A surge of optimism now envelops Riverstone Holdings (SGX:AP4), with the one-year price target ascending to 0.74 per share. This upward revision amounts to a significant 6.57% from the prior estimate of 0.70 disclosed back on January 16, 2024.

The price target signifies an amalgamation of numerous projections furnished by analysts. The latest targets exhibit a spectrum ranging from a modest low of 0.63 to a lofty high of 0.86 per share. The average price target epitomizes a commendable 4.87% jump from the most recent closing price of 0.71 per share.

Fundamental Insight: Gauging Market Sentiment

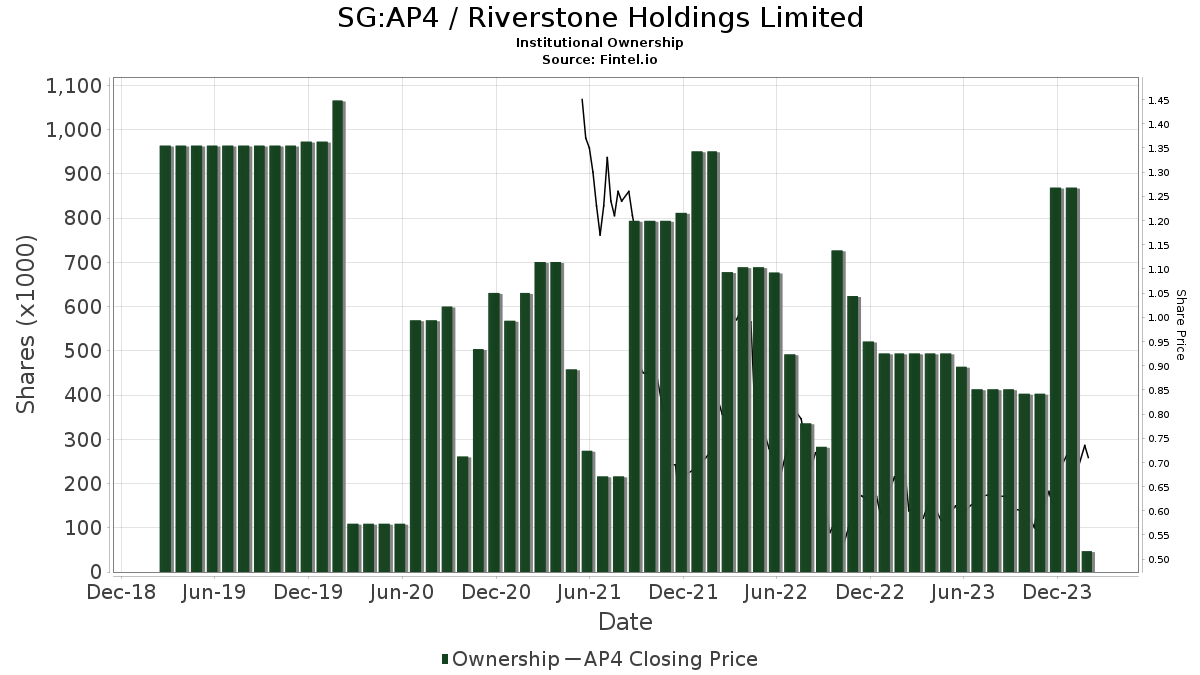

Presently, a cohort of 1 fund or institution divulges their positions in Riverstone Holdings. This reflects a downturn of 1 owner, showcasing a stark 50.00% decline within the last quarter. The mean portfolio weight attributed to AP4 by all funds stands at 0.00%, manifesting a substantial dip of 98.96%. Noteworthy is the descent in the total shares owned by institutions which fell by 0.00% in the bygone three months, now lodging at 47K shares.

Action in Shareholder Sphere: Insights from the Field

The JISAX – International Small Company Fund Class NAV retains 47K shares, representing 0.00% ownership of the firm, with an unaltered stance in the last quarter.

Fintel stands as a premier avenue for investing research sources designed to cater to individual investors, traders, financial advisors, and small hedge funds alike.

Our expansive data network spans globally, encompassing fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. On top of that, our exclusive stock recommendations harness the prowess of advanced, backtested quantitative models, paving the path for augmented profitability.

Click to Learn More

This story was originally featured on Fintel.

The views and opinions articulated herein represent the sentiments of the author and may not necessarily mirror those of Nasdaq, Inc.