Within the ever-evolving realm of decentralized finance (DeFi), effective risk management serves as the cornerstone for the viability of lending protocols. Striking a harmonious equilibrium between paternalistic oversight (established by DAO governors and risk management entities) and the organic mechanisms of the market is vital.

The Nuances of Risk Management in Lending Protocols

Consider a lending protocol where borrowers leverage USDC to secure ETH loans. Pinpointing the optimal loan-to-value (LTV) ratio in this scenario is no mean feat. This LTV metric constantly fluctuates, influenced by factors like asset volatility, liquidity, and market dynamics. In the fast-paced DeFi arena, calculating the precise LTV at any given moment becomes impractical.

As a result, lending protocol design necessitates heuristic approaches and pragmatic decisions. This gives rise to three broad risk management categorizations.

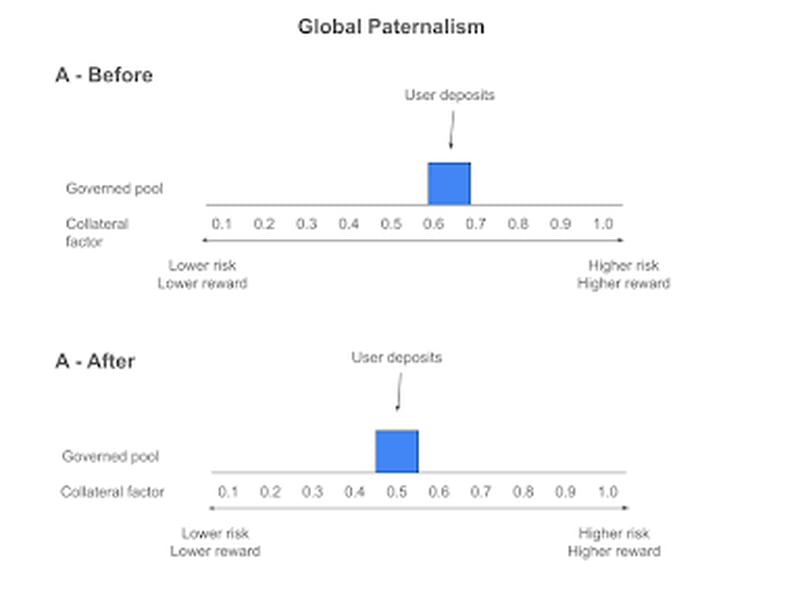

The Global Paternalism of DAO Governance

Presently, the predominant risk management model for DeFi lending protocols is the “paternalistic” paradigm, steered by DAOs and risk management bodies like Gauntlet, Chaos, and Warden. This model presupposes that a governing entity – whether a DAO or another organization – possesses superior insight into user risk tolerance than the users themselves.

This approach, embraced by platforms such as Euler v1, Compound v2, Aave v2/v3, and Spark, involves conservatively setting LTV ratios. In adverse risk scenarios, governance can recalibrate protocol-wide LTV ratios for all users.

While this model ensures efficient capital utilization for borrowers and curbs liquidity dispersal, it’s not without drawbacks. DAOs comprise individuals with diverse skill sets, not all of whom may be adept at directly voting on risk parameters.

Delegating voting power can channel decision-making to more proficient DAO members. Yet, this risks centralizing decision authority in a select few, potentially leading to delays in implementing decisions when environmental conditions shift rapidly.

Moreover, governance obliges protocol users to embrace or decline a single risk/reward scenario, despite users’ varying risk tolerance levels. This reliance on paternalistic risk management may hinder users from making informed risk/reward evaluations independently in the future.

The Unseen Hand of Isolated Pools

The laissez-faire principles underpinning the “invisible hand” model empower lenders to actively select their risk/reward preferences. Coined by economist Adam Smith, the “Invisible Hand” symbolizes the intangible forces propelling a free-market economy towards optimal outcomes.

Platforms such as Kashi, Silo, Compound v3, Morpho Blue, Ajna, and FraxLend permit lenders to engage with mostly ungoverned, isolated pools, offering flexibility in LTV ratios based on market dynamics. With a plethora of pools to choose from, users enjoy the liberty to lend across a broad spectrum of LTV ratios and other risk parameters.

This approach fosters the emergence of diverse lending and borrowing use-cases. At the protocol layer, operational simplicity is often observed with free-market models. The absence of governance allows for the construction of immutable primitives accessible to all. While this may not streamline the overall system’s complexity, it does simplify the trusted codebase for users comfortable with taking charge of their risks.

However, this approach isn’t devoid of challenges, such as liquidity fragmentation, impeding lenders and borrowers from seamless connection. Isolated pools not only complicate matchmaking between lenders and borrowers but also elevate borrowing costs, especially when borrowers utilize non-yielding collateral (as seen in Morpho Blue, Compound v3, FraxLend).

In stark contrast, monolithic lending protocols…

The Evolution of Decentralized Lending: Navigating Risks and Rewards in the DeFi Space

Redefining Borrowing Dynamics

Gone are the days when borrowing was a simple transaction. Enter a new era where borrowers flex their assets in a double whammy – as collateral while simultaneously lending them out, potentially turning a profit. This unique strategy of interest-rate arbitrage, known as “carry trades,” has investors brimming with excitement. The allure of increased yields for lenders in this scenario is undeniable. However, caution lights flicker as lenders expose themselves to rehypothecation risks, especially pronounced in monolithic lending protocols, unlike their isolated counterparts.

A New Dimension of Local Paternalism via Aggregators

Aggregators strut onto the scene as the cavalry to the limitations of isolated pools. These platforms promise to dissolve the liquidity woes linked with isolated pools, at least from the lenders’ perspective. Lenders cozy up to aggregators, yet borrowers linger in a fragmented landscape. Aggregators act as middlemen, housing diverse assets managed by a local risk manager, paving a path to seamless access to risk/reward profiles. From the neutral stance of Yearn and Idle to the protective stance of MetaMorpho, aggregators offer a bouquet of choices. Lenders savor the flexibility but swallow the bitter pill of additional fees and paternalistic overtures, leaving borrowers to navigate their risk management strategies amid the fragmented experience.

Embracing Modularity and Flexibility

Decentralized finance (DeFi) yearns for a lending ecosystem marked by modularity, the key to competing with traditional finance. A one-size-fits-all approach won’t cut it. Monolithic lending protocols decked with capital efficiency lack a smorgasbord of risk/reward options, while isolated lending markets, guided by the invisible hand, offer flexibility at a cost of liquidity fragmentation and high borrowing fees. Aggregators, though a step forward, introduce a new set of challenges.

Protocols championing modularity emerge as the heroes by bridging the gap between monolithic giants and isolated pools. By promoting bespoke user experiences through tailored lending vaults, these protocols blaze the trail for a new era of customization in permissionless settings.

The Pinnacle of Flexibility: Euler v2’s Ethereum Vault Connector

Euler v2’s ethos revolves around the Ethereum Vault Connector (EVC), a yet-to-launch feature undergoing stringent tests and audits, sporting a generous bug bounty. Once live, the EVC promises a playground where users stack vaults on vaults. This approach accommodates both immutable and governed preferences, offering users the liberty to opt for hands-on or hands-off experiences. Whether users lean towards a self-directed journey or a guided tour led by DAOs and risk management entities, the neutrality ingrained in the core code allows users to dance to their own beat.

The expressions and opinions detailed in this article belong to the writer and may not align with Nasdaq, Inc.’s viewpoints.