Roku Faces Challenges but Holds Long-term Growth Potential

Roku Inc. (ROKU) has encountered a difficult beginning to 2025, with its stock dropping 21.4% year to date (YTD), while the Zacks Consumer Discretionary sector experienced a decline of 9.7%. This performance has led investors to reassess the company’s investment viability. Nevertheless, Roku maintains strategic resilience and growth opportunities that merit careful analysis.

Financial Performance and Growth Overview

In its fourth-quarter 2024 earnings report, Roku presented a nuanced story of growth and strategic positioning. The company recorded over $1 billion in Platform revenues for the first time, which signifies a 25% year-over-year increase.

Roku has successfully expanded its streaming household base to 89.8 million, aiming to reach 100 million soon. This growth aligns with its diversified strategy that focuses on platform revenues, advertising innovations, and international ventures.

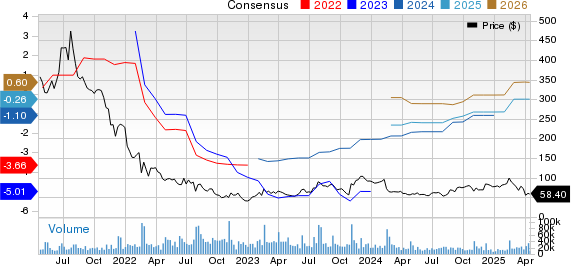

The Zacks Consensus Estimate for 2025 revenues stands at $4.59 billion, indicating an anticipated growth of 11.52% year-over-year. Furthermore, the consensus estimate reflects a loss of 26 cents per share, which is an improvement of 70.79% from the previous year.

Roku, Inc. Price and Consensus Trends

Roku, Inc. price-consensus-chart | Roku, Inc. Quote

See the Zacks earnings Calendar to stay ahead of market-making news.

Advertising Insights and Revenue Diversification

One of Roku’s notable strengths is its advertising ecosystem. The company is actively enhancing its ad capabilities, including launching a self-serve ads manager catering to small and medium-sized businesses. Notably, political advertising contributed roughly 6% of Platform revenues in the fourth quarter. Additionally, Roku is broadening its advertising partnerships, including strategic deals with platforms like ADWEEK and content providers such as Fremantle.

Roku’s strategy for international growth looks promising, especially in regions such as Canada, Mexico, and the United Kingdom. The company is systematically enhancing its TV operating system footprint and expanding its content offerings. Recent exclusive streaming rights deals, like the Canadian simulcast of American Idol, showcase its approach to content acquisition.

Challenges and Investment Considerations

Nonetheless, investors should proceed with caution. The device segment faces margin pressures, with the fourth-quarter device gross margin significantly declining. Although Roku anticipates normalizing device margins in 2025, this area may be subject to continued volatility.

For those contemplating an investment in Roku, a hold strategy with a wait-and-see approach seems most prudent. The stock valuation reflects the company’s growth potential alongside challenges posed by larger competitors such as Netflix (NFLX), Disney (DIS)-owned Disney+, and Amazon (AMZN) Prime Video, which provide low-cost TV programming and strong content offerings.

Potential investors should keep an eye on several essential indicators, including the success of Roku’s international expansion, the effectiveness of its advertising and subscription strategies, improvements in device margins, and the continued growth in streaming households.

The company anticipates platform revenue growth of 12-15% in 2025 (excluding political advertising), suggesting a cautiously optimistic outlook. Additionally, Roku expects to achieve positive operating income by 2026, further solidifying its long-term investment potential.

Conclusion

Despite a concerning 21.4% YTD decline, Roku’s strategic plans, diversified revenue streams, and market position indicate possibilities for future growth. Investors should view this period as an opportunity for careful evaluation rather than an immediate buy or sell signal. A patient investment strategy that focuses on the company’s long-term execution could prove most beneficial for Roku in 2025, currently rated at a Zacks Rank #3 (Hold).

Access Zacks’ Top Recommendations for Just $1

We’re not kidding.

Years ago, we surprised our members by offering a 30-day trial to all our stock picks for just $1, with no further obligations.

Many have taken advantage of this unique opportunity. For those who hesitated, yes, we have a reason for this offer. We want you to discover our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which closed 256 positions with double- and triple-digit gains in 2024 alone.

Want the latest recommendations from Zacks Investment Research? Download our report on the 7 Best Stocks for the Next 30 Days for free. Click here.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

The Walt Disney Company (DIS): Free Stock Analysis Report

Roku, Inc. (ROKU): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.