Revvity Prepares for Q3 Earnings Reveal Amid Market Volatility

Revvity, Inc. (RVTY), based in Waltham, Massachusetts, specializes in health sciences solutions and services that harness translational multi-omics technologies. With a market cap of $14.8 billion, the company works on biomarker identification, diagnostics, informatics, and more detailed medical technologies. The leading research and diagnostic firm is set to announce its fiscal third-quarter earnings for 2024 before the market opens on Monday, November 4.

Financial Outlook and Analyst Expectations

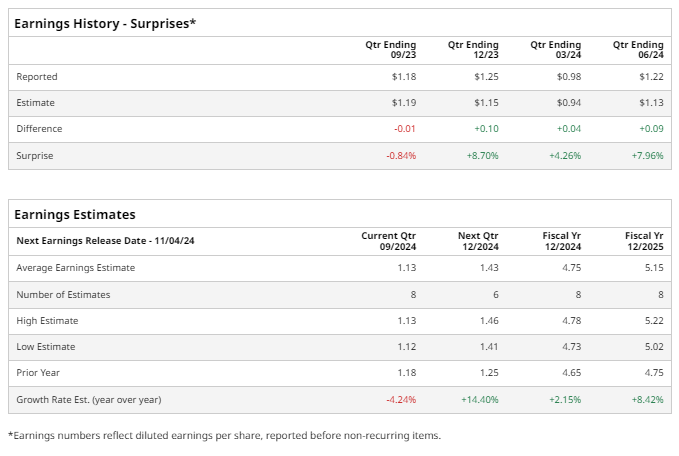

As the earnings date nears, analysts predict RVTY will report a profit of $1.13 per diluted share, reflecting a decline of 4.2% from $1.18 per share during the same quarter last year. Recently, the company surpassed consensus estimates in three out of four quarters. Last quarter, Revvity posted an EPS of $1.22, exceeding expectations by 8%, driven by strong demand for its diagnostic products.

Yearly Projections Show Improvement

For the current fiscal year, projections indicate RVTY will report an EPS of $4.75, up 2.2% from $4.65 in FY 2023.

Comparative Performance Against Market Indices

Year-to-date, RVTY stock has lagged behind the S&P 500’s ($SPX) impressive 23% gain, with its shares increasing by only 9.5%. It has also underperformed the S&P 500 Healthcare Sector SPDR’s (XLV) 12.3% growth over the same period.

Market Reactions to Recent Announcements

Revvity’s stock experienced volatility recently, dropping more than 3% on October 16, following a lowered annual sales forecast from Swiss rival Tecan Group, which affected the broader life-sciences equipment sector. However, the stock rebounded, rising over 9% on July 29 after the company posted Q2 earnings results. Despite missing revenue estimates, the market reacted positively to the improved profit outlook and robust performance in key product lines, encouraging a significant price increase.

Analysts Maintain a Positive Sentiment

Currently, analysts generally hold a favorable view on RVTY stock, maintaining a “Moderate Buy” rating. Among 17 analysts covering the stock, nine recommend a “Strong Buy,” one suggests a “Moderate Buy,” while seven advise a “Hold.”

The average price target among these analysts for RVTY is $134.53, indicating a potential upside of 12.4% from current levels.

More Stock Market News from Barchart

On the date of publication, Kritika Sarmah did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are intended solely for informational purposes. For further details, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.