Rosenblatt Downgrades Apple; Institutional Interest Grows

Fintel reports that on May 2, 2025, Rosenblatt downgraded their outlook for Apple (WBAG:AAPL) from Buy to Neutral.

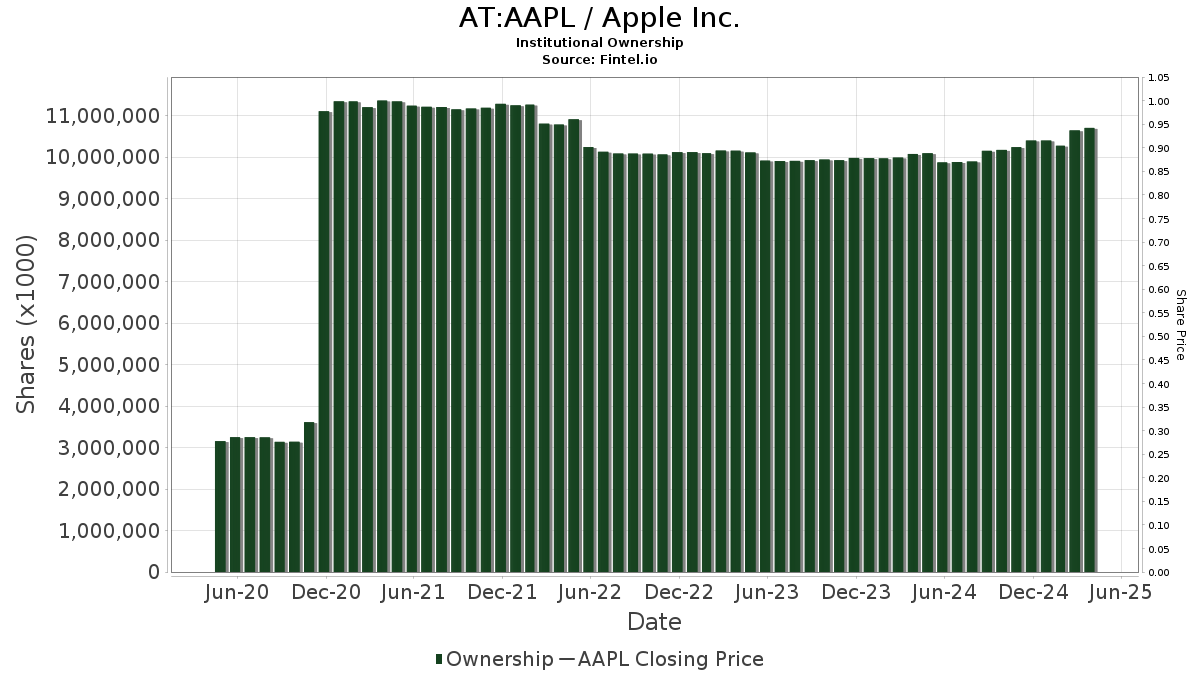

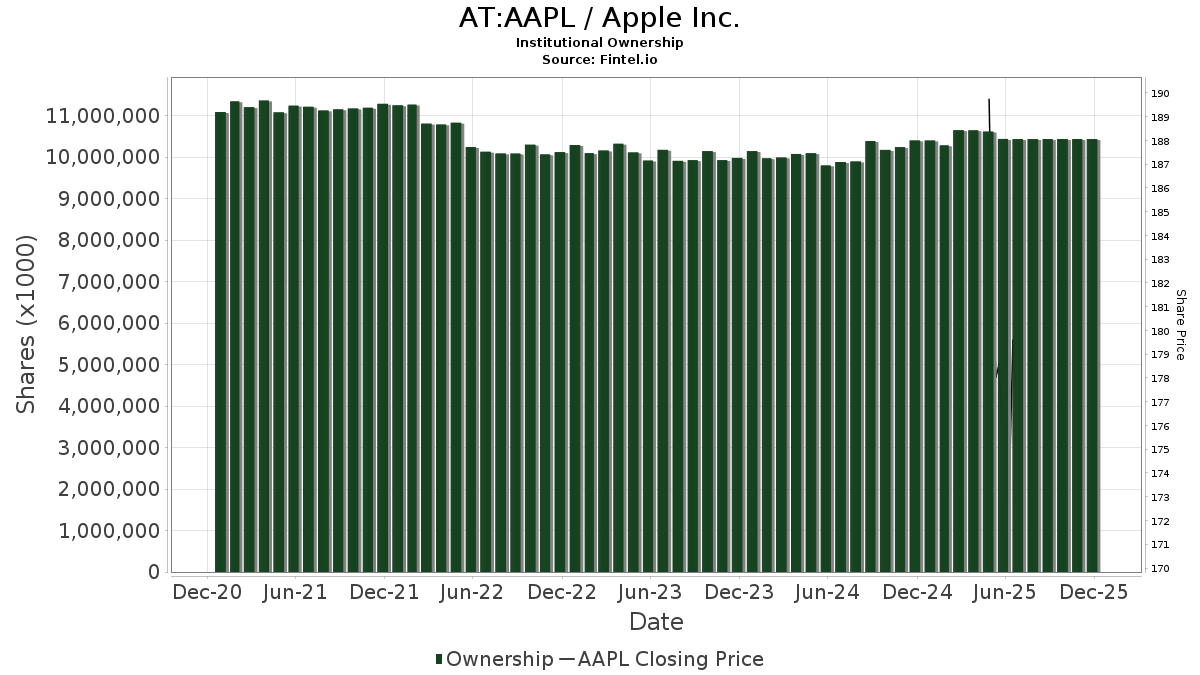

Institutional Fund Sentiment

In total, 7,664 funds or institutions are reporting positions in Apple, which reflects an increase of 460 owners or 6.39% in the past quarter. The average portfolio weight of all funds dedicated to AAPL is 3.72%, up by 8.72%. Additionally, the total number of shares owned by institutions rose by 3.33% over the last three months, reaching 10,621,361K shares.

Movements Among Key Shareholders

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares now holds 473,592K shares, translating to 3.15% ownership. This represents an increase from 457,849K shares in its previous filing, marking a growth of 3.32%. Over the last quarter, the firm raised its portfolio allocation in AAPL by 9.56%.

VFINX – Vanguard 500 Index Fund Investor Shares maintains 409,170K shares, which accounts for 2.72% ownership, up from 398,082K shares reported previously, indicating an increase of 2.71%. The firm boosted its portfolio allocation in AAPL by 4.51% this past quarter.

Geode Capital Management holds 340,165K shares, representing 2.26% ownership. In its earlier filing, the firm reported ownership of 333,858K shares, showing a 1.85% increase. Their portfolio allocation in AAPL also rose by 4.89% over the last quarter.

Berkshire Hathaway continues to hold 300,000K shares, maintaining a 2.00% stake with no changes in the last quarter.

Price T Rowe Associates has 220,108K shares, representing 1.47% ownership. This is a decrease from 235,581K shares in their prior filing, showing a decline of 7.03%. However, they increased their portfolio allocation in AAPL by 0.54% over the last quarter.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.