Global EV Sales Reached 25 Million Units This Year

The global market for passenger electric vehicles (EVs), which includes plug-in and conventional hybrids, is set to surpass 25 million units in 2023.

As for the battery capacity in use, a more accurate reflection of demand for battery materials versus just sales figures, the EV sector has seen a remarkable increase of 34% this year. Toronto-based Adamas Intelligence predicts that by 2025, battery capacity deployment will exceed 1 TWh for the first time.

The United States plays a crucial role in achieving this benchmark. Pending tax bill provisions in Congress that may reduce EV subsidies could significantly impact growth in the world’s second-largest EV market.

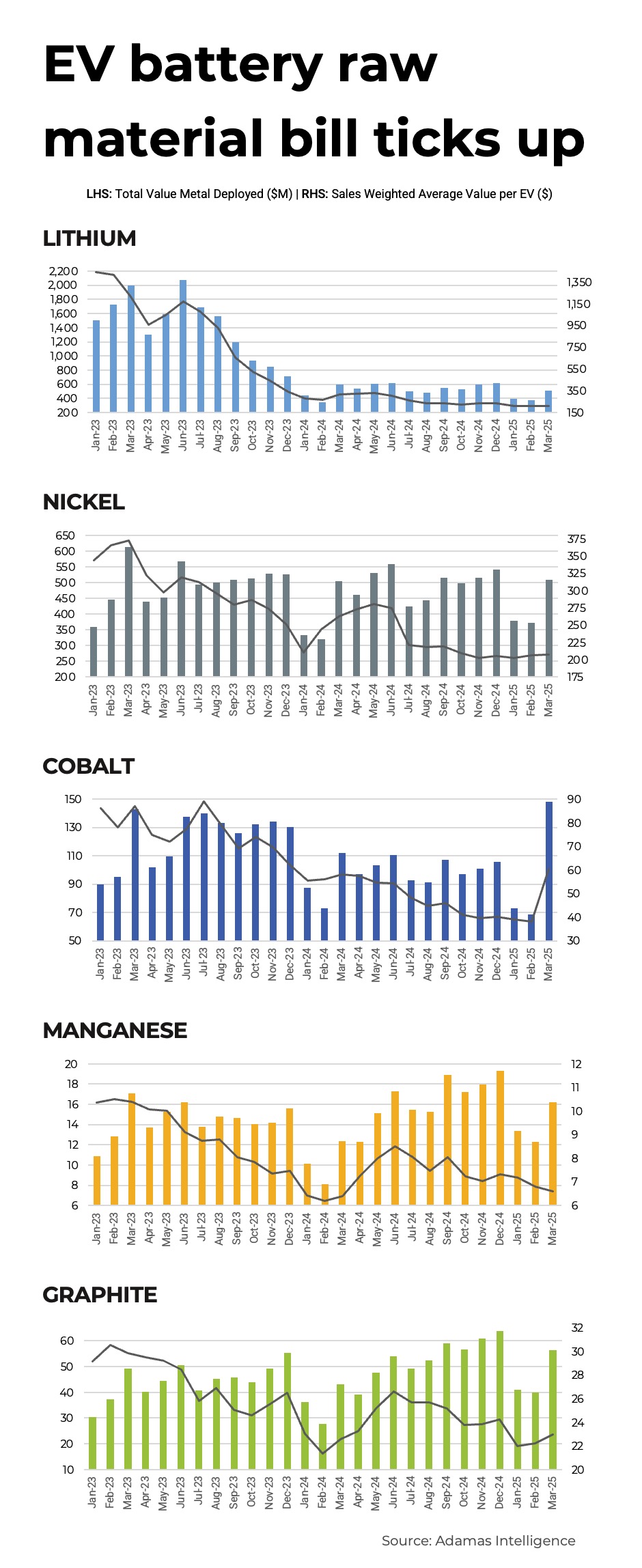

During the first four months of the year, the raw material cost for lithium, graphite, nickel, cobalt, and manganese in EV batteries exceeded $4 billion, amid declining prices for lithium hydroxide and carbonate.

In April, the average price for lithium carbonate in China fell below $10,000 per tonne, marking the lowest level since January 2021. Meanwhile, lithium hydroxide, used in nickel-rich EV batteries, is trading below $9,000 per tonne, having dropped by double digits this year.

Notably, February marked the first time nickel’s value outstripped that of lithium in a monthly assessment. From January to April, the total value of lithium used in battery production was $1.71 billion, while nickel’s value was $1.73 billion.

Year-to-date, nickel sulfate prices entering the EV battery supply chain in China have risen by 8%, averaging $3,770 per tonne in April. This increase in nickel’s value comes even as the adoption of lithium iron phosphate (LFP) batteries accelerates among Chinese automakers.

Last year, LFP chemistry contributed to 58% of the total battery capacity for EVs sold worldwide from China, compared to just 5% in the U.S. and 10% in Europe. This share is anticipated to grow as LFP manufacturing plants begin operations in both Europe and the U.S. by the end of the decade.

It’s important to note that the installed tonnage figures do not account for losses during processing, chemical conversion, or battery production scrap, which can often be significant.

Growth in the electric vehicle segment aligns with a return to battery electric vehicles (BEVs), which have larger batteries compared to plug-in hybrids (PHEVs) and conventional hybrids (HEVs).

Data on sales, battery capacity, and chemistry across over 120 countries, combined with monthly pricing, indicate that the average dollar value of battery metals in EVs is on the rise. Despite downward trends in natural and synthetic graphite, nickel and cobalt prices have spurred an increase in the total metals cost for batteries, which reached $506 in March, the latest month for which detailed data is available.

With a greater proportion of BEVs in the mix, lithium values slightly increased despite falling prices. The current value of lithium contained in an average EV battery now stands at $209, compared to $207 for nickel.

A resurgence in cobalt prices, primarily due to exports from the Democratic Republic of the Congo (DRC), led to a 58% month-on-month rise in average cobalt values. As of March, the cobalt content in the average EV battery was valued at over $60, the highest since December 2023.

Meanwhile, manganese sulfate prices have decreased since August and now average just $7 per battery, while the value of contained graphite, critical for most EVs, remains stable at just under $23 per average EV battery.

Even though the current battery metals bill exceeds $500, it is significantly lower than the same month in 2024 and far from the peak of over $1,900 in early 2023, when lithium prices soared.

For in-depth analysis of the battery metals market, refer to the latest issue of the Northern Miner.

Frik Els is Editor at Large for MINING.COM and Head of Adamas Inside, providing insights based on Adamas Intelligence data.