# Economic Shifts Reported Amidst Market Rally

As the market responds to President Trump’s “Liberation Day” tariffs, investor Louis Navellier emphasizes a significant economic transformation. He refers to this change as Liberation Day 2.0, suggesting it could generate up to $10 trillion in new stimulus and millions of high-paying jobs, potentially fueling a new bull market.

Key Strategies Behind the Economic Shift

Navellier identifies a three-part strategy driving this transition: Tax Liberation, Tech Liberation, and Energy Liberation. Each segment aims to revitalize specific areas of the U.S. economy. He outlines these elements in his upcoming presentation, The Liberation Day Summit, scheduled for Wednesday, May 28, at 1 p.m. ET.

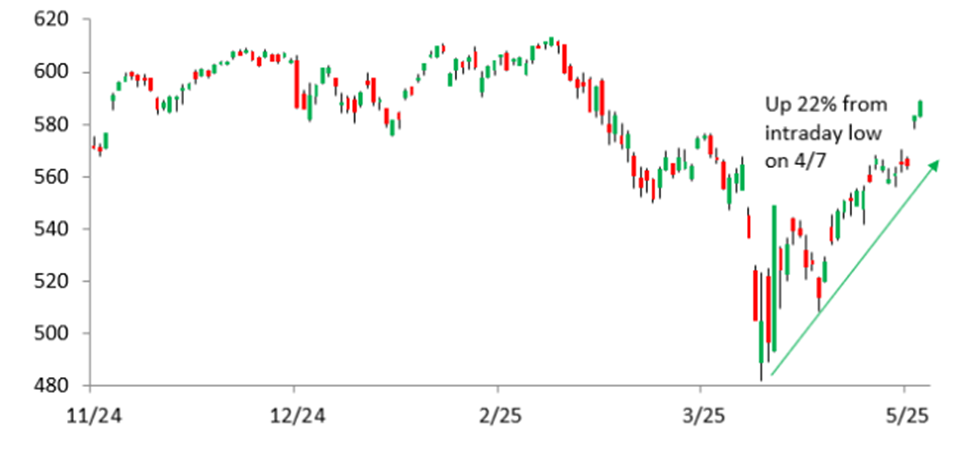

Following a notable selloff on April 3, where the S&P 500 dipped over 15% year-to-date, a rapid recovery occurred. In just 25 days, the index regained losses, which many in the media viewed as surprising and unpredictable.

Past Predictions from Navellier

Navellier reflects on three major predictions he successfully made over the last two years:

- Biden’s Departure: In December 2023, Navellier predicted President Biden would not complete his term. He anticipated a California Democrat would succeed him, ultimately being Kamala Harris.

- Trump’s Return: He forecasted Donald Trump would win the 2024 presidential election. Navellier also highlighted Trump’s focus on reviving American manufacturing and fueling technological advancements.

- Trade Shifts: Navellier anticipated the introduction of tariffs, warning of media panic. He assured investors that such tariffs were part of a broader strategy to realign international trade.

What to Expect from Liberation Day 2.0

Navellier outlines the framework of Liberation Day 2.0, including:

1. Tax Liberation

Trump’s proposal to cut income taxes for Americans earning under $150,000 could significantly boost consumer spending and GDP over the next decade.

2. Tech Liberation

Over $2 trillion has been committed to AI and tech infrastructure since the election, with a focus on reversing regulatory barriers to stimulate innovation.

3. Energy Liberation

The U.S. possesses over $100 trillion in untapped resources. Recent executive efforts are aimed at facilitating mining and energy projects to ignite a boom in strategic materials.

Investment Opportunity: One Stock to Consider

Navellier has recommended Powell Industries Inc. (POWL) to his premium members, due to its proven track record of remarkable earnings surprises over recent quarters.

In summary, the economic shifts highlighted by Navellier point to significant changes on the horizon, impacting various sectors and providing potential investment opportunities.

# Powell Industries Reports Strong Earnings Amid AI Market Growth

## Earnings Overview

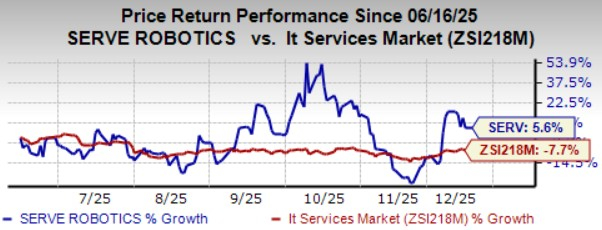

Powell Industries has seen a remarkable 300% increase in its stock. Despite fluctuations in earnings surprises, the company benefits significantly from the booming artificial intelligence (AI) sector.

During the last few months, after Powell was initially recommended, it became evident that its products are vital for AI data centers, known as hyperscalers. As early as June 2024, Powell was identified as an AI data center beneficiary, leading to a stock price doubling shortly thereafter.

## Market Demand

The growth of AI leads to increased need for reliable, scalable data centers, which require customized electrical solutions. Powell’s client base includes petrochemical plants, oil and gas producers, utilities, and transportation facilities, positioning the company to take advantage of current economic policies.

Powell has developed strong relationships with hyperscaler operators and co-locators, which is now yielding positive results.

## Financial Performance

In the second quarter of fiscal year 2025, Powell reported new orders of $249 million and maintained a backlog of $1.3 billion. Revenue increased 9% year-over-year to $279 million, nearing estimates of $282.68 million. Earnings rose 38% year-over-year to $46 million, or $3.81 per share, surpassing analyst expectations of $3.44 per share by 10.8%.

Despite a recent decline from all-time highs, Powell remains on a strong growth path. Analysts project revenue of $1.12 billion in 2025, compared to $1.01 billion the previous year. Earnings are also expected to rise to $14.17 per share from $12.29 a year ago.

## Conclusion

Powell currently holds a “B” rating and is recommended as a buy under $227.

Additionally, a discussion about potential investment opportunities related to ongoing economic changes is planned for May 28, aimed at identifying stocks with even higher buy ratings than Powell’s.

### Important Disclosure

Louis Navellier owns shares of Powell Industries Inc. (POWL).