Rivian Automotive, Inc. RIVN is gearing up to disclose its fourth-quarter 2023 financial results on Feb 21, following the close of the market. According to the Zacks Consensus Estimate, the company’s anticipated loss per share and revenue for the quarter stand at $1.39 and $1.28 billion, respectively.

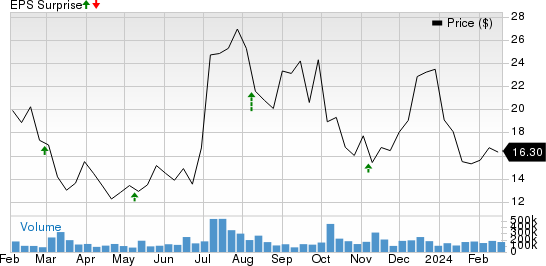

The consensus forecast for RIVN’s projected quarterly loss has expanded by 2 cents over the last 30 days. Earnings estimates indicate a 19.7% rise from the corresponding figure reported a year ago, while the consensus estimate for quarterly revenues suggests an impressive year-over-year surge of 93.5%. Rivian outperformed earnings estimates in each of the trailing four quarters, delivering an average positive surprise of 15.4%. The company’s progress can be visually depicted in the graph below:

Rivian’s Performance Momentum

Looking back at the third quarter of 2023, RIVN’s adjusted loss per share was $1.44, narrower than the consensus prediction of a $1.61 loss. The bottom line also showed improvement from a year-ago loss of $1.57 per share. Notably, the total revenues of $1.34 billion surpassed the consensus estimate of $1.30 billion, demonstrating significant growth from the $536 million generated in the third quarter of 2022.

Driving Forces Behind Rivian’s Anticipated Results

In the fourth quarter of 2023, Rivian achieved a remarkable production and delivery milestone by producing 17,541 and delivering 13,972 vehicles. This represented a substantial jump from the 10,020 and 8,054 vehicles produced and delivered, respectively, in the fourth quarter of 2022. Such elevated deliveries are anticipated to contribute to boosted revenues. Moreover, the company reported a gross loss of $477 million in the last reported quarter, narrower than the $917 million gross loss reported in the corresponding quarter of 2022. The company’s cost-reduction endeavors have led to a significant improvement in its Adjusted EBITDA projection, which is currently estimated at $(4) billion. Additionally, the company has revised its capital expenditure guidance to $1.1 billion from the previous estimate of $1.7 billion. These adjustments are expected to positively impact Rivian’s fourth-quarter performance.

The downward trend in net losses observed in the third quarter of 2023, which narrowed to $1.37 billion from $1.72 billion reported in the same quarter of 2022, is forecasted to have continued and potentially strengthen the company’s upcoming results.

Earnings Anticipation

Our reliable model indicates an expected earnings beat for the electric vehicle manufacturer for the upcoming quarter. When a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) are combined, the probability of an earnings beat increases. Rivian currently possesses an Earnings ESP of +0.72%, with the Most Accurate Estimate for a loss of 1 cent being narrower than the Zacks Consensus Estimate. The company holds a Zacks Rank #3, further affirming this upbeat outlook.

Earnings and Auto Industry Landscape

Alongside Rivian, other players in the automotive industry, such as Lucid Group, Nikola Corporation, and Fisker Inc., are also set to report their fourth-quarter earnings. Investors keen on keeping track of upcoming earnings announcements can utilize the Zacks Earnings Calendar as their go-to resource.

Disclaimer: This article has been written by the author’s own views and does not necessarily reflect those of Nasdaq, Inc.