Rosenblatt Downgrades Apple Outlook, Yet Analysts Predict Price Growth

Fintel reports that on May 2, 2025, Rosenblatt downgraded their outlook for Apple (XTRA:APC) from Buy to Neutral.

Analyst Price Forecast Suggests Potential Growth

As of April 24, 2025, the average one-year price target for Apple is €208.91 per share. These forecasts range from a low of €123.36 to a high of €272.86. The average price target indicates a potential increase of 11.12% from its most recent closing price of €188.00 per share.

Projected Revenue and Earnings Data

The projected annual revenue for Apple is €448.014 billion, representing an increase of 11.90%. Additionally, the projected annual non-GAAP EPS stands at 7.23.

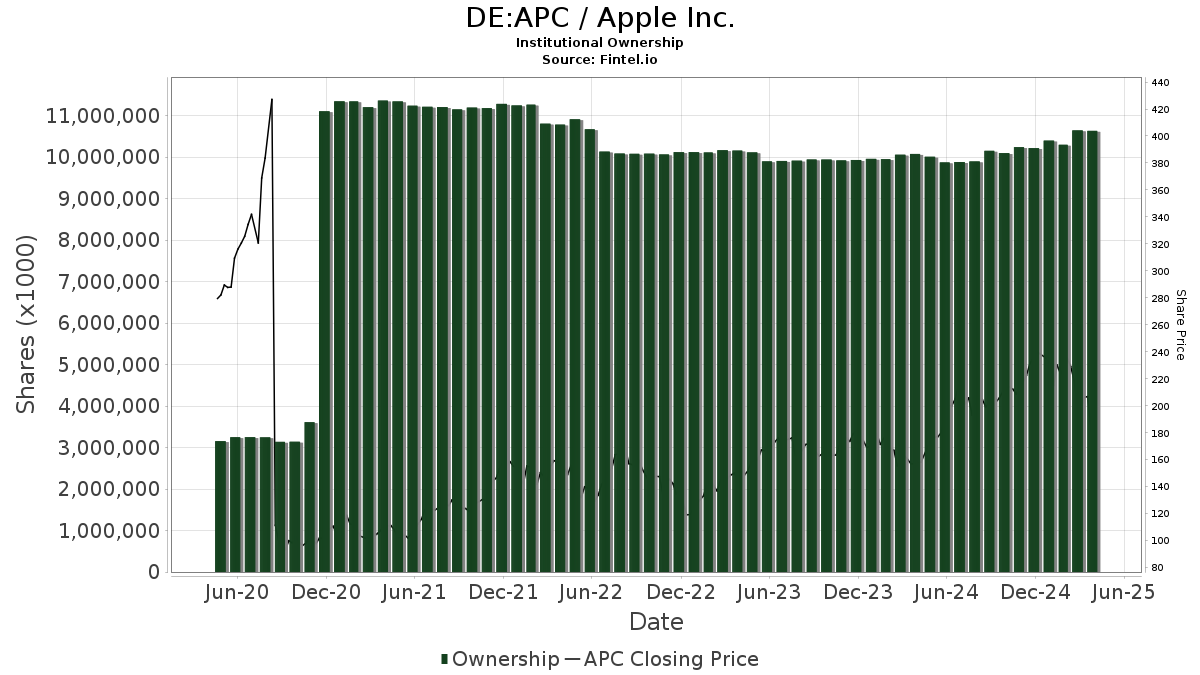

Fund Sentiment Overview

Currently, 7,665 funds and institutions report positions in Apple, marking an increase of 461 owners, or 6.40%, in the last quarter. The average portfolio weight of all funds dedicated to APC is 3.72%, which has risen by 8.73%. Total shares held by institutions increased by 3.33% over the last three months, totaling 10,621,420K shares.

Institutional Stakeholders

The VTSMX – Vanguard Total Stock Market Index Fund Investor Shares, holds 473,592K shares, representing 3.15% ownership in Apple. This reflects an increase from 457,849K shares reported in its previous filing, a rise of 3.32%. The firm raised its allocation in APC by 9.56% over the last quarter.

The VFINX – Vanguard 500 Index Fund Investor Shares owns 409,170K shares, representing 2.72% ownership. Previously, it reported ownership of 398,082K shares, highlighting a 2.71% increase, and a portfolio allocation increase of 4.51% over the last quarter.

Geode Capital Management holds 340,165K shares, which amounts to 2.26% ownership. This is up from 333,858K shares reported earlier, showing a 1.85% increase, with a portfolio allocation increase of 4.89% in the last quarter.

Berkshire Hathaway retains 300,000K shares, maintaining a 2.00% ownership with no changes reported in the last quarter.

Price T Rowe Associates holds 220,108K shares, accounting for 1.47% ownership. In its previous filing, it disclosed ownership of 235,581K shares, reflecting a decrease of 7.03%, although it increased its allocation by 0.54% in the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.