Rolls-Royce Holdings plc – Depositary Receipt (OTCPK:RYCEY) has witnessed a soaring ascent as its one-year price target now rests at 4.85 / share, marking a substantial 9.96% surge from the prior estimate of 4.41 delineated on January 18, 2024.

Analysts have heralded this remarkable uptick, with price targets ranging from a modest 3.04 to a lofty 5.67 / share. The average price target shines as a beacon of hope, illuminating a prosperous 16.60% leap from the most recent closing price of 4.16 / share.

Exploring the Fund Sentiment

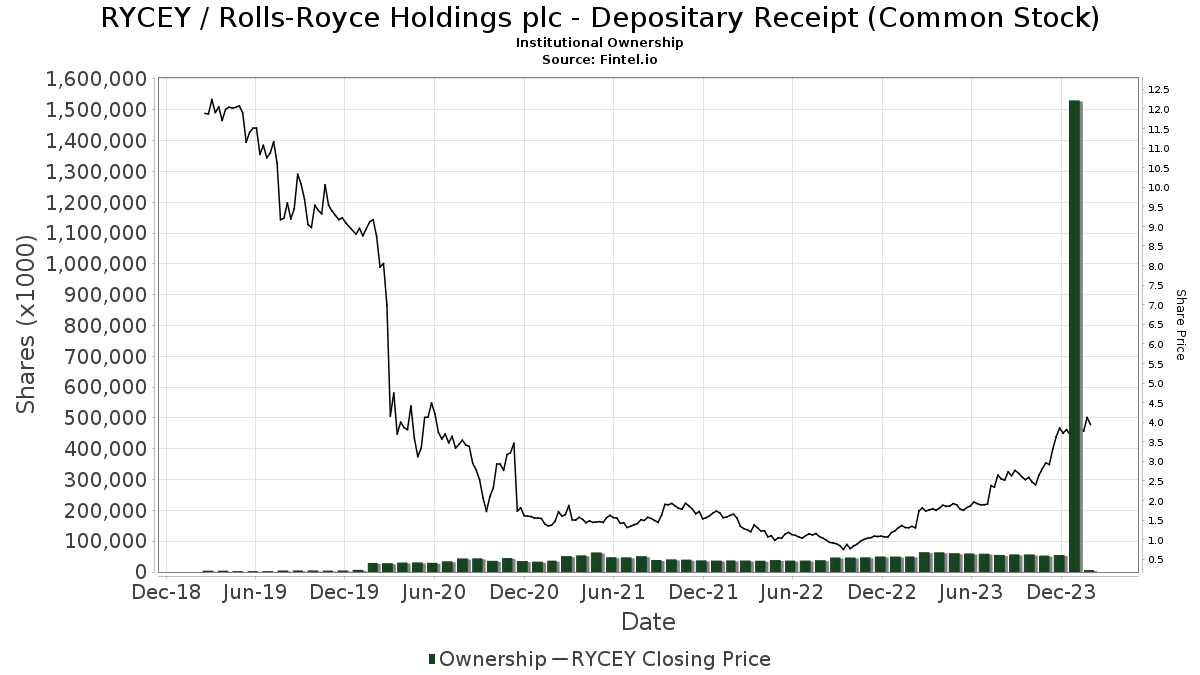

The ranks have swelled as 23 funds or institutions have emblazoned their names in support of Rolls-Royce Holdings plc – Depositary Receipt (). This surge of 4 owners, a 21.05% surge in the last quarter, signals unwavering faith in the stock. The average portfolio weight dedicated to RYCEY now stands at 0.27%, despite a slight drop of 20.54%. Collectively, institutions harbor 6,231K shares, a 1.00% dip in ownership over the past three months.

The Shareholder Symphony

Turning the spotlight on shareholder movements, Boothe Investment Group stands tall with 2,735K shares. This tally represents a slight decline of 1.07%, countered by a monumental surge of 135.44% in portfolio allocation over the last quarter.

Similarly, Renaissance Group orchestrates its position with 2,396K shares, notwithstanding a 2.71% drop. Demonstrating resilience, the firm bolsters its allocation by a significant 24.90% in the RYCEY domain.

Meanwhile, PMDEX – PMC Diversified Equity Fund Advisor Class Shares charts a growth trajectory with 308K shares, undergoing a remarkable 35.54% surge in shares. In sync with the upward trend, the firm amplifies its portfolio allocation by an impressive 91.60%.

Other notable performers include Henry James International Management, conducting a melodious symphony with 160K shares, and Yousif Capital Management maintaining harmony with 130K shares, steadfast in their support.

Fintel stands tall as one of the most expansive investing research platforms accessible to individual investors, traders, financial advisors, and small hedge funds.

Delving deep into the world of data, Fintel offers a treasure trove covering fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and beyond. Exclusive stock picks are harnessed by advanced, backtested quantitative models for an enhanced investment experience.

Embark on a learning journey with Fintel today!

This piece was initially featured on Fintel.

The views and opinions aired in this narrative solely reflect those of the author and not necessarily Nasdaq, Inc.