Gold Prices Soar Amid Economic Uncertainty, Contrarians Eye Opportunities

Fear often drives market behavior, as evidenced by the surge in gold prices to record highs. In times of political and economic uncertainty, both individual and institutional investors are turning to gold for security and confidence. Yet, as always, financial markets experience fluctuations, presenting opportunities for those who think differently.

The current narrative surrounding gold is decidedly bullish. Recently, the spot price of gold exceeded the $3,200 per ounce mark, largely due to escalating trade tensions. While President Donald Trump announced a 90-day delay on new tariffs, he maintained a steep 125% tariff on Chinese imports, in addition to an existing 20% duty.

Given China’s status as the world’s second-largest economy, uncertainty remains high regarding the evolving trade conflict. Despite this, gold continues to gain traction, with no signs of diminishing investor interest. According to the World Gold Council, global physically-backed gold ETFs saw inflows of $8.6 billion in March alone. Such intense demand has propelled both the price of gold and the associated mining sector upwards.

However, skepticism persists regarding the value of precious metals. Legendary investor Warren Buffett has openly criticized gold, arguing that, unlike stocks or bonds—which provide earnings, interest, or dividends—gold has minimal utility. He famously remarked, “Gold will never produce anything… it doesn’t do anything but sit there and look at you.”

Additionally, while gold is not a common asset, its supply is not diminishing. In fact, the availability of gold continues to rise; Statista reports an increase of over 3,000 metric tons per year in market supply.

From a historical perspective, gold has not consistently outperformed other investments. Between January 1990 and late 2020, gold appreciated by just over 372%, compared to a staggering 1,700% return for the S&P 500 during the same period. This indicates that while gold may excel during pessimistic market conditions, it can underperform in more favorable environments.

Trading in Direxion ETFs

Given these contrasting views, there are compelling opportunities for investors in gold-mining-focused exchange-traded funds (ETFs). Traders who are optimistic about gold’s upward trend might consider the Direxion Daily Gold Miners Index Bull 2X Shares NUGT. Alternatively, those with a contrarian mindset might prefer the Direxion Daily Gold Miners Index Bear 2X Shares DUST.

Both NUGT and DUST aim to deliver daily investment results equivalent to either 200% or -200% of the performance of the NYSE Arca Gold Miners Index before fees and expenses. As 2X leveraged ETFs, they permit investors to amplify their speculative positions.

These financial instruments provide a convenient alternative for accessing leveraged or short trades without the complexities and potential risks associated with options trading. Direxion ETF shares can be traded like traditional securities, offering accessibility to everyday investors.

Nevertheless, investors considering NUGT and DUST should understand the inherent risks. The gold-mining sector is known for its volatility. Even if gold performs well, that does not guarantee the same for its mining counterpart. Furthermore, leveraged and inverse ETFs are intended for shorter-term exposure; holding them for prolonged periods can result in performance discrepancies due to daily compounding effects.

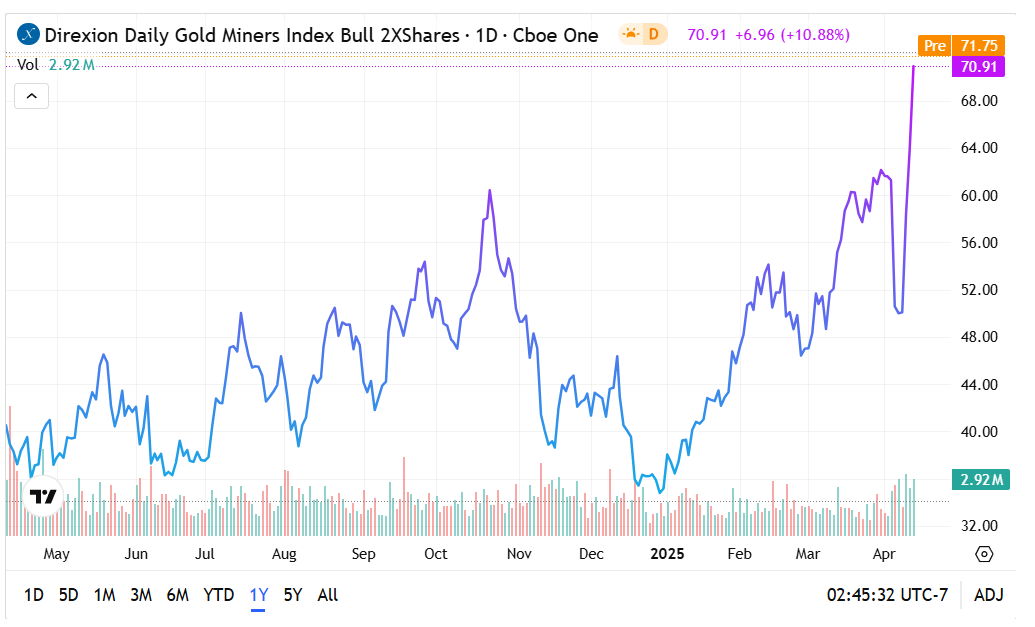

Performance of the NUGT ETF

Performance metrics can be persuasive, and NUGT has recently excelled, accumulating nearly 102% of market value year-to-date.

- NUGT reached a price per unit of $70.91, surpassing its 20-day exponential moving average, indicating strong short-term momentum.

- Considering the upward zig-zag trend established since late January, investors should remain vigilant for a potential pullback.

- Volume levels remain robust, reflecting sustained investor enthusiasm for this 2X bull ETF.

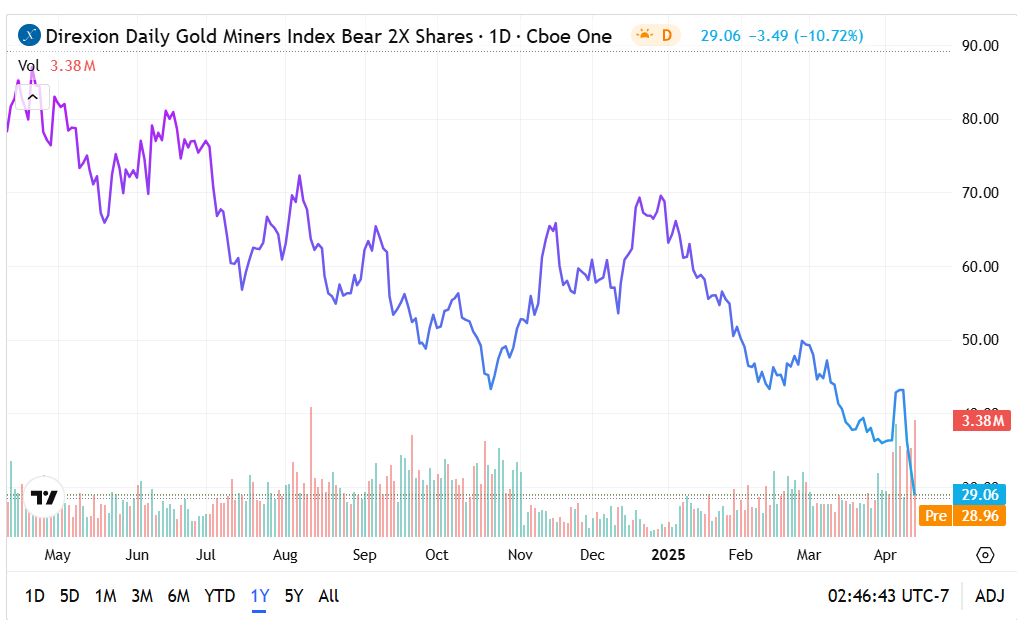

Challenges for the DUST ETF

Conversely, the DUST ETF has faced headwinds, losing nearly 58% of its value since January.

- Currently priced at $29.06, DUST sits below its 20-day exponential moving average as well as the 50-day and 200-day moving averages.

- Despite a consistent downtrend since January, a temporary rebound for the DUST ETF is still possible.

- Strong distribution volume indicates significant hesitance among investors when betting against gold miners.

Featured image by istara on Pixabay.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.