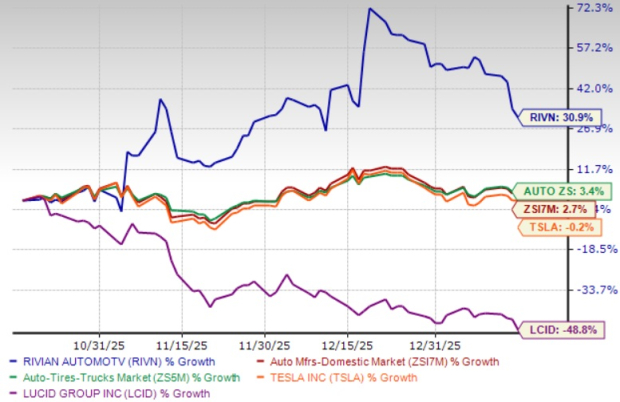

Rivian Automotive (RIVN) has seen its share price increase by 30.9% over the past three months, significantly outperforming the industry’s growth of 2.7% and sector growth of 3.4%. In contrast, rival companies such as Tesla (TSLA) and Lucid Group (LCID) faced declines of 0.2% and 48.8%, respectively.

However, Rivian’s vehicle deliveries dropped to 42,247 in 2025, down from 51,579 in 2024, while production fell to 42,284 from 49,476. In comparison, Tesla delivered over 1.635 million vehicles in 2025, a decrease from more than 1.789 million in 2024. The company’s cash balance decreased from $7.7 billion to $7.1 billion, signaling increasing cash flow pressures due to rising capital expenditures linked to the R2 program.

Furthermore, Rivian’s growth is threatened by slowing demand for electric vehicles and intense competition in an increasingly crowded market. The expiration of the $7,500 U.S. tax credit has raised vehicle prices and could further limit demand for its premium-priced models. Analysts have issued a cautious consensus on Rivian, with a Zacks Rank of #4 (Sell) and EPS estimates for 2026 being revised downward.