Roku’s Q1 2025 Earnings Preview: Revenue Growth Amid Challenges

Roku (ROKU) is scheduled to announce its first-quarter 2025 results on May 1. The company anticipates total net revenues of $1.005 billion, reflecting a 14% increase year over year.

Revenue Expectations

Roku projects its Platform revenues to grow by 16%, whereas Device revenues are expected to remain steady. This expectation follows a period of elevated inventory levels resulting from lower holiday sales. The company forecasts a total gross profit of $450 million and adjusted EBITDA of $55 million for Q1 2025.

The Zacks Consensus Estimate for Q1 revenues is around $1 billion, denoting a year-over-year growth of 13.96%. Analysts have set the consensus loss estimate at 20 cents per share, signaling a potential year-over-year improvement of 42.86%.

ROKU Estimate Movement

Image Source: Zacks Investment Research

Earnings Surprise History

In the last reported quarter, Roku achieved an earnings surprise of 45.45%. The company has consistently surpassed the Zacks Consensus Estimate in the past four quarters, averaging a surprise of 55.07%.

Earnings Whispers for Roku

Current projections are optimistic for Roku this quarter. The expectations are bolstered by a positive earnings ESP (+65.17%) alongside a Zacks Rank of #3 (Hold). This combination typically increases the likelihood of an earnings beat.

Factors Influencing Roku’s Results

As Roku approaches its Q1 earnings report, caution is advisable for investors. Although the Platform segment is expected to show robust momentum, Device revenues and gross profit have come under pressure from increased seasonal discounts, resulting in high inventory at the end of 2024. Consequently, gross margins may experience slight impacts in Q1 2025.

Growth within the Platform segment remains positive, with management forecasting a year-over-year increase of 16%. Contributions from both streaming services distribution and advertising are credited for this growth. However, a reduction in political advertising compared to Q4, coupled with seasonal trends, may have curtailed advertising momentum.

The Roku Channel continues its rapid expansion, currently reaching about 145 million U.S. users and achieving 82% year-over-year growth in streaming hours during Q4. Despite advancements in user engagement through an AI-powered interface and new advertising formats, macroeconomic uncertainties and competition may present short-term challenges.

Roku faces growing competition in the advertising space from firms like Netflix (NFLX), Warner Bros. Discovery (WBD), and Disney (DIS), which are expanding their ad-supported streaming services. These firms’ established brand presence and advertiser relationships may hinder Roku’s ability to secure advertising budgets.

Expansion into international markets like Mexico, Canada, and the United Kingdom has propelled user growth, but near-term revenue impacts from these efforts are anticipated to be limited as monetization is still in its early stages.

Top-Line Growth Estimates for Q1

The Zacks Consensus Estimate for average revenue per user stands at $42.09. Estimated revenues for Devices in Q1 2025 are projected at $127 million, while Platform revenues are estimated at $877 million.

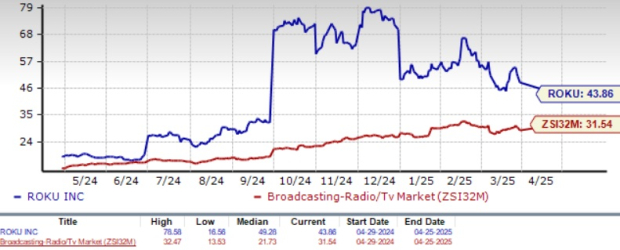

ROKU Price Performance and Stock Valuation

Year-to-date, Roku shares have decreased by 11.6%. In comparison, the Zacks Consumer Discretionary sector and the S&P 500 index have seen declines of 4.9% and 6.4%, respectively.

ROKU’s YTD Price Performance

Image Source: Zacks Investment Research

In terms of valuation, Roku currently trades at a price-to-cash flow ratio of 43.86, a considerable premium over the industry average of 31.54. This valuation suggests market expectations for high growth, making Roku less appealing to value investors. A value score of D further indicates an unfavorable valuation at this time.

Price-to-Cash Flow Ratio

Image Source: Zacks Investment Research

Investment Considerations

Roku shows strong fundamentals with robust user engagement and ongoing international expansion. However, investors should remain cautious ahead of the Q1 2025 results. High inventory levels and competitive pressures in the ad-supported streaming market may affect performance in the near term.

Roku’s Growth Potential: Navigating Challenges Ahead of First-Quarter Results

Roku’s platform revenues are on track for double-digit growth, with advertising remaining a significant strength. However, given the company’s high valuations and possible fluctuations in advertising trends, investors may benefit from exercising patience before seeking a more appealing entry point.

Conclusion

Roku’s growth trajectory in its platform business is encouraging. Nonetheless, current valuations reflect its anticipated growth. The first quarter has seen gross margins squeezed by excess holiday inventory, while seasonal advertising trends are returning to normal. Moreover, competitive pressures in ad-supported streaming are intensifying. Investors might want to maintain their current holdings as they look for a more favorable entry point. Innovations in Home Screen monetization and efforts in international expansion suggest long-term upside, but careful investors may find it prudent to wait for first-quarter results.

7 Best Stocks for the Next 30 Days

Experts have identified 7 standout stocks from a pool of 220 Zacks Rank #1 Strong Buys. These stocks are considered most likely to see early price increases.

Since 1988, this list has outperformed the market by more than two times, averaging a gain of +23.9% annually. Investors should give these selected stocks immediate consideration.

Want the latest recommendations from Zacks Investment Research? Download your free report on the 7 Best Stocks for the Next 30 Days.

Netflix, Inc. (NFLX): Free Stock Analysis report.

The Walt Disney Company (DIS): Free Stock Analysis report.

Warner Bros. Discovery, Inc. (WBD): Free Stock Analysis report.

Roku, Inc. (ROKU): Free Stock Analysis report.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.