Shifting Poll Numbers Signal Uncertain Future for Trump and Harris

The upcoming U.S. presidential election is heating up, revealing a competitive landscape between Vice President Kamala Harris and former President Donald J. Trump. A surprising poll from Iowa could hold important implications for the election and beyond.

Poll Results Show a Close Race

Recent polling by Ann Selzer from the Des Moines Register indicates that Harris leads Trump 47% to 44% among likely voters. As noted by Benzinga’s Bibhu Pattnaik, this marks a notable shift from September when Trump held a four-point advantage – he even led President Joe Biden by 18 points before Biden exited the race.

In contrast, an Iowa poll by Emerson College Polling/RealClearDefense shows Trump ahead of Harris by 10 percentage points. The Trump campaign has labeled the Des Moines Register/Mediacom survey as an “outlier poll,” questioning its validity.

Selzer’s Track Record Sets High Expectations

Selzer has a strong reputation, previously making accurate predictions about Trump’s victories in Iowa during both the 2016 and 2020 elections. If her current findings prove accurate, investors may need to re-evaluate their positions in the geopolitical market.

Harris and Continued Support for Ukraine

Harris has consistently supported Ukraine against Russia’s aggression and has criticized Trump for his close ties with Russian President Vladimir Putin. If Harris wins, it is likely she would push for increased military support to Ukraine, which could positively affect the defense sector.

Investment Opportunities in the Defense Sector

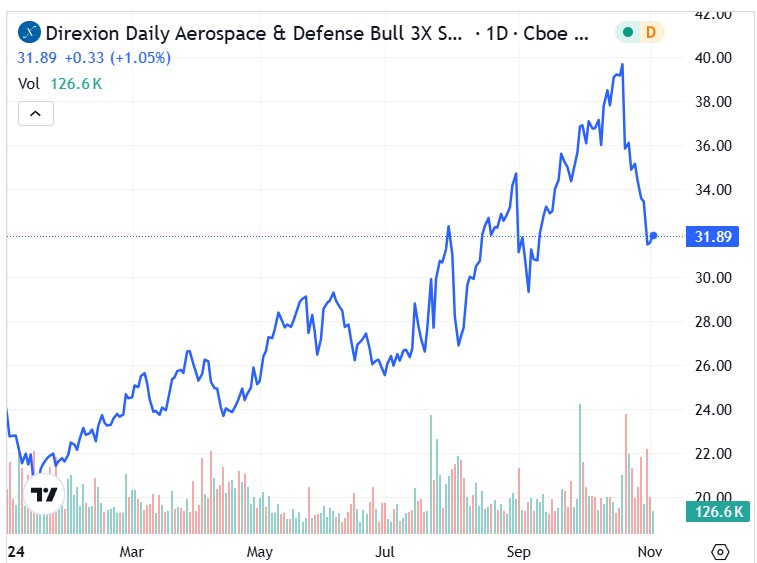

For investors betting on a Democratic victory, the Direxion Daily Aerospace & Defense Bull 3X Shares DFEN might be appealing. This highly leveraged ETF aims to deliver 300% of the daily performance of the Dow Jones U.S. Select Aerospace & Defense Index.

DFEN includes top defense firms like RTX Corp RTX and Lockheed Martin Corp LMT. It also features companies like General Electric Co GE and Boeing Co BA, which are involved in civilian aerospace infrastructure.

A Caution for Investors

Investors should be mindful of the high risks associated with leveraged ETFs. It is advisable not to hold positions for longer than a single day, as volatility can lead to significant loss over time.

Analyzing the DFEN ETF’s Performance

Despite recent volatility, DFEN has shown a bullish trend overall, gaining 34% year-to-date.

- The ETF experienced a spike on Monday following the Iowa poll results.

- Interestingly, after Biden dropped out of the race, DFEN began to gain momentum as Harris emerged as a prominent candidate.

- Investors should remain cautious, however, as a broadening wedge formation since July could indicate bearish trends in the near future.

Featured photo by Robert Waghorn on Pixabay.

This post contains sponsored content. It is for informational purposes only and should not be considered as investment advice.

Market News and Data brought to you by Benzinga APIs