Rivian Automotive Secures ‘Buy’ Rating from Analyst as EV Market Heats Up

Analyst Outlook: The Benchmark Company’s Mickey Legg Initiates Rivian Coverage

Equity research analyst at The Benchmark Company, Mickey Legg, has begun coverage on electric vehicle startup Rivian Automotive Inc. RIVN, giving it a “buy” rating and setting a price target of $18.

Market Position: Rivian Aims to Capture Growth Amid Changing Industry Dynamics

“Rivian is well-positioned to gain significant share of a massive market opportunity in the coming decade,” Legg stated, according to a report by Barron’s. He noted that after a slow period this year, domestic EV production is projected to improve by 2025, with additional growth expected in 2026 and 2027. This improvement is connected to declining average selling prices and developments in charging infrastructure.

Currently, Rivian’s lineup includes the R1T electric truck and the R1S electric SUV, both starting at around $70,000, which places them in the higher price range of the EV market.

Future Plans: Expansion with New Models on the Horizon

Rivian is set to broaden its market appeal with the release of the R2 SUV, projected to be priced around $45,000, matching the cost of Tesla’s popular Model Y SUV. Production of the R2 is expected to commence in early 2026.

Following that, Rivian plans to launch the R3 crossover, anticipated to be priced lower than the R2, although its exact pricing compared to the Tesla Model 3 remains uncertain.

Production and Financial Health: Rivian’s Vehicle Deliveries and Cash Reserves

In the third quarter, Rivian produced 13,157 vehicles and successfully delivered 10,018 of them. For the full year, the company anticipates delivering between 50,500 and 52,000 vehicles. Despite these efforts, Rivian has not yet achieved profitability.

As of the end of the third quarter, Rivian holds $6,739 million in cash, cash equivalents, and short-term investments. This financial cushion is bolstered by a partnership with German automaker Volkswagen.

Rivian’s stock closed 11.2% higher at $14.45 on Monday, although it has dropped approximately 31.5% year-to-date, as reported by Benzinga Pro.

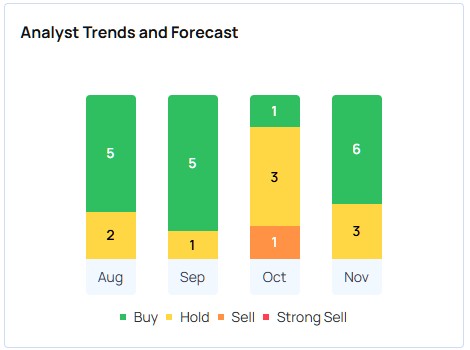

A consensus price target for Rivian stands at $16.17, based on evaluations from 25 analysts. Canaccord Genuity set the highest price target of $28 on October 7, while Mizuho provided the lowest target at $11 on November 8.

Explore more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs