The Journey So Far

Boyd Gaming Corporation (BYD) finds itself riding high on a wave of robust visitation, fueled by new property openings and strategic refurbishments. The company’s Online segment stands tall as a beacon of success. However, lurking beneath this tale of triumph are the looming shadows of high costs that threaten to dampen the spirits.

Currents of Growth

In the vibrant landscape of Las Vegas, BYD has pinpointed a treasure trove of growth opportunities. The year 2023 painted a promising picture – with positive trends in guest counts, frequency, and spending. A 5% surge in visitation across Nevada set the stage, with Las Vegas emerging as a beacon of growth. The convention business witnessed a remarkable 20% upswing.

The dawn of 2023 saw a 12% surge in average daily room rates within the Southern Nevada market. The upcoming extravaganza of Las Vegas’ maiden Super Bowl, a bustling convention calendar, and a flurry of new properties and revamps promise a blooming market scenario. Boyd Gaming’s expansion plans underscore a strategic focus on acquisitions to bolster its brand presence.

Recent revelations from BYD’s fourth-quarter 2023 earnings call unveiled the extensive expansion pursuits at the Wilton Rancheria Tribe property. While the roadmap includes additional casino facilities, a towering hotel, and top-notch meeting spaces, the company maintains a cautious optimism on the long-term potential of this venture. Further, management eyes expansions at Gold Coast, Blue Chip, Ameristar St. Charles, and Valley Forge in 2024.

The Online segment has remained a bright spot in BYD’s narrative, with adjusted EBITDAR soaring by 56.5% in 2023. The company projects continued success, particularly in Ohio where sports betting is gaining momentum. The relaunch of Starts branded online casinos in Pennsylvania and New Jersey marks a strategic milestone, showcasing Boyd Interactive platform’s prowess in managing online casino operations.

Uncharted Waters Ahead

Amidst the shining stars of success, BYD finds itself wrestling with the dark clouds of escalating costs. Rising wages, utilities, and property insurance expenses have cast a shadow on the financial landscape. The year 2023 witnessed surges in food and beverage, room, online, and general administrative expenses — sounding a cautionary note within the company’s financial reports. Total operating costs for the year climbed to $2.84 billion, marking a steep rise from the previous year.

Peering into the horizon, BYD remains vigilant, monitoring economic cues to navigate through the potential impacts of interest rate hikes and inflation. Although cost pressures are expected to remain steady in 2024, the specter of prolonged challenges looms large.

Spotting Gems Along the Way

Beyond the shores of Boyd Gaming lies a treasure trove of promising stocks awaiting discovery. Trip.com Group Limited (TCOM), Royal Caribbean Cruises Ltd. (RCL), and Hyatt Hotels Corporation (H) beckon as prudent picks in the Zacks Consumer Discretionary sector.

TCOM, with a Zacks Rank #1 (Strong Buy), boasts a track record of earnings surprises, while RCL and H stand firm with Zacks Rank #1 and #2, respectively. These stocks emerge as promising beacons of growth, offering valuable insights for investors seeking to navigate the volatile waters of the financial markets.

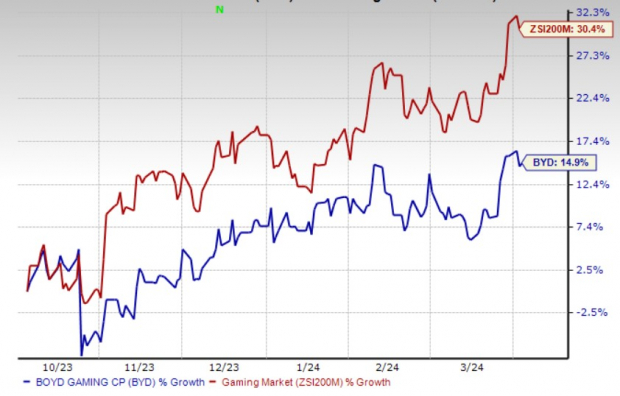

Image Source: Zacks Investment Research

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.