The latest buzz in the financial world surrounds Roblox (NYSE:RBLX) as the price target for this gaming giant has been catapulted by 13.87% to a stellar $50.01 per share. This surge follows a notable revision from the prior prediction of $43.92 dating back to January 16, 2024. With analysts pouring over their crystal balls, the bullish outlook on Roblox is shining brighter than ever.

Analyst Predictions and Price Targets

The average price target for Roblox amalgamates forecasts from various financial wizards, ranging from a modest $29.29 to an ambitious $68.25 per share. This average projection marks a substantial 20.63% rise from Roblox’s most recent closing price of $41.46 per share.

Insight into Investor Sentiment

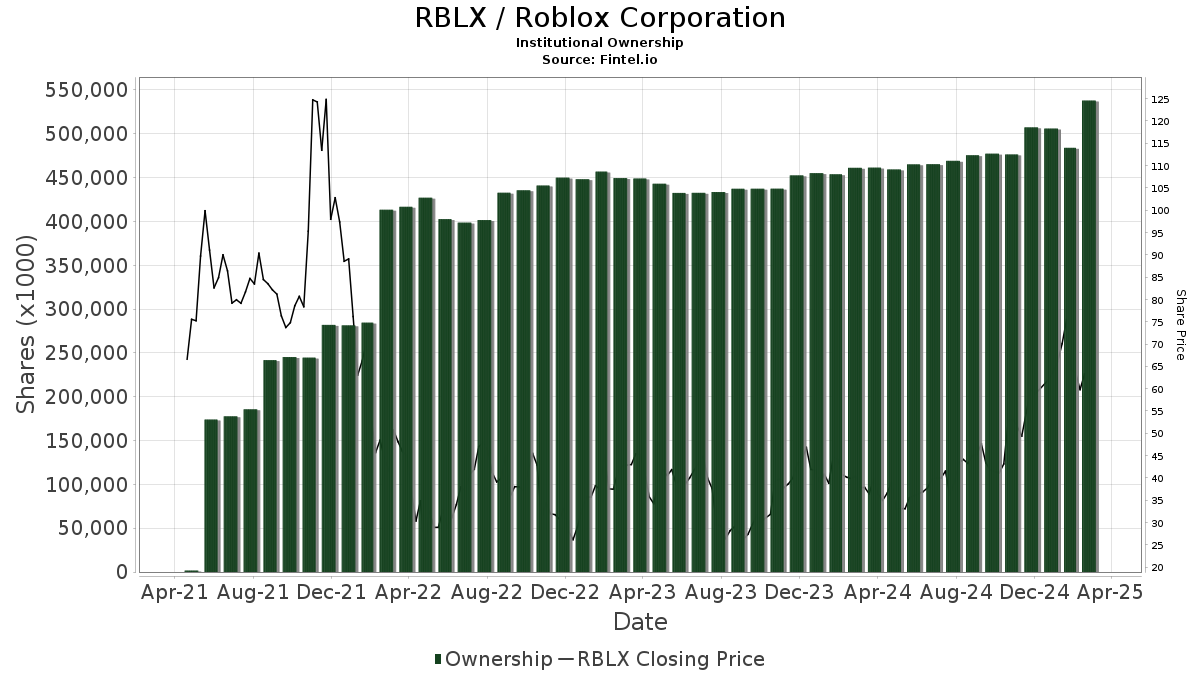

Steering attention towards the fund sentiment, 1065 funds or institutions have disclosed their positions in Roblox, indicating an impressive hike of 91 owners or 9.34% in the last quarter alone. The average portfolio weight across all funds invested in RBLX stands at 0.44%, showcasing a slight decrease of 11.72%. Noteworthy is the total share ownership by institutions which surged by 5.70% in the past three months, now resting comfortably at 464,397K shares.

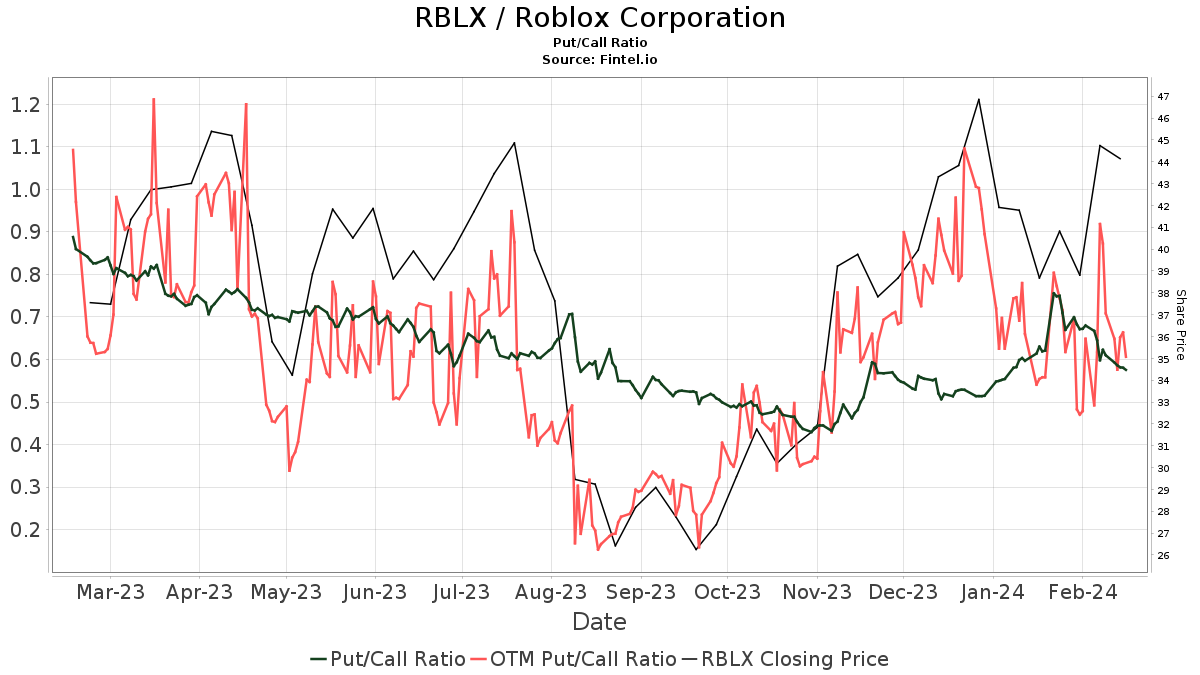

The put/call ratio for RBLX stands at an optimistic 0.51, hinting at a bullish trend according to market sentiment.

Snapshot of Shareholder Activity

Delving into the shareholder landscape, Altos Ventures Management proudly holds 48,927K shares, representing a noteworthy 7.75% stake in the company. Shockingly, the firm witnessed a 23.06% decrease in ownership when compared to its prior filing. On the contrary, Baillie Gifford tightened its grip on Roblox by increasing its portfolio allocation by a whopping 35.14% over the last quarter.

Turning the spotlight on Vanguard Total Stock Market Index Fund Investor Shares (VTSMX), the fund now holds 15,032K shares, marking a 2.38% ownership in Roblox. Impressively, VTSMX saw a 24.22% increase in its shareholding, painting a rosy picture amidst varied investor sentiments.

Not to be left behind, Temasek Holdings also joined the fray, boasting 13,289K shares or a solid 2.11% stake in the gaming powerhouse. Demonstrating their confidence, Temasek Holdings ramped up their portfolio allocation in RBLX by an impressive 48.88% over the last quarter.

Meanwhile, ARK Investment Management, wielding 11,906K shares, commands a respectable 1.89% ownership of Roblox. In a display of strategic maneuvering, ARK increased its stake in RBLX by 21.47% during the last quarter, defying the odds of volatility.

Roblox: Building Dreams Together

Roblox’s journey unveils a saga of building a human co-experience platform geared to unite billions across the globe through shared digital experiences. A community of over five million creators breathes life into the platform, where 36 million users revel in immersive adventures daily. An ethos of safety, diversity, and creativity defines Roblox’s mission, fostering positive relationships and boundless creativity worldwide.

Fintel, a premier investing research platform, equips individual investors, financial advisors, and hedge funds with comprehensive data, analysis, and insights to navigate the unpredictable financial seas. Their treasure trove covers fundamentals, analyst reports, ownership data, and intricate fund sentiments – a beacon of light guiding investors to potentially greater profits.

This story initially surfaced on Fintel, offering a glimpse into the bustling world of high finance and market maneuvers.

As a parting thought, remember that the views expressed here belong solely to the author and may not align with the perspectives of Nasdaq, Inc.