AI Revolution in Medical Devices: Key Players and Innovations

The medical device industry is entering a transformative phase in 2025, driven by advancements in generative AI and agentic AI technologies. At the forefront of this evolution is NVIDIA (NVDA), whose AI computing platforms are facilitating the growth of AI-powered medical applications, capturing the interest of investors and healthcare professionals alike.

NVIDIA’s Innovations in AI Medical Applications

NVIDIA’s Clara platform harnesses generative AI to provide enhancements in real-time medical imaging and predictive diagnostics. Similarly, its BioNeMo, a generative AI model designed for life sciences, is reshaping drug discovery and biomarker identification, thereby influencing the creation of AI-driven medical devices. In January, NVIDIA convened with industry leaders in genomic research, drug discovery, clinical trials, and patient care to discuss how emerging AI technologies are advancing healthcare delivery.

MedTech Companies Leading the Charge

In this article, we examine three MedTech leaders—Resmed (RMD), GE HealthCare (GEHC), and Medtronic (MDT)—who are integrating various AI technologies into their devices. This integration allows systems to autonomously analyze patient data, adjust treatment plans, and enhance clinical decision-making without continuous human oversight. AI-driven solutions such as insulin pumps and robotic surgical systems are evolving to provide unprecedented precision in treatments.

Healthcare Sector Rapidly Adapting to AI

According to the World Health Organization (WHO), the healthcare industry is projected to face a shortfall of 11 million healthcare workers by 2030. In light of this acute labor shortage, the role of AI in optimizing workflows and enhancing patient care has assumed critical importance.

Regulatory agencies are evolving swiftly to accommodate AI-enabled devices. The FDA and the European MDR are developing new frameworks for approving autonomous systems in healthcare. The implementation of predetermined change control plans (PCCP) and related frameworks allows AI models to adapt post-market while ensuring safety compliance, thereby facilitating faster market entry for AI-powered medical devices.

In addition to partnerships with NVIDIA, MedTech giants are also collaborating with AI leaders like Google Health and Microsoft to co-create advanced solutions, further accelerating AI integration in imaging, diagnostics, and device automation.

Highlighted MedTech Stocks

Resmed: The company is making strides in digital health technology, turning vast amounts of data into actionable insights. With around 21 billion nights of medical data stored in the cloud and over 27 million cloud-connectable medical devices sold across 140 countries, ResMed is well-positioned in the digital health market.

Aiming to improve 500 million lives by 2030 through enhanced residential healthcare, ResMed is expanding AI capabilities in its AirView platform and other customer-facing products. This $34.8 billion market capitalization Stock has a Zacks Rank of #2 (Buy) and an expected long-term earnings growth rate of 16%. In 2025, Resmed anticipates a 22.7% growth in earnings. Over the past two months, the Zacks Consensus Estimate for RMD’s 2025 earnings has increased by 13 cents.

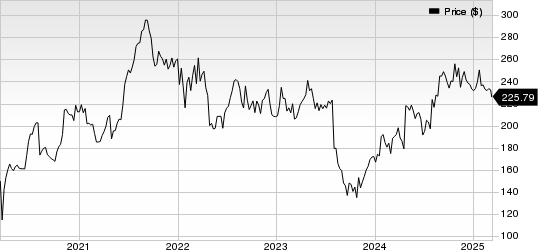

ResMed Inc. Price

ResMed Inc. price | ResMed Inc. Quote

GE HealthCare: This company utilizes artificial intelligence and machine learning to enhance clinical decision support and facilitate highly personalized therapies through improved diagnostics and remote patient monitoring. A growing demand for advanced imaging systems—such as ultrasound devices and interventional solutions—due to the transformation of healthcare facilities, emphasizes the focus on upgrading aging infrastructure.

With a market cap of $39.03 billion, this Stock holds a Zacks Rank of #3 (Hold) and a projected long-term earnings growth rate of 6.2%. In 2025, GE HealthCare expects earnings growth of 4.7%, with the Zacks Consensus Estimate for GAHC’s 2025 earnings having risen by 4 cents over the past month.

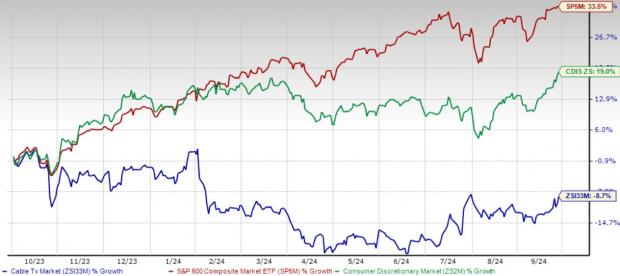

GE HealthCare Technologies Inc. Price

GE HealthCare Technologies Inc. price | GE HealthCare Technologies Inc. Quote

Medtronic: This company is actively applying AI across its diverse portfolio to improve clinical outcomes. For example, its GI Genius system uses AI to help detect colorectal polyps during colonoscopies, while the Touch Surgery Enterprise platform provides AI-driven surgical video management and analytics. Furthermore, Medtronic has developed adaptive deep brain stimulation systems that utilize AI to adjust electrical stimulation based on real-time neural activity.

With a market cap of $119.6 billion, MDT has a Zacks Rank of #3 and an anticipated long-term earnings growth rate of 7.3%. In fiscal 2025, Medtronic is projected to experience a 5% growth in earnings, with the Zacks Consensus Estimate for the company’s fiscal 2025 earnings inching up by a penny over the past month.

Medtronic PLC Price

Medtronic PLC price | Medtronic PLC Quote

Potential Investment Opportunities

Investors may find opportunities among five selected stocks, each endorsed by a Zacks expert as strong candidates for significant future gains. Previous recommendations have seen increases of +143.0%, +175.9%, +498.3%, and +673.0%.

A number of these stocks are not widely recognized, providing a unique chance to invest early in promising companies. Today, you can discover these five potential standout stocks >>

For the latest insights from Zacks Investment Research, download “7 Best Stocks for the Next 30 Days.” Get this free report

Medtronic PLC (MDT): Free Stock Analysis report

NVIDIA Corporation (NVDA): Free Stock Analysis report

ResMed Inc. (RMD): Free Stock Analysis report

GE HealthCare Technologies Inc. (GEHC): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.