Rio Tinto RIO recently unveiled plans to cultivate Pongamia seed farms in Australia, aiming to harness the potential of its oil-rich seeds for renewable diesel production. This strategic move aligns with RIO’s overarching mission to steer away from traditional fossil diesel, a source contributing to approximately 10% of its overall emissions in Australia.

In a bid to achieve net-zero Scope 1 and 2 carbon emissions by 2050, Rio Tinto has identified electrification as the long-term solution for displacing diesel use within its operational fleet. Meanwhile, as the electrification roadmap progresses, the corporation is exploring alternative pathways like biofuels to swiftly curtail diesel-linked emissions.

Australia currently lacks a robust biofuel feedstock sector that can adequately cater to local demands. Rio Tinto anticipates that this experimental initiative will not only help bridge this gap but also bolster its transition towards achieving ambitious decarbonization objectives.

Rio Tinto Partners with Midway for Pongamia Cultivation Experiment

An indigenous tree to northern Australia, Pongamia is distinguished by its rapid growth rate and the copious seeds it produces, abundant in oil and protein content. These seeds can be processed to yield renewable diesel, significantly slashing carbon emissions in contrast to conventional fossil fuel diesel.

Post-oil extraction, the residual seed pod and meal can be repurposed for diverse applications such as cattle feed. Pongamia boasts a plethora of ecological advantages, characterized by its resilience to droughts, salinity, and floods, as well as its minimal water consumption, nutrient requirements, and pest control needs, rendering it an easily cultivable crop.

At present, Rio Tinto is in the advanced stages of acquiring approximately 3,000 hectares of cleared land near Townsville in north Queensland, earmarked for the establishment of farms to analyze growth patterns and gauge seed oil productivity.

RIO has forged an alliance with Midway Limited to supervise the plantation and management of the seed farms. Collectively, they aim to plant close to 750,000 Pongamia saplings in the upcoming period.

Rio Tinto’s Ongoing Decarbonization Ventures

As of 2023, Rio Tinto reported Scope 1 and 2 emissions amounting to 32.6Mt CO2e, reflecting a 5.5% decline from its 2018 baseline. The company has earmarked an investment bracket of $5-$6 billion by 2030 to actualize its decarbonization strategy.

In a significant move earlier this year, RIO revealed intentions to embed carbon-free aluminum smelting cells at its Arvida smelter in Québec, Canada, leveraging cutting-edge technology licensed by the ELYSIS joint venture. The innovative ELYSIS technology targets the eradication of all direct greenhouse gas emissions from traditional aluminum smelting processes, concurrently yielding oxygen byproducts and enhancing operational efficiency by producing more aluminum at reduced costs.

Furthermore, in a collaborative endeavor with BHP Group BHP, Rio Tinto is set to trial sizeable battery-powered haul trucks supplied by industry stalwarts Caterpillar CAT and Komatsu KMTUY in Western Australia’s Pilbara region. This groundbreaking collaboration not only involves two prominent global mining entities but also represents a concerted effort to surmount the monumental challenge of achieving emissions-free haulage within the mining domain.

Even as electrification emerges as the most pragmatic and efficient approach to curbing fossil diesel utilization across mining operations, Rio Tinto acknowledges that mass deployment of battery electric haul trucks may not be technologically or commercially viable until post-2030. Consequently, in parallel to these advancements, RIO is exploring supplementary avenues like biofuels to abate diesel-sourced emissions.

Further underscoring its commitment to sustainability, Rio Tinto successfully transitioned heavy machinery at its Boron facility in California from conventional fossil diesel to renewable diesel in June 2023, marking a remarkable industry milestone. With intentions to replicate this feat at its Kennecott copper operations in Utah and exploring biofuel adoption in scenarios that may pose challenges for electrification, Rio Tinto remains steadfast in its pursuit of greener practices.

RIO’s Stock Performance & Analyst Rating

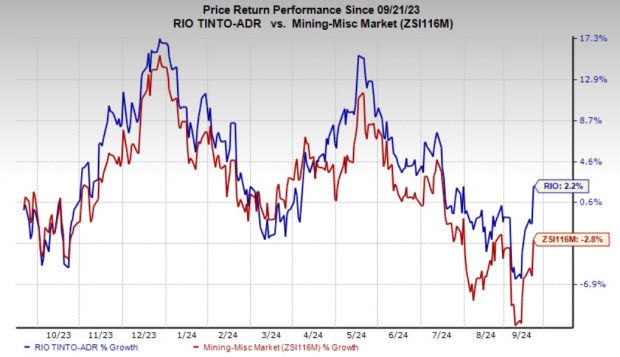

Over the past year, Rio Tinto’s stock has witnessed a 2.2% uptick, outperforming the industry’s 2.8% decline.

Image Source: Zacks Investment Research

Presently, Rio Tinto holds a Zacks Rank #3 (Hold), highlighting a nuanced market sentiment towards the company.

To access this article on Zacks.com, please click here.

Market News and Data brought to you by Benzinga APIs