Rithm Capital Corporation (NYSE:RITM) has become more attractive as a high-yield stock after the company’s fourth quarter earnings triggered a minor stock correction.

Rithm Capital reflects one of the best values that I have ever seen in the high-yield mortgage trust market, primarily because of the trust’s extremely low dividend pay-out ratio.

The mortgage real estate investment trust produced an unreal amount of excess dividend coverage in 2023 which in turn makes the 10% yield extraordinarily attractive for passive income investors.

Though there are risks, which I will discuss, I think Rithm Capital’s below-book value market price makes the mortgage trust a steal.

Unlocking the Potential

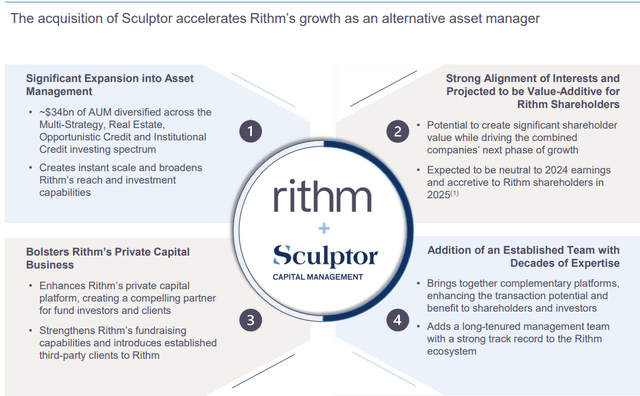

Rithm Capital created a new income stream through the acquisition of Sculptor Capital in 2023 which creates an opportunity for the mortgage real estate investment trust to build and grow an asset management company that is involved in third-party capital management.

Rithm Capital did not capture any excess income from MSR sales in 4Q-23, but the segment remains a compelling income driver moving forward.

Taking into account Rithm Capital’s substantial excess dividend coverage (with or without MSR sales), I think that the stock offers up some of the safest high yields in the mortgage trust sector.

Impressive Financial Footing

Rithm Capital is structured as a mortgage real estate investment trust and thus has to pay out the majority of its profits in order to receive special tax treatment.

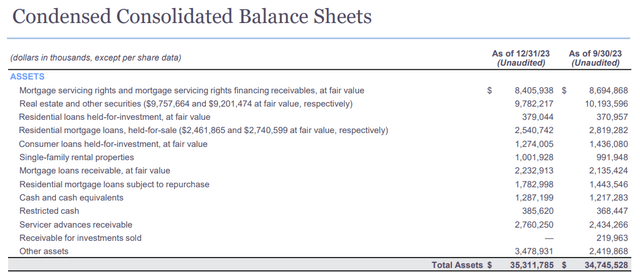

The mortgage trusts invests into a whole range of assets including Mortgage Servicing Rights, real estate securities, single-family rentals, mortgage loans etc. The biggest asset are Mortgage Servicing Rights which increase in value in a rising-rate environment.

Mortgage Servicing Rights, or MSRs for short, were the second-biggest investment pillar for Rithm Capital in 2023, accounting for about $8.4 billion of the trust’s $35.3 billion in assets.

MSRs are mortgage assets that rise in value when interest rates go up because servicers can capture a large amount of fees from such rights. High interest rates prevent refinancings which in turn extends the life of the underlying fee stream.

Strategic Acquisitions and Market Sentiment

Rithm Capital acquired asset management company Sculptor and its $33 billion in assets under management last year for $720 million in order to diversify its business and generate synergies.

The entry into the third-party asset management business was not particularly welcomed by investors as it moves the trust away from its core real estate business.

The acquisition is anticipated to make a positive financial impact on Rithm Capital and I personally think that the increased diversification in Rithm Capital’s investment portfolio benefits shareholders.

Improved Performance and Market Position

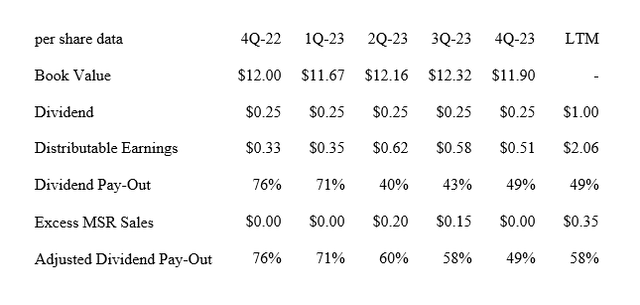

In the second and third quarters of 2023 Rithm Capital received excess income from the sale of MSRs in the total amount of $0.35 per share. In the fourth quarter, Rithm Capital did not receive such additional income from MSR-related sales, resulting in a QoQ decline in distributable earnings and a higher dividend pay-out ratio. The trust’s dividend pay-out ratio in 4Q-23 rose to 49%, up from 43% in the prior quarter.

The pay-out ratio in 2023 was also 49%, but rises to 58% when corrected for non-recurring income from MSRs sales. This, however, is still exceptional when compared to the dividend pay-out ratio of Annaly Capital Management Inc. (NLY) which paid out more than 90% of its distributable earnings in the last year.

There is, however, a big difference between the portfolios and balance sheets of Rithm Capital and Annaly Capital Management. Rithm Capital is primarily invested in MSRs and real estate securities whereas Annaly Capital Management is more focused on agency-quality mortgage-backed securities.

Taking into account how large the degree of excess dividend coverage is, I think that Rithm Capital at some point could pay a special dividend or put more money towards share repurchases which would be accretive to book value.

Untapped Potential Over Market Perception

Rithm Capital owns a more complex portfolio of mortgage assets than other mortgage REITs and the fact that the mortgage trust is moving into the asset management business (non-real estate) may explain why some passive income investors are shunning the stock.

With that said, as long as Rithm Capital maintains its REIT classification and pays out the majority of its earnings as dividends, I think that the discount to book value makes Rithm Capital an absolute steal, most certainly when compared against more traditional mortgage trusts like Annaly Capital Management.

Rithm Capital: A Deeper Look into Investment Valuation

When it comes to making investment decisions, the relationship between a firm’s market value and its book value can be a critical determinant of potential returns. Rithm Capital, a trust with a unique mortgage portfolio, has been sparking intrigue due to its significant discount in the market. Let’s delve into the complexities of this discrepancy, its implications on investment prospects, and whether Rithm Capital warrants a second look from investors.

The Distinctiveness of Rithm Capital’s Portfolio

Rithm Capital has set itself apart in the market with its distinctive trust composition. This includes a diverse range of assets such as single-family rentals, MSRs, servicer advances, and real estate securities. The trust’s stock has been observed to trade at a significant discount to book value for an extended period. This unique composition of assets within the trust’s mortgage portfolio is likely a contributing factor to this valuation anomaly.

A prolonged period of higher interest rates would likely favor Rithm Capital due to its substantial investments in MSRs, which tend to appreciate in value when short-term interest rates rise. Conversely, a swifter-than-anticipated decline in key interest rates would present a challenge to the trust’s considerable MSR portfolio and equity value.

Insights into Rithm Capital’s Appeal as an Investment

Rithm Capital’s allure to passive income investors lies in its impressive dividend coverage. Despite MSR sales impacting the trust’s dividend pay-out ratio in specific quarters, the foundation of a robust dividend remains evident. Even after removing the effects of such sales, Rithm Capital maintains an enviable pay-out ratio of just 58%. This reaffirms its position as an attractive option for those seeking steady income from their investments.

Furthermore, the fact that Rithm Capital’s stock is currently trading at a 14% discount to its book value is noteworthy. Despite this discount, the trust offers a more intricate yet diversified investment portfolio that serves as a hedge against potential interest rate hikes. This unique positioning demands a closer examination from those seeking opportunities in the market.

Rithm Capital, featuring prominently among the top holdings in many passive income portfolios, has earned a Strong Buy stock classification in the eyes of several experts, reaffirming its desirability as an investment prospect worth consideration.