Amazon’s Performance and Future Outlook

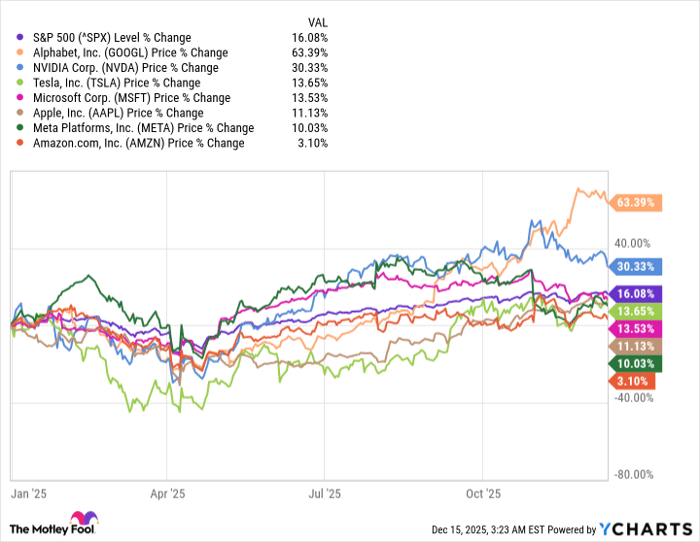

Amazon has seen disappointing stock performance this year compared to its peers in the “Magnificent Seven,” with all other stocks in this group yielding double-digit returns, while Amazon’s stock has lagged. As of December 15, 2023, this group includes Nvidia, Apple, Microsoft, Alphabet, Meta, Tesla, and Amazon, collectively representing nearly 35% of the S&P 500.

Throughout the first nine months of 2023, Amazon’s capital expenditures reached about $90 billion, primarily focused on expanding Amazon Web Services (AWS). Although AWS remains the world’s largest cloud platform, it has lost market share to competitors like Microsoft and Alphabet. With more than 3.8 gigawatts added in the past year and plans to double capacity through 2027, Amazon aims to enhance its infrastructure to better serve AI demands, with each additional gigawatt potentially generating $3 billion in revenue.

In the third quarter, Amazon’s advertising revenue grew 24% to $17.7 billion, surpassing subscription revenue of $12.5 billion. This growth underscores the company’s high-margin advertising business, positioning Amazon for potential profitability improvements in 2026.