Etsy Faces Challenges as Sales and Sellers Decline

Etsy(NASDAQ: ETSY) has delighted shoppers with handmade and vintage items, but investors are feeling disheartened. The stock surged during the pandemic, driven by increased interest in its products as people stayed home. However, like many e-commerce platforms, Etsy has struggled to maintain its momentum, with sales steadily declining.

While some attributed these challenges to a post-pandemic hangover in 2022 and 2023, it is evident that deeper issues affect the craft-oriented marketplace. Following a disappointing earnings report on Wednesday, Etsy’s stock has continued to decline.

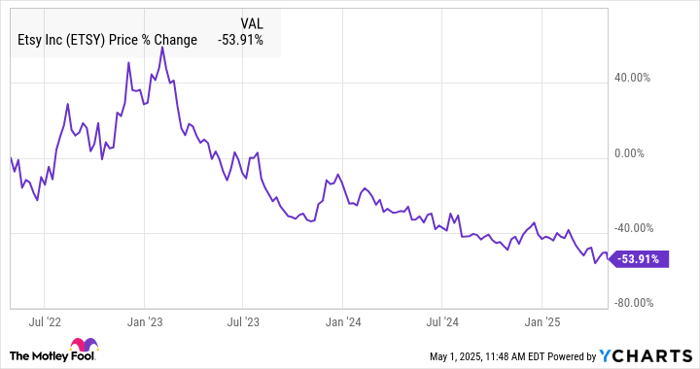

ETSY data by YCharts

The downward trajectory of the stock over the past 18 months suggests that investors are losing confidence in the company. Etsy’s first-quarter report reaffirmed this narrative, showing a 6.5% decrease in gross merchandise sales (GMS) to $2.8 billion. Additionally, both active sellers and buyers fell, with the number of sellers dropping 11.3% to 8.1 million. Active sellers on Etsy fell from 7 million to 5.4 million, marking a 23% decline.

Furthermore, Etsy is selling the musical instrument marketplace Reverb, which it acquired in 2019, and reported an impairment charge of $101.7 million. This indicates it sold Reverb for that much less than its purchase price.

Given the latest earnings report, investors may wonder whether Etsy can recover. It is crucial to analyze the setbacks the company has faced over the past few years and explore its prospects for a turnaround.

Image source: Getty Images.

Acquisition Strategy Concerns

Etsy’s acquisition of Reverb initiated its “House of Brands” strategy, aiming to incorporate sub-brands into its e-commerce platform. Previously, Etsy owned three sub-brands: Reverb, Depop, and Elo7. With the sale of Reverb, only Depop remains. The company incurred losses on both Reverb and Elo7; it sold Elo7, a Brazilian online marketplace, in 2023 after acquiring it in 2021. Etsy also recorded a $1 billion impairment for Depop and Elo7 in 2022, primarily due to Depop’s performance, which focuses on vintage fashion resale.

While Depop is currently growing—with GMS rising 32% in 2024 and approximately 60% growth in the U.S.—the overall acquisition strategy has not succeeded. The company has incurred an accounting loss on all three brands and has diverted focus from its core business, which has not met expectations.

Sellers Departing the Platform

It is evident that sellers are abandoning Etsy’s platform, reflected in the 23% decline over the past year. Unlike Amazon, Etsy relies on its seller base since it does not offer first-party products. The decline can be attributed to multiple factors, with rising seller fees being one of the most significant. Etsy’s take rate—the percentage of revenue relative to GMS—has increased from 17.8% in 2022 to 23.3% in Q1 2025.

Company management might argue that this increase is justified based on investments in technology and platform enhancements, but higher fees have not translated to increased sales, as evidenced by the GMS decline. Furthermore, there are concerns that the brand is diluting its identity by allowing the sale of non-handmade items.

The challenge for Etsy is to balance its commitment to artisan-made goods with the need to expand the marketplace. However, it appears that this balance has shifted, compromising the brand.

Prospects for Recovery

During Etsy’s earnings call, management emphasized key performance metrics such as app usage and advertising revenue. However, these may mask the underlying structural problems facing the company. Before recovery can occur, Etsy must address these issues and focus on restoring GMS growth by attracting new sellers.

Etsy’s current low valuation could make it attractive to activist investors. Elliott Management, which holds a 13% stake, previously influenced stock price gains in 2017 by reshaping leadership and cutting costs. The company might also consider acquisition options, potentially appealing to buyers such as Shopify, Target, or private equity firms.

Although Etsy holds unique potential in e-commerce, poor management execution since the pandemic and a reluctance to confront fundamental issues threaten its future. Absent significant changes, Etsy’s stock may continue to decline, as merely increasing the take rate will not resolve the GMS downturn.

The company may require fresh leadership, a strategic partner, or a comprehensive overhaul. As the brand loses its relevance, the window for recovery may be closing quickly.

Should You Invest in Etsy Now?

Before considering an investment in Etsy, it’s essential to evaluate the current landscape.

Various analysts have identified standout stocks for investment, and Etsy has not made that list. Potential investors may want to explore options that demonstrate stronger growth potential.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.