with potential advisers about a listing of Inspire Brands in late 2024 or 2025. Inspire Brands owns the Dunkin’ Donuts, Arby’s, Baskin-Robbins, Buffalo Wild Wings, Sonic, and Jimmy John’s restaurant chains. In addition to these, Roark Capital also owns Focus Brands, which includes Auntie Anne’s, Cinnabon, and Jamba, and has a stake in The Cheesecake Factory (CAKE).