Rodman & Renshaw Calls Quince Therapeutics a Strong Buy

On October 29, 2024, Fintel reported that Rodman & Renshaw has initiated coverage of Quince Therapeutics (NasdaqGS:QNCX) with a Buy recommendation.

Analyst Price Forecast Indicates Massive Growth Potential

As of March 27, 2023, analysts forecast the average one-year price target for Quince Therapeutics to be $50.49 per share. Projections vary, with predictions ranging from a low of $3.03 to a high of $100.80. This average target represents a remarkable potential increase of 4,107.50% based on its latest closing price of $1.20 per share.

For those interested, we also provide a leaderboard showcasing companies with significant price target upside.

The projected annual non-GAAP EPS stands at -1.76.

Current Fund Sentiment Regarding Quince Therapeutics

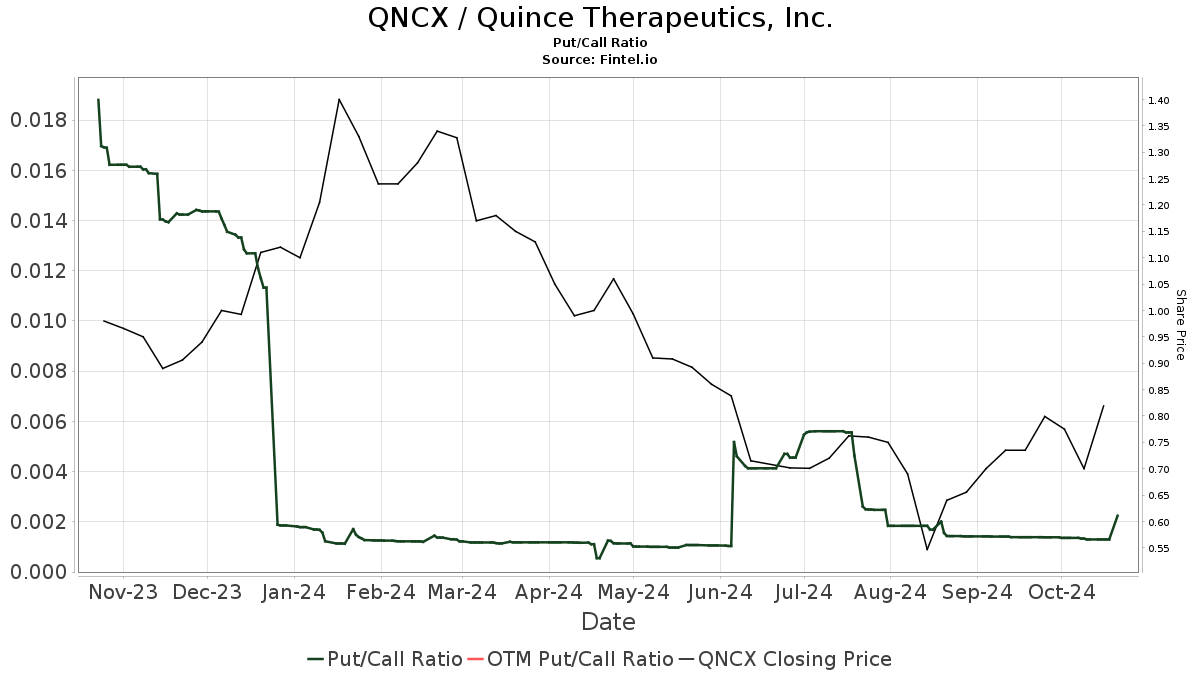

At present, there are 63 funds or institutions reporting stakes in Quince Therapeutics, marking a decline of one owner, or 1.56%, over the last quarter. The average allocation from all funds to QNCX is 0.01%, which shows an impressive increase of 44.66%. However, the total shares owned by institutions have decreased by 12.50% over the past three months, amounting to 6,385K shares.  The put/call ratio for QNCX is 0.01, indicating a positive market sentiment.

The put/call ratio for QNCX is 0.01, indicating a positive market sentiment.

What Investors Are Doing

Tang Capital Management holds 1,500K shares, accounting for 3.47% of the company. This represents a significant decrease from their previous holding of 2,948K shares, reflecting a drop of 96.51%. The firm has decreased its portfolio allocation in QNCX by 64.78% over the last quarter.

EPIQ Capital Group owns 852K shares, which represents 1.97% of Quince. In their prior filing, they reported 846K shares, showing a small increase of 0.77%. However, their allocation in QNCX has declined by 40.13% in the previous quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 848K shares, representing 1.96% of the company. Their previous holding was 818K, indicating an increase of 3.58%, though they too reduced their allocation by 28.64% over the last quarter.

Renaissance Technologies retains 484K shares, translating to 1.12% ownership. In its last filing, it owned 520K shares, signifying a 7.48% decrease. They have reduced their allocation in QNCX by 28.92% in the past quarter.

Lastly, the Vanguard Extended Market Index Fund Investor Shares (VEXMX) holds 346K shares, comprising 0.80% ownership. This is an increase from 293K shares, showing growth of 15.27%, despite a 13.26% reduction in their overall QNCX allocation for the quarter.

Background on Quince Therapeutics

(This information is provided by the company.)

Cortexyme, Inc. is a biopharmaceutical company in clinical stages, focusing on innovative therapeutic approaches aimed at enhancing the quality of life for individuals diagnosed with Alzheimer’s and other degenerative disorders. They are currently advancing their leading drug candidate, atuzaginstat (COR388), in the GAIN Trial, which is a Phase 2/3 clinical trial for patients experiencing mild to moderate Alzheimer’s disease. Cortexyme is targeting a specific infectious pathogen identified in the brain and other organs, known for its links to degeneration and inflammation in both humans and animal models.

Fintel stands out as one of the most comprehensive investing research platforms available for individual investors, traders, financial advisors, and small hedge funds.

Our data encompasses a wide range, including fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Moreover, our exclusive stock picks are bolstered by advanced, backtested quantitative models aimed at enhancing profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.