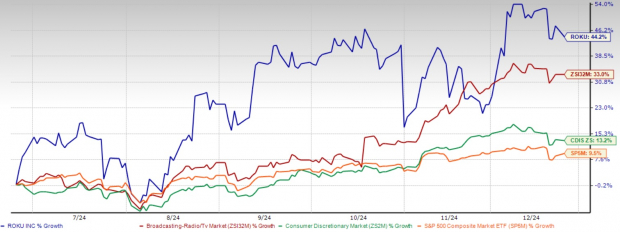

Roku’s Growth Potential Shines Bright in Streaming Landscape ROKU has become an attractive investment choice, with its stock soaring by 44.2% in the last six months. As the streaming sector grows and transforms, Roku’s strategic approach and recent achievements highlight significant growth prospects as it heads into 2025.

2024’s Impressive Year-to-Date Results

Image Source: Zacks Investment Research

Strong Financial Gains and Market Leadership

Roku’s third-quarter 2024 results show significant growth, marking the first time the company surpassed $1 billion in total net revenues. Platform revenues rose by 15% year over year to reach $908 million, alongside a healthy gross margin of 54%. This consistent performance, alongside five quarters of positive adjusted EBITDA and free cash flow, indicates Roku’s solid financial footing and efficient operations.

As the leading TV streaming platform in the United States, Canada, and Mexico, Roku boasts 85.5 million streaming households with streaming hours increasing by 20% annually to 32 billion hours. These user engagement metrics reveal strong adoption and loyalty to the platform.

Strategic Initiatives Enhancing Future Growth

Roku’s growth plan focuses on three vital areas that position it favorably for 2025. Firstly, the company is enhancing its Home Screen to unlock additional monetization opportunities, seen in the success of features like Sports Zone and other content-specific areas. This strategy not only boosts viewer engagement but also benefits content partners and advertisers.

Secondly, Roku is strengthening its programmatic advertising ties, particularly through close integration with The Trade Desk and adopting Unified ID 2.0. These collaborations are already yielding positive results and are expected to contribute to revenue growth into 2025.

Lastly, Roku is witnessing strong growth in its Roku-billed subscriptions, bolstered by initiatives like the Olympic Zone that drive sign-ups for services like Peacock. The addition of premium offerings such as Max, BET+ Essential, and Crunchyroll further enhances Roku’s value to subscribers.

Expansion in Content and Advertising Ecosystem

The Roku Channel has become the third most popular app on the platform, with a dramatic 80% annual increase in streaming hours. This growth is fueled by new partnerships, including exclusive deals with Curtis “50 Cent” Jackson for the 50 Cent Action Channel and the inclusion of Warner Bros. Discovery’s Max streaming service.

Roku’s advertising segment diversifies further with the launch of Roku Ads Manager, aimed at small and medium-sized businesses. Enhanced targeting and integration with third-party platforms position the company to capture a larger share of advertising budgets going forward.

International Expansion and Future Forecast

Roku aims to reach 100 million streaming households in the next 12-18 months, demonstrating progress with its international growth strategy. Its success in key markets reflects its ability to replicate U.S. achievements on a global scale.

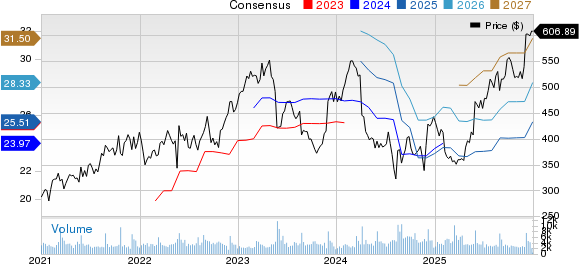

The Zacks Consensus Estimate for Roku’s 2024 revenues stands at $4.05 billion, reflecting a 16.32% year-over-year rise, despite an anticipated loss of $1.10 per share compared to a $5.01 loss from the previous year.

Image Source: Zacks Investment Research

Explore the latest earnings estimates and surprises on Zacks Earnings Calendar.

Potential Challenges Ahead

The streaming landscape is increasingly competitive, with heavyweights like Netflix NFLX, Disney DIS’s Disney+, and Amazon AMZN Prime Video enhancing their offerings. This heightened competition raises concerns about Roku’s ongoing growth potential.

Flat average revenue per user (ARPU) growth and rising operating expenses—projected to increase by 9% year over year in the fourth quarter—could pressure profitability. Furthermore, Roku’s decision to stop revealing streaming households and ARPU metrics starting in the first quarter of 2025 has caused some investor apprehension regarding transparency.

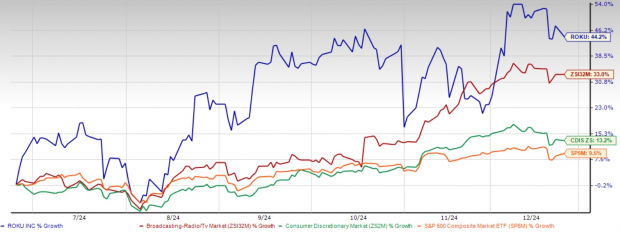

Some might find Roku’s stock relatively pricey compared to its cash flow generation and industry counterparts. With a two-year price-to-cash flow ratio of 73.61X, it surpasses the Zacks Broadcast Radio and Television industry average of 25.03X.

Roku’s Current Valuation Signals Caution

Image Source: Zacks Investment Research

Why Roku Is a Promising Buy for 2025

Investors should view Roku as a solid buy as 2025 approaches for several key reasons. First, its robust financial performance and operational improvements indicate sustainable growth. Secondly, strategic initiatives in advertising, content partnerships, and platform monetization provide multiple revenue sources. Lastly, the company’s international expansion signals significant growth opportunities beyond the U.S. market.

Roku’s management is optimistic about 2025, supported by strong third-quarter 2024 results and encouraging trends in critical metrics. As the leader in TV operating systems, its growing advertising framework and expanding content ecosystem present it as a strategic investment for those interested in the shift to streaming.

Roku’s recent stock performance and solid fundamentals mark it as a potential investment for those wanting to engage with the future of television and digital entertainment. With ongoing execution of its strategic plans and a broader global presence, Roku appears poised for more growth through 2025. Roku currently holds a Zacks Rank #2 (Buy). A complete list of today’s Zacks #1 Rank (Strong Buy) stocks can be found here.

5 Stocks Poised for a 100% Increase

Handpicked by a Zacks expert, each stock is the #1 choice expected to gain +100% or more in 2024. While past selections had remarkable returns of +143.0%, +175.9%, +498.3%, and +673.0%, not every pick can be a winner.

Many of these stocks are under the radar on Wall Street, offering investors an early advantage.

Today, Discover These 5 Potential Giants >>

For the latest recommendations from Zacks Investment Research, download 5 Stocks Set to Double. Access your free report now.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

The Walt Disney Company (DIS): Free Stock Analysis Report

Roku, Inc. (ROKU): Free Stock Analysis Report

To read the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.