“`html

Investing in E-Commerce: Comparing Amazon and Shopify

It’s not just an enormous company. Amazon (NASDAQ: AMZN) is also one of the world’s most recommended stocks. There’s a good chance you own it, in fact, or have at least considered owning it at some point in the past. And for good reason. After all, it’s the king of e-commerce, at least in the Western Hemisphere.

If you’re looking for the best way to plug into the next chapter of e-commerce’s growth story, however, there may be a better option. That’s Shopify (NYSE: SHOP), which in many ways is the opposite of what Amazon is. That’s why it presents such a compelling prospect.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Two Giants of E-Commerce: A Closer Look

Amazon didn’t just rise to the top of the online shopping market; it was instrumental in creating it. The company popularized online shopping in the late 1990s, a time when internet access was just beginning to flourish. Consumers embraced “the everything store,” and it remains a favorite today. According to market research firm eMarketer, Amazon holds about 40% of the U.S. online retail market, which accounts for roughly 16% of the nation’s total retail spending, per the U.S. Census Bureau.

However, with its size and self-service model, Amazon presents both opportunities and challenges. Sellers often face fierce competition, including from Amazon itself, and find it challenging to build strong relationships with customers, who ultimately belong to Amazon.

Enter Shopify, a platform that empowers businesses to create and manage their own online stores. Shopify provides tools for digital shopping carts, payment processing, marketing, and inventory management, allowing sellers to operate independently of large, impersonal online marketplaces like Amazon. Brands such as Nutriseed, Worldwide Cyclery, and Florivera Skincare show that Shopify can foster the personalized experiences consumers desire.

A report from the Boston Consulting Group states that roughly 80% of U.S. consumers expect some level of personalization during shopping.

Amazon’s platform simply can’t offer this level of personal touch to its sellers or their customers.

Strong Growth: Past Trends and Future Projections

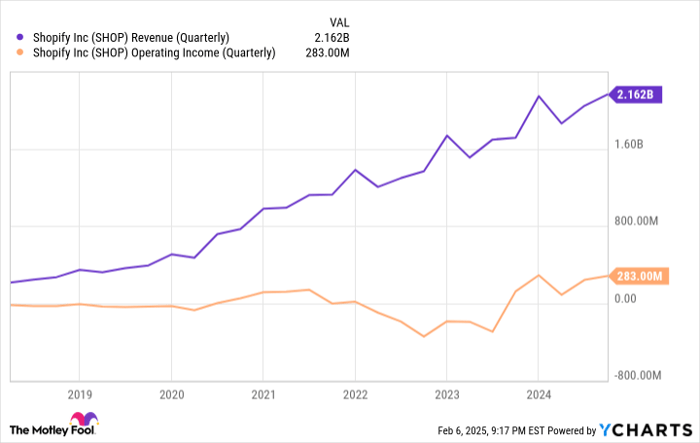

The statistics support that more businesses are turning to Shopify’s alternative. In the last quarter of 2022, Shopify facilitated sales of $69.7 billion in goods and services, reflecting a 24% year-over-year increase. This resulted in nearly $2.2 billion in revenue, a 26% increase year over year, continuing a growth trend since its launch in 2006.

SHOP Revenue (Quarterly) data by YCharts

However, this is just the beginning. Shopify’s growth has been impressive, but it has only begun to tap into its full potential. The U.S. e-commerce market is valued at over $1.1 trillion annually, and the total U.S. retail industry exceeds $7 trillion in sales each year. As more shopping shifts online, market researcher Oberlo projects a 9% annual growth rate in U.S. e-commerce by 2028. Analysts expect Shopify to capture a significant portion of this growth.

Data source: StockAnalysis.com. Chart by author.

Shopify controls nearly one-third of the U.S. e-commerce platforms and continues to expand internationally, claiming about 10% of the global e-commerce technology market.

Evaluating the Premium Cost

Despite these positive trends, Amazon isn’t merely sitting back. It recognizes the competitive landscape and is making adjustments. For instance, it is reducing the imitation of top-selling products from third-party sellers to allow partners to receive greater shares of their sales. Additionally, Amazon is providing generative artificial intelligence tools to help sellers streamline their listings.

Shopify’s stock price reflects its growth, currently priced at over 90 times last year’s estimated earnings and more than 70 times this year’s expected profit of $1.54 per share. Such high valuations can limit short-term gains and lead to higher volatility.

However, growth is strong and seems likely to continue, allowing the market to support Shopify’s premium price. The extraordinary 350% increase from its lows in 2022 may appear daunting, yet there may still be ample opportunity for further gains. The rise of independently managed e-commerce platforms indicates a shift in the industry, and Shopify is positioned to monetize this increasing demand effectively.

A Unique Investment Opportunity

Have you ever felt you missed out on top-tier stocks? This could be your chance.

Occasionally, our expert analysts issue a “Double Down” stock recommendation for companies they predict will see significant growth soon. If you think you’ve missed your chance to invest, now might be the best time to act, especially with the following historical successes:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $336,677!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $43,109!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $546,804!*

This moment may not come again soon with “Double Down” alerts for three promising companies being released now.

Learn more »

*Stock Advisor returns as of February 3, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Shopify. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`