The one-year price target for Rivian Automotive (NasdaqGS:RIVN) has been updated to $16.91 per share, marking an 11.04% increase from the previous estimate of $15.23 as of December 3, 2025. This target represents a 24.69% decrease compared to the last reported closing price of $22.45 per share. Analysts’ targets for Rivian range from a low of $10.10 to a high of $26.25 per share.

Currently, 1,119 funds report positions in Rivian, a slight increase of 0.72% from the last quarter. Institutional share ownership rose by 2.57%, totaling 718,270,000 shares. Amazon holds the largest stake at 12.96% with 158,364,000 shares, unchanged from last quarter. Notably, Baillie Gifford decreased its holdings by 5.89%, while Vanguard Total Stock Market Index Fund increased its allocation by 3.28%.

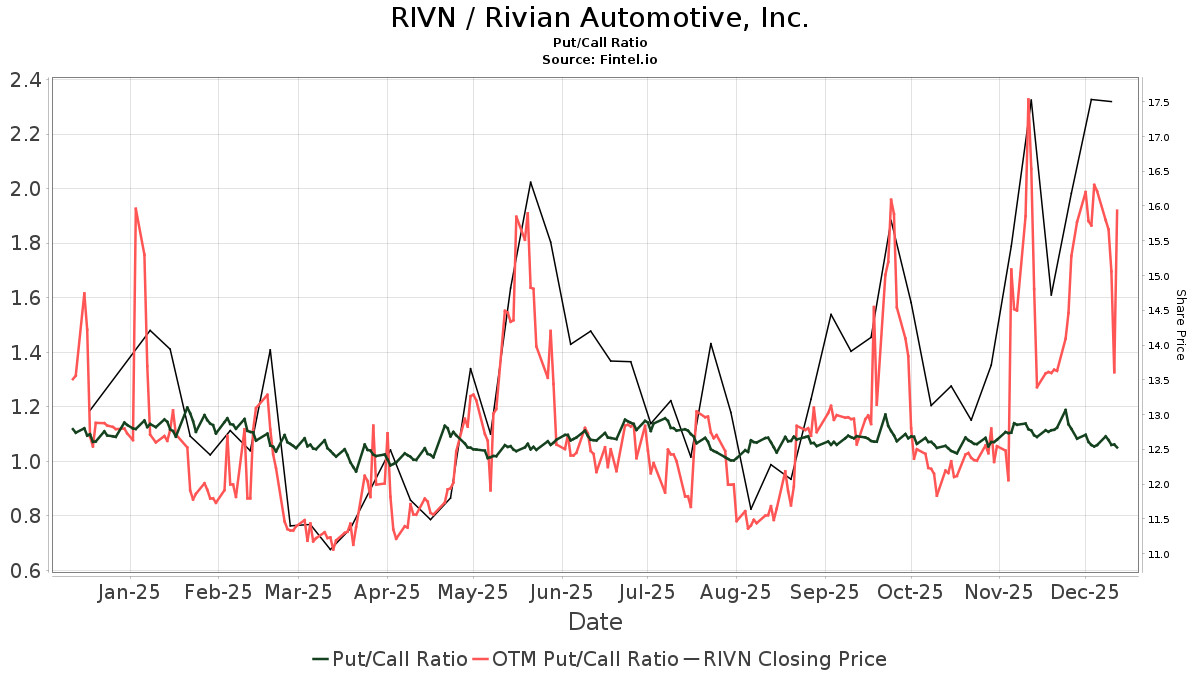

The put/call ratio for Rivian is 1.10, suggesting a bearish sentiment among investors.