Root Inc. reported a steady growth in its policies-in-force (PIF), from 0.2 million at the end of 2022 to 0.4 million by Q2 2025. This growth is attributed to improved retention ratios and new policy writings, supported by a strategic focus on geographic expansion and diversified distribution channels.

During the second quarter of 2025, the company emphasized the $300 billion U.S. auto insurance market’s potential for disruption. Root is enhancing its insurance offerings by collaborating with platforms like Carvana and aims to invest in technology and expand its presence across additional states.

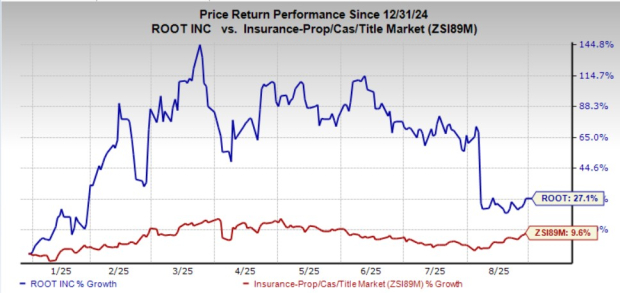

In contrast, major players like Allstate Corporation reported a PIF of 37.9 million, and Progressive Corporation has also seen consistent PIF growth, demonstrating robust competition in the auto insurance sector. Root’s stock has gained 27.1% year to date, despite a high price-to-book ratio of 5.83 compared to the industry average of 1.57.