Strength Across Segments Drives Growth

Roper Technologies, Inc. has been on a winning streak, capitalizing on the robust performance across its various segments. The upward trajectory is particularly noticeable in its Application Software segment, with Deltek, Vertafore, Strata, Frontline, and Aderant businesses all contributing to its success. Deltek is experiencing a surge in its SaaS solutions, benefiting from stable momentum in the SMB channel and private sector offerings. The recent acquisition of Replicon in August 2023 has further fortified Deltek’s growth by enhancing its SaaS solutions portfolio.

The adoption and cross-selling of SaaS solutions, along with ongoing GenAI innovation, are pivotal factors driving Aderant’s expansion. Strata’s performance is underpinned by its acclaimed decision support and financial planning solutions. With the acquisitions of MGA Systems and Syntellis, as well as robust performance in the core P&C business, Vertafore is also experiencing substantial growth. The Frontline business is bolstered by a strong customer renewal season. Looking ahead to 2024, Roper anticipates a notable 11-12% year-over-year increase in total revenues, with organic revenues forecasted to rise by 5-6%.

Strategic Acquisitions and Shareholder Rewards

Roper’s strategy of fortifying its business through strategic acquisitions has been paying off. The acquisition of cloud-based performance management provider, Syntellis Performance Solutions, in August 2023, and the purchase of Frontline Education for $3.7 billion in October 2022, have significantly enhanced Roper’s business footprint. These acquisitions played a pivotal role in boosting sales by 4% in the last quarter.

Additionally, ROP remains steadfast in rewarding its shareholders through consistent dividend payouts and share buybacks. In 2023, the company distributed a dividend payment of $262.3 million, reflecting an 11% increase year over year. Moreover, in November 2023, Roper raised its dividend by a commendable 10%, underscoring its commitment to shareholder value.

Addressing Concerns: Managing Costs and Mitigating Risks

While Roper continues to shine, concerns loom over escalating costs and expenses. In 2023, the company witnessed a 15.5% year-over-year increase in the cost of sales, coupled with a 15% uptick in selling, general, and administrative expenses. If left unchecked, these rising costs could potentially impact the company’s bottom line.

Moreover, given Roper’s extensive global presence, it is susceptible to risks associated with fluctuations in foreign currencies and geopolitical uncertainties. In 2023, adverse movements in foreign currency translations negatively impacted revenue growth by 0.1%.

Looking Ahead

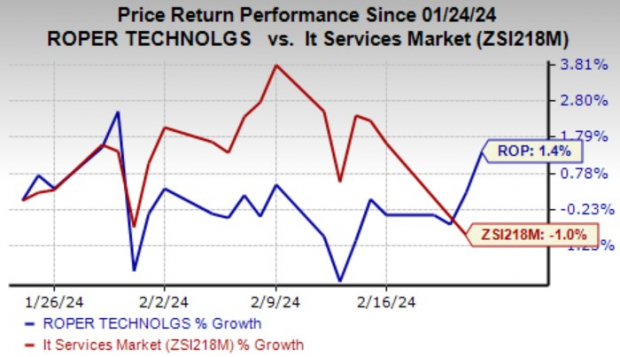

In a volatile market environment marked by uncertainties and challenges, Roper Technologies (ROP) stands out as a beacon of resilience and adaptability. While navigating through potential risks and cost pressures, the company’s strategic initiatives, robust business model, and commitment to shareholder value continue to position it as a steadfast and reliable player in the tech industry.