Rigetti Computing Surges Ahead of Major Competitors in Quantum Computing

Rigetti Computing (RGTI) has seen its shares rise impressively this year, outperforming prominent companies in the sector, including Salesforce, International Business Machines (IBM), and Alphabet (GOOGL).

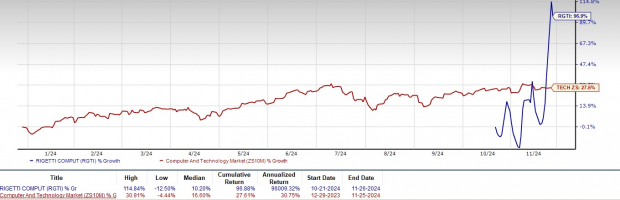

Year-to-date, RGTI shares have increased by 96.9%, while Salesforce, IBM, and Alphabet gained 28.8%, 38.2%, and 20%, respectively. The broader Computer & Technology sector only climbed 27.6% over the same period.

Moreover, RGTI has outpaced the Zacks Internet – Software industry, which returned 31.2% year-to-date.

This strong performance can be largely attributed to RGTI’s growing customer base and its rising prominence in quantum computing technology.

Year-to-Date Gains

Image Source: Zacks Investment Research

Innovations Bolster RGTI’s Future

Rigetti’s innovations in quantum computing are key to its success. In the third quarter of 2024, the company rolled out a new modular system architecture. Looking ahead, RGTI plans to introduce a 36-qubit system by mid-2025 and a 100-qubit system by the end of 2025.

The company has showcased significant advancements in its quantum chips, achieving a remarkable 99.4% median 2-qubit gate fidelity with its 9-qubit chips—this is essential for scaling quantum systems.

Furthermore, Rigetti unveiled the Alternating Bias-Assisted Annealing technique, which enables targeted cubic frequencies in quantum processors. This new method aims to improve fidelity and enhance performance, aiding the scalability of its multi-chip architecture.

RGTI’s modular chip approach is particularly noteworthy as it allows for efficient connections between identical chips, enabling a path to higher-qubit quantum processors. This strategy positions Rigetti to satisfy the growing demand for scalable quantum solutions, thereby solidifying its role in the expanding quantum computing landscape.

As the quantum market develops, RGTI stands to reap the rewards. A report from Grand View Research forecasts that the quantum computing market will grow at a compound annual growth rate (CAGR) of 20.1% from 2024 to 2030.

Growing Client Relationships Create Opportunities

Rigetti benefits from partnerships with companies such as Riverlane and NQCC, and collaborations in quantum machine learning with NVIDIA (NVDA) and Quantum Machines.

A significant collaboration involves Rigetti and Riverlane’s work on quantum error correction (QEC) technology. In the third quarter of 2024, they published results showing real-time low-latency QEC using Rigetti’s 84-qubit Ankaa 2 system, a vital step in enhancing quantum computing reliability.

At the Institute of Electrical and Electronics Engineers Quantum Week, RGTI presented its Nuvera QPU, emphasizing its leadership in quantum computing and reinforcing its machine learning capabilities, supported by NVIDIA’s advanced hardware.

Additionally, Rigetti’s 24-qubit Ankaa-class system has been integrated into the new National Quantum Computing Centre in the UK, increasing its visibility within the global quantum research sphere as researchers utilize its technology for testing and benchmarking.

RGTI Stock: Buy, Sell, or Hold?

Rigetti’s strides in quantum processors and modular architecture continue to propel its revenue growth. However, challenges from macroeconomic factors and fierce competition in the rapidly changing quantum field may hinder RGTI’s financial performance.

The Zacks Consensus Estimate for fourth-quarter revenues is projected at $2.40 million, reflecting a year-over-year decline of 28.99%. Analysts also expect an earnings loss of 8 cents per share, unchanged from previous estimates, but this figure represents an 11.11% increase from the loss noted in the same quarter last year.

Rigetti Computing Price and Consensus

Rigetti Computing, Inc. price-consensus-chart | Rigetti Computing, Inc. Quote

For more information on the latest EPS estimates and surprises, visit Zacks Earnings Calendar.

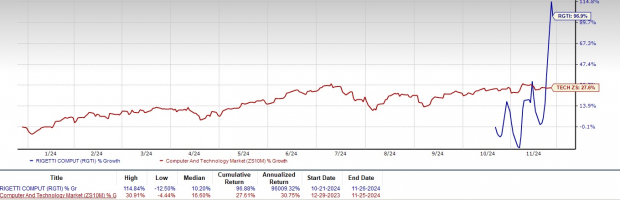

Currently, the RGTI stock is considered less attractive, indicated by a Value Score of F. Its forward 12-month Price/Sales ratio stands at 35.50X, significantly higher than the sector average of 3.02X.

Price/Sales (F12M)

Image Source: Zacks Investment Research

At present, Rigetti holds a Zacks Rank #3 (Hold), suggesting that investors might want to wait for a more opportune moment to buy the stock. You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Five Stocks with Potential to Double

These stocks have been handpicked by Zacks experts as top contenders for +100% gains in 2024. Although not all selections guarantee success, past recommendations have achieved returns as high as +143.0%, +175.9%, +498.3%, and +673.0%.

Many stocks featured in this report are currently under the radar on Wall Street, presenting an opportunity for early investors.

Explore these five prospective gains and more.

Interested in the latest recommendations from Zacks Investment Research? Now, you can download the report on Five Stocks Set to Double for free.

International Business Machines Corporation (IBM): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Rigetti Computing, Inc. (RGTI): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.