Revving its engines, Revvity, Inc. RVTY recently unveiled a groundbreaking end-to-end workflow solution tailored for newborn research. This innovative offering promises a versatile approach, allowing users to tailor their choices with respect to instruments, reagents, and databases specific to each laboratory’s needs.

The research-use-only package includes diverse components such as dried blood spot collection and processing devices, Chemagic kits for nucleic acid extraction, liquid handlers, and reagents for library preparation, VICTOR2 D Instrument for sample quality control, and software features. This revolutionary workflow is fully compatible with the Element AVITI system and other leading next-generation sequencing (NGS) platforms.

This recent product launch is anticipated to propel Revvity’s sequencing research segment on a global scale, firmly establishing its presence in this specialized field.

The Revolutionary Impact

According to Revvity, this cutting-edge solution is designed to detect variants in over 350 genes, backed by an extensive database of meticulously curated variants. Management believes that this novel workflow will not only enhance the customer experience by leveraging a comprehensive variant database for newborn sequencing research but also provide essential elements crucial for navigating from sample to result.

Prospects in the Industry

Reports from Grand View Research suggest that the global NGS market was valued at $8.40 billion in 2023 and is projected to experience a CAGR of around 21.7% from 2024 to 2030. Factors such as the increasing applications of NGS and technological advancements in NGS instruments and technologies are expected to be the driving forces behind this market growth.

Given the vast potential within the market, this latest launch is poised to significantly enhance Revvity’s international operations.

Milestones and Progress

Just last month, Revvity made headlines by introducing Signals Clinical, a software and informatics division. Signals Clinical is a state-of-the-art software-as-a-service clinical data science platform, aimed at centralizing all clinical trial data. The platform promises rapid, actionable insights to expedite clinical decisions and accelerate the market delivery of therapeutics.

During the same period, Revvity reported its fourth-quarter results for 2023. Despite prevailing industry challenges, the company exceeded expectations and exhibited robust performance in the latter part of the year. By emphasizing innovation and positioning itself as a strategic scientific partner for customers, Revvity is well-positioned to maintain its high-level performance.

Analyzing Performance

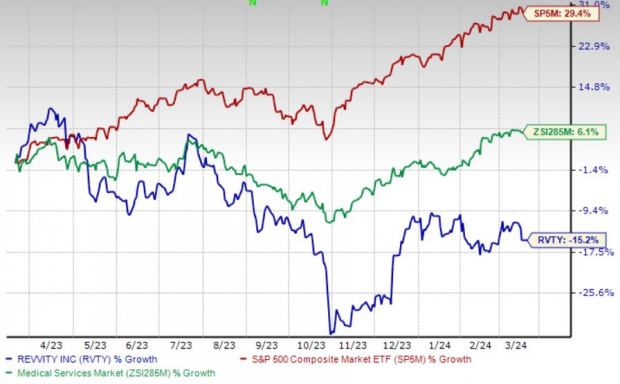

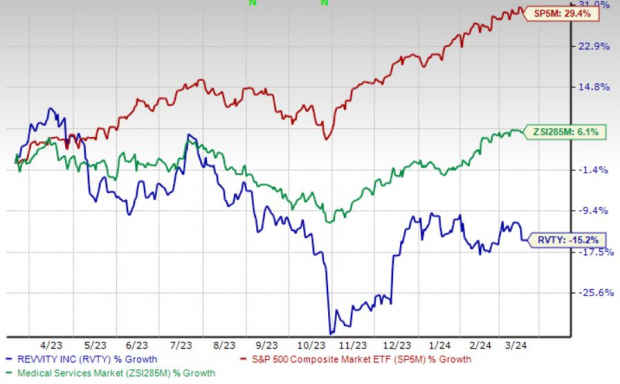

Although Revvity’s shares witnessed a 15.3% decline over the past year, this drop contrasts with the healthcare industry’s 6.1% increase and the S&P 500’s 29.4% growth.

Image Source: Zacks Investment Research

Stock Rankings and Top Choices

At present, Revvity holds a Zacks Rank #3 (Hold).

Other notable stocks in the broader medical sector include DaVita Inc. DVA, Cardinal Health, Inc. CAH, and Cencora, Inc. COR.

DaVita, with its Zacks Rank #1 (Strong Buy), boasts an estimated long-term growth rate of 12.1%. DVA surpassed earnings estimates in each of the past four quarters, with an average surprise of 35.6%. Explore today’s Zacks #1 Rank stocks here.

Over the past year, DaVita’s shares have surged by 75.2%, outperforming the healthcare industry’s 23.8% rise.

Cardinal Health, currently holding a Zacks Rank of 2 (Buy), exhibits an estimated long-term growth rate of 14.2%. CAH delivered earnings above estimates in each of the past four quarters, with an average surprise of 15.6%.

Cardinal Health’s stock has shown a strong performance with a 55.5% increase compared to the healthcare industry’s 15.6% growth in the previous year.

Cencora, also with a Zacks Rank of 2, has an estimated long-term growth rate of 9.8%. The company surpassed earnings estimates in each of the past four quarters, with an average surprise of 6.7%.

Cencora’s shares have soared by 54.8% in the past year, surpassing the healthcare industry’s 6.1% growth rate.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

Revving Inc. (RVTY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.