“`html

Rivian Automotive, Inc. (RIVN) has announced that it will not pursue extended-range electric vehicles (EREV) or hybrid configurations, steering its long-term strategy towards full electrification. The company aims to capitalize on the midsize SUV segment with its upcoming models, the R2 and R3, designed for strong performance and competitive pricing.

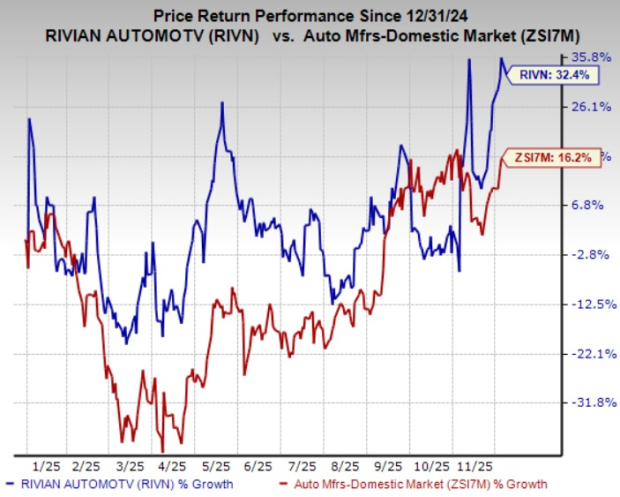

Year-to-date, RIVN shares have gained 32.4%, outperforming the industry growth of 16.2%. In contrast, shares of Lucid Group, Inc. (LCID) have dropped 57.7%, while Tesla, Inc. (TSLA) has seen an 8.9% increase in the same timeframe. Rivian’s forward price/sales ratio is 3.25, marginally lower than the industry’s 3.42.

Additionally, the Zacks Consensus Estimate for RIVN’s losses per share for 2025 and 2026 has decreased by 2 cents and 5 cents, respectively, in the past month.

“`