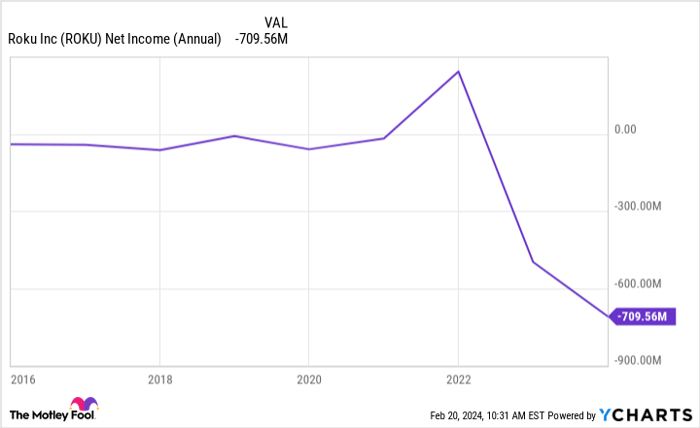

Investors eyeing robust net profits would find little solace in the financial trajectory of the connected-TV platform giant Roku (NASDAQ: ROKU). Following a groundbreaking full-year net profit in 2021, Roku nosedived in 2022, culminating in a staggering $531 million loss.

Fast forward to 2023, the red ink on Roku’s balance sheet deepened further, setting a new record of $710 million in losses. The optics appear grim for shareholders, indeed.

Data by YCharts.

However, isolating Roku’s net loss figures reveals merely one side of the coin, devoid of actionable insights for investors. The pivotal question remains: why is the company hemorrhaging money, potentially prompting some to offload the stock? Conversely, amidst the storm, there lurks a glimmer of hope, presenting an alluring buying opportunity for those with a brighter outlook.

The Red Flag: Declining Margins Amid Revenue Shift

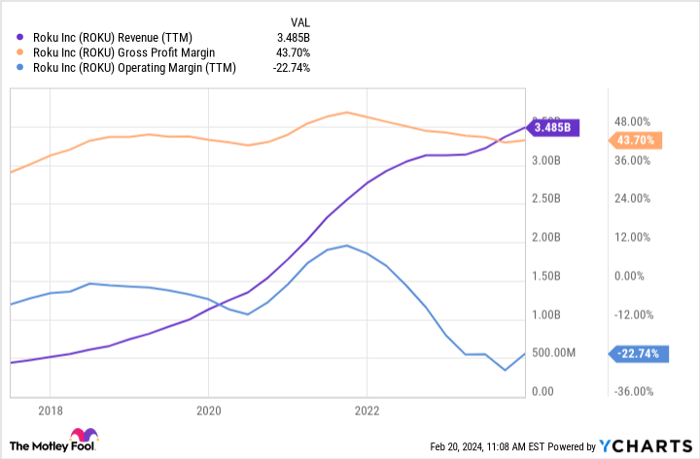

Roku’s revenue streams bifurcate into two: the sale of low-margin connected-TV hardware (device revenue) and the provision of high-margin connected-TV operating system software (platform revenue). The latter segment, a cornerstone of Roku’s bullish investment narrative, has witnessed a distressing trend – a decline in margins contrary to anticipated growth.

Data by YCharts.

A stark contrast emerges when tracing back to 2019: device revenue accounted for 34% of total revenue, boasting a modest 4% gross margin. Meanwhile, platform revenue flaunted an almost princely gross margin of 65%.

Fast forward to 2023, and Roku’s financial landscape has metamorphosed. Platform revenue now reigns supreme, constituting 86% of the total revenue. Yet, the once-healthy gross margin has dwindled to a mere 48%. Adding to the woes, device revenue now bears a negative gross margin of 9%, signifying a perilous pivot.

As Roku expanded its footprint, slashing hardware prices led to profitability sacrifices. Rising fixed costs in the platform realm, coupled with dwindling advertising rates, have only fueled the fire of unprecedented losses.

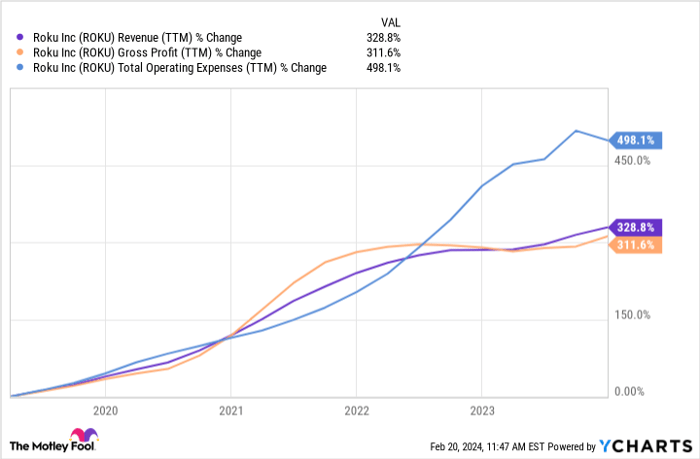

The upshot? Roku’s gross profit trails revenue growth, lacking the operative leverage anticipated with scale. Operating expenses spiraled at an alarming rate, outpacing revenue growth, rendering the outlook grim for discerning investors.

Data by YCharts.

The Silver Lining: A Growing User Base Amidst Advertising Conundrum

While Roku flounders in hardware-induced losses, the strategic gamble seems to be paying dividends. In 2023, the company welcomed 10 million new active accounts, breaching the 80 million milestone – marking its second-best year in user expansion.

With a massive user enclave, Roku reigns supreme in the streaming-TV arena. These aren’t just passive spectators; they gorge on video content voraciously. In 2023 alone, Roku devices streamed over 106 billion hours, marking a staggering 21% surge from the previous year.

For advertisers, Roku’s captive audience is an opportunity too grand to overlook. Despite a 4% downturn in average revenue per user in Q4 2023, implying a fiscal caution among advertisers, the behemoth audience remains the crown jewel in Roku’s arsenal.

Conventionally, advertisers gravitate where eyeballs converge. Ergo, the current ad revenue hiccup for Roku seems transient, paving the way for a potential revival.

Should the connected TV sphere burgeon further, Roku maintain its pivotal role, and ad fervor regain its fervency in forthcoming periods, then the stock sits poised to outshine the market from its current vantage – a compelling reason to plunge headfirst into a buy-side position.

Striking a Balance

From a personal vantage point, the conundrum beckons me. Roku’s plummeting financials raise valid concerns, hinting at underlying frailties within its core operations. Yet, the escalating user base signifies a potential runway for growth in the foreseeable future.

Hence, I opt for a prudent middle ground. Maintaining my Roku holdings acknowledges the positive strides within the business. Nonetheless, the specter of record losses hints at brewing competition-induced vulnerabilities, warranting a tempered approach towards expanding my stake at present.

Should you invest $1,000 in Roku right now?

Before diving into Roku stocks, ponder this:

The Motley Fool Stock Advisor prognoses the 10 best stocks primed for investors currently, with Roku not making the cut. The selected decile promises to unfurl colossal returns in the imminent years.

Stock Advisor brings forth a structured blueprint for investors, offering counsel on portfolio management, analyst insights, and bimonthly stock recommendations. Since 2002, the service has magnified S&P 500 returns thrice over*.

Explore the 10 stocks

*Stock Advisor returns as of February 20, 2024

Jon Quast holds positions in Roku. The Motley Fool maintains positions in and endorses Roku. The Motley Fool abides by a transparent disclosure policy.

The views and opinions articulated herein are the sole perspectives of the author and may not implicitly align with Nasdaq, Inc.’s viewpoints.