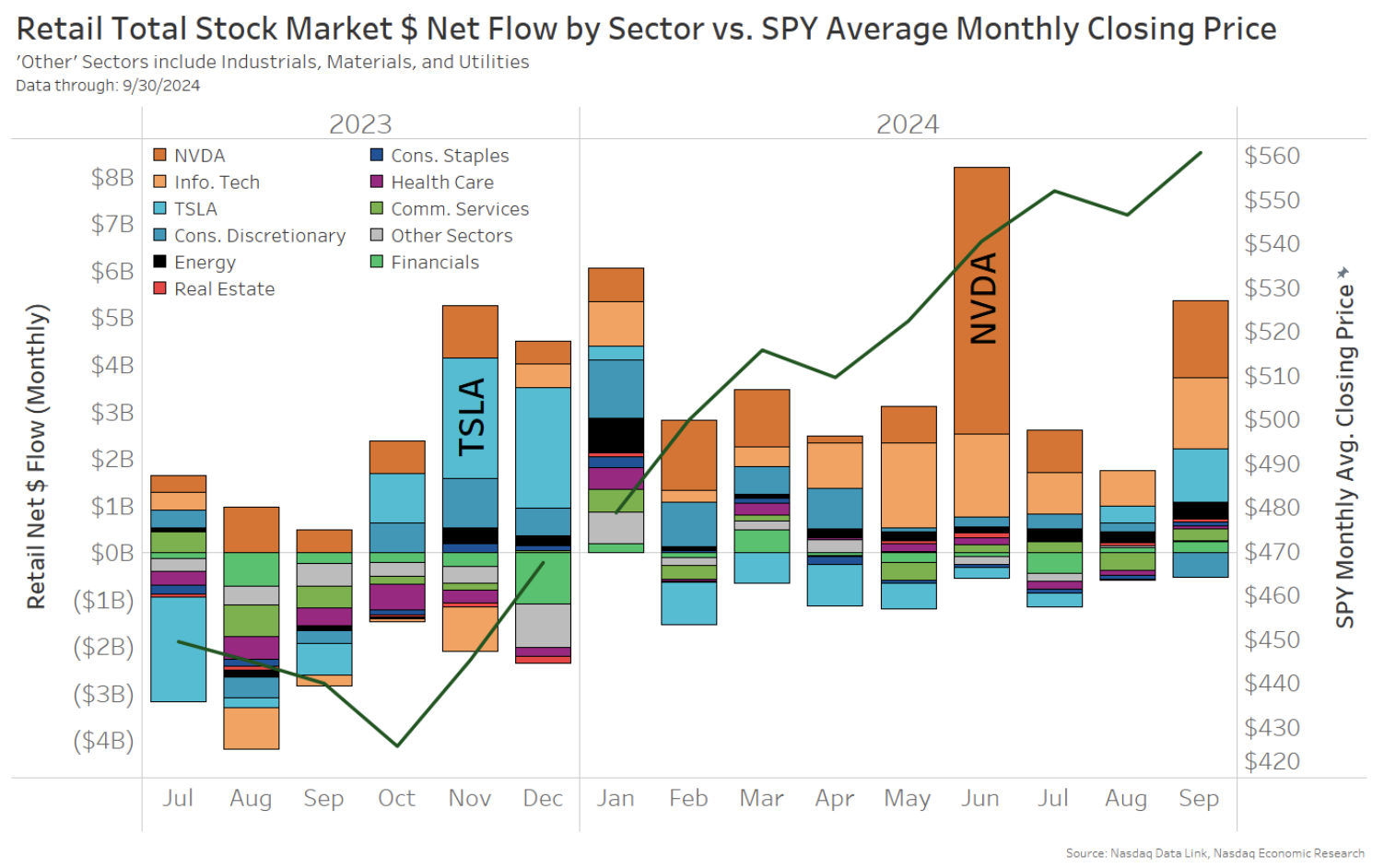

Retail Investors’ Stock Preference Moves from TSLA to NVDA

Retail traders have shifted their attention from Tesla (TSLA) to Nvidia (NVDA) this year, with daily trading in NVDA reaching nearly $4 billion. Retail investors have shown a strong interest in NVDA, accumulating almost $13 billion worth of shares.

Retail Investor Trends in Stock Concentration

Retail investors often stick to a “favorite stock” while still maintaining a diversified portfolio. In 2021, NVDA accounted for 13.4% of all retail trading, holding the title of the most popular stock on 64% of trading days. In contrast, Tesla (TSLA) dominated retail trading in 2020, with peaks of nearly 30% of total value traded in February 2023.

Over the past five years, Tesla has been a go-to choice for retail traders, leading in number of trading days. Apple (AAPL) follows as the second most traded stock, with its last significant surge in retail trading seen in September 2022.

Retail Investors Boost Net Buying of Stocks and ETFs

Retail investors have been active buyers of both individual stocks and ETFs in 2024, adding approximately $32 billion to net stock purchases and a substantial $120 billion to ETF investments. With the possibility of Fed rate cuts on the horizon and market uncertainties, retail investors have turned towards fixed income ETFs, channeling around $26 billion into bond ETFs.

Analysis of Retail Trading Levels Post-Covid

Despite trading values remaining high at around $600 billion daily, retail trading as a proportion of the entire market has seen a steady increase. Retail trading activity remains above pre-Covid levels, with value traded and share volumes showing sustained growth since the onset of the pandemic. Interestingly, while the value traded has rebounded post-2020, share volumes peaked during the meme stock frenzy of 2021 and have been gradually declining.

Retail Investors Provide Significant Liquidity

Despite some households depleting their Covid savings, retail trading continues to play a vital role in the stock and ETF markets, offering essential liquidity for a variety of assets.