Rocket Pharmaceuticals Reports Smaller Loss Than Expected in Q4 2024

Rocket Pharmaceuticals (RCKT) reported a loss of 62 cents per share for the fourth quarter of 2024, which is a smaller deficit than the Zacks Consensus Estimate of a 71-cent loss. This reflects an improvement from the same quarter last year when the loss stood at 64 cents per share.

See the Zacks Earnings Calendar to stay ahead of market-making news.

Despite the narrower loss, Rocket Pharmaceuticals did not generate any revenues in Q4 since the company lacks a marketed product in its portfolio.

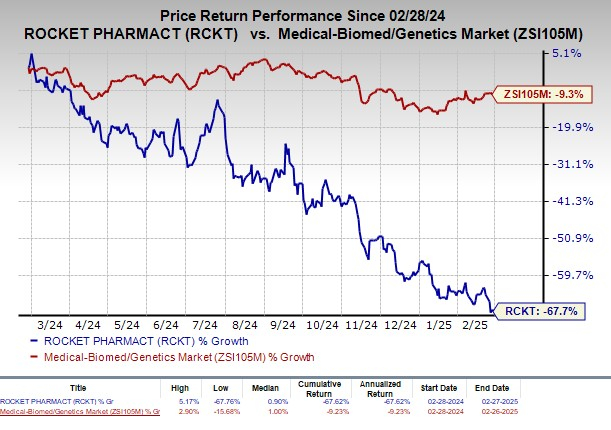

Over the past year, Rocket Pharmaceuticals’ stock has decreased by 67.7%, while the overall industry has experienced a more modest decline of 9.3%.

Image Source: Zacks Investment Research

Insights on RCKT’s Q4 Financials

In Q4, general and administrative expenses rose by 17.7% year-over-year to $25.3 million. This increase resulted from higher costs related to the company’s commercial preparations, which included expenses for strategy, medical affairs, and legal services.

Research and development expenses decreased to $37.4 million, down 10.3% from the previous year. This decline stemmed from reduced manufacturing and development costs.

As of December 31, 2024, Rocket Pharmaceuticals reported cash, cash equivalents, and investments totaling $372.3 million, compared to $235.7 million at the end of September 2024. The company anticipates that this cash balance will cover operations and capital expenses through the third quarter of 2026.

2024 Full-Year Results Overview

For the entire year of 2024, Rocket Pharmaceuticals posted a loss of $2.73 per share, an improvement from the loss of $2.92 reported in 2023.

Similar to the quarterly performance, the company did not record any revenues during the year.

Recent Pipeline Developments for RCKT

Rocket Pharmaceuticals is advancing Kresladi, a treatment aimed at patients with severe leukocyte adhesion deficiency-I (LAD-I), a rare genetic disorder. In June 2024, the FDA issued a complete response letter (CRL) regarding the biologics license application (BLA) for Kresladi, requesting “limited” additional information about the Chemistry Manufacturing and Controls (CMC) as part of the application. The agency is currently reviewing this additional information.

To address the CRL, the company plans to submit a complete BLA later in 2025.

In addition, Rocket has developed RP-L102, another gene therapy intended for the treatment of Fanconi anemia (FA). A rolling BLA has recently been initiated for this candidate, which is also undergoing evaluation in the European Union for the same condition.

The company is also focused on developing adeno-associated virus (AAV) gene therapies to address genetic cardiovascular indications linked to mutations in various genes. Currently, a Phase II study is underway for the investigational gene therapy candidate RP-A501, targeting male patients with Danon disease, with further updates expected in the first half of 2025.

Additionally, RP-A601, another AAV-based gene therapy, is in Phase I development for treating arrhythmogenic cardiomyopathy, with patient enrollment in the low dose cohort already completed. Initial data from this study is expected in the first half of 2025.

Rocket Pharmaceuticals Price and EPS Analysis

Rocket Pharmaceuticals, Inc. price-consensus-eps-surprise-chart | Rocket Pharmaceuticals, Inc. Quote

Current Zacks Rank and Comparable Stocks

Rocket Pharmaceuticals holds a Zacks Rank #2 (Buy).

Other highly rated stocks in the drug and biotech sector include Rigel Pharmaceuticals, Inc. (RIGL), argenx SE (ARGX), and Pacira BioSciences, Inc. (PCRX), each rated with a Zacks Rank #1 (Strong Buy) at this time. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the last 60 days, estimates for Rigel Pharmaceuticals’ earnings per share have risen from 92 cents to $1.28 for 2025. RIGL shares have also gained 40.5% over the past year.

RIGL has beaten earnings estimates in three of the last four quarters, with an average surprise of 1,754.28%.

Over the last 60 days, estimates for argenx’s earnings per share increased from $9.08 to $10.85 for 2025, with a 57.1% rise in ARGX shares in the past year.

ARGX has met or beaten earnings estimates in two of the last four quarters, averaging a surprise of 339.37%.

Similarly, estimates for Pacira BioSciences’ earnings per share have grown from $2.79 to $3.59 for 2025, although PCRX shares have decreased by 15.2% in the past year.

PCRX has beaten earnings estimates in two of the last four quarters, met in one, and missed once, averaging a surprise of 7.13%.

7 Top Stocks for the Next 30 Days

Just released: Experts have identified 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys, which are deemed “Most Likely for Early Price Pops.”

Since 1988, this full list has consistently outperformed the market, averaging gains of +24.3% per year. Be sure to give these hand-picked stocks your attention.

Key Financial Updates from Prominent Stock Reports

Explore the latest stock insights here >>

For those interested in current market opportunities, Zacks Investment Research is offering a free download of 7 Best Stocks for the Next 30 Days. This report includes valuable recommendations for investors looking to make informed decisions.

Featured Stock Analysis Reports

Included in this month’s recommendations are several notable companies:

- Rigel Pharmaceuticals, Inc. (RIGL): Comprehensive Stock Analysis Report

- Pacira BioSciences, Inc. (PCRX): In-Depth Stock Analysis Report

- argenx SE (ARGX): Detailed Stock Analysis Report

- Rocket Pharmaceuticals, Inc. (RCKT): Comprehensive Stock Analysis Report

For those interested in Rocket Pharmaceuticals, additional insights can be found in our latest article discussing their Q4 loss and pipeline developments. Read more here.

This report is sourced from Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect the official stance of Nasdaq, Inc.