Rosenblatt Initiates Buy on MARA Holdings Amid Growing Institutional Interest

Fintel reports that on March 7, 2025, Rosenblatt initiated coverage of MARA Holdings (WBAG:MARA) with a Buy recommendation.

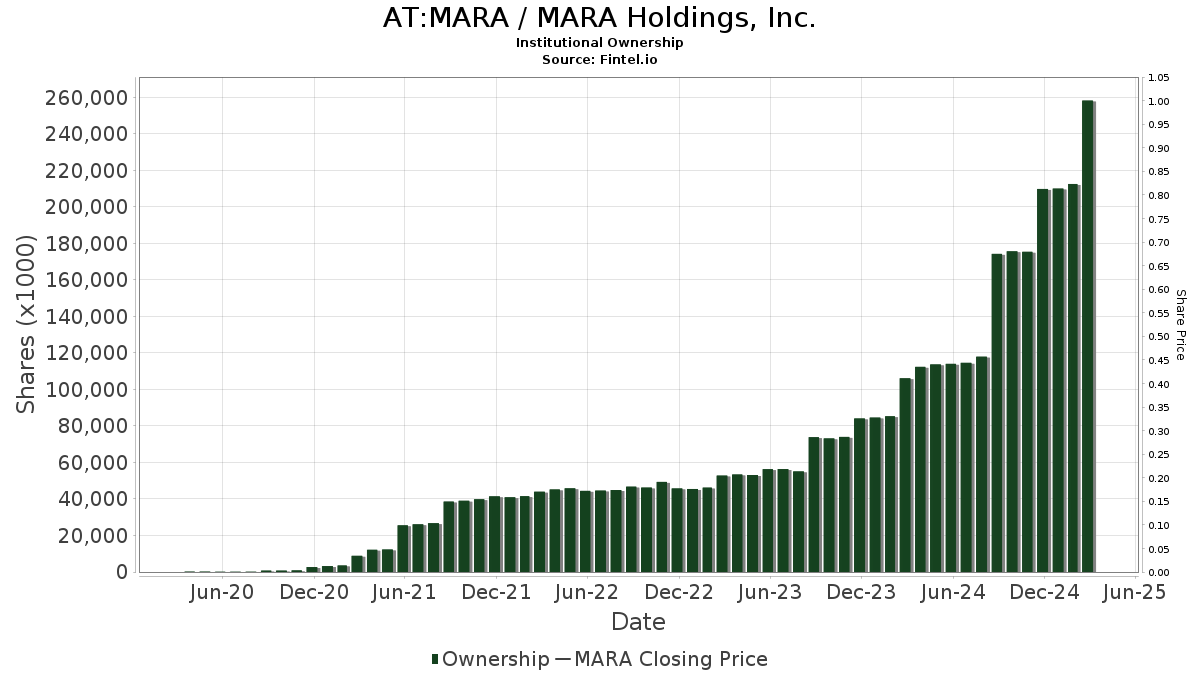

Institutional Investor Sentiment on MARA Holdings

Currently, 695 funds or institutions have reported positions in MARA Holdings. This marks an increase of 70 owners, or 11.20%, over the last quarter. The average portfolio weight for all funds dedicated to MARA Holdings now stands at 0.22%, reflecting a rise of 0.90%. Furthermore, total shares owned by institutions grew by 24.35% in the past three months, reaching 258,265K shares.

Actions of Notable Shareholders

The iShares Core S&P Small-Cap ETF (IJR) holds 20,759K shares, accounting for 6.00% ownership. Previously, this firm reported owning 18,713K shares, indicating a 9.86% increase. Their portfolio allocation for MARA increased by 12.86% over the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 9,601K shares, representing 2.78% ownership. This is an increase from 8,880K shares previously, marking a 7.50% rise. The fund increased its allocation in MARA by 10.16% last quarter.

Similarly, the Vanguard Small-Cap Index Fund Investor Shares (NAESX) holds 7,787K shares, or 2.25% ownership, up from 7,003K shares before, which is a 10.07% increase. Their portfolio allocation expanded by 12.30% last quarter.

Geode Capital Management owns 7,676K shares, accounting for 2.22% ownership. Their previous holding was 7,157K shares, reflecting a 6.75% increase. The firm’s portfolio allocation in MARA rose by 6.11% in the last quarter.

Lastly, the iShares Russell 2000 ETF (IWM) holds 7,667K shares, representing a 2.22% ownership stake. This is an increase from the prior holding of 7,104K shares, showing a 7.35% rise. The fund increased its allocation in MARA by 7.52% last quarter.

Fintel provides one of the most comprehensive investing research platforms available, catering to individual investors, traders, financial advisors, and small hedge funds. Our data encompasses global fundamentals, analyst reports, ownership data, and more.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.