Roth MKM Boosts Tesla Rating to Buy: What Investors Should Know

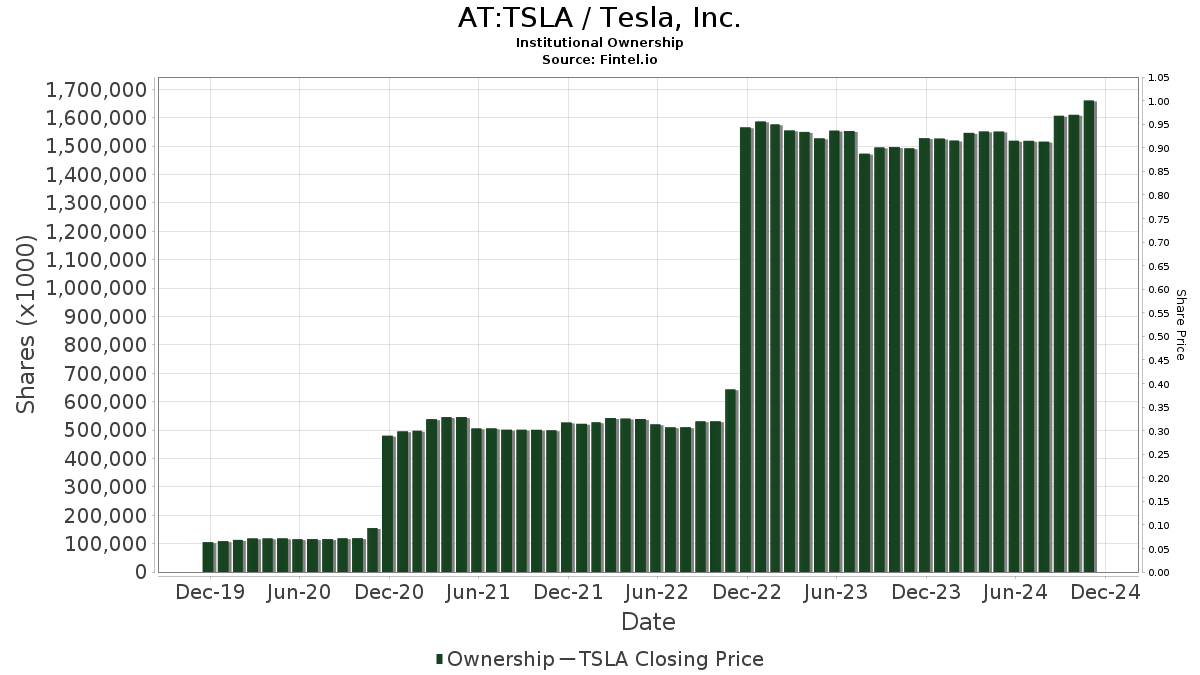

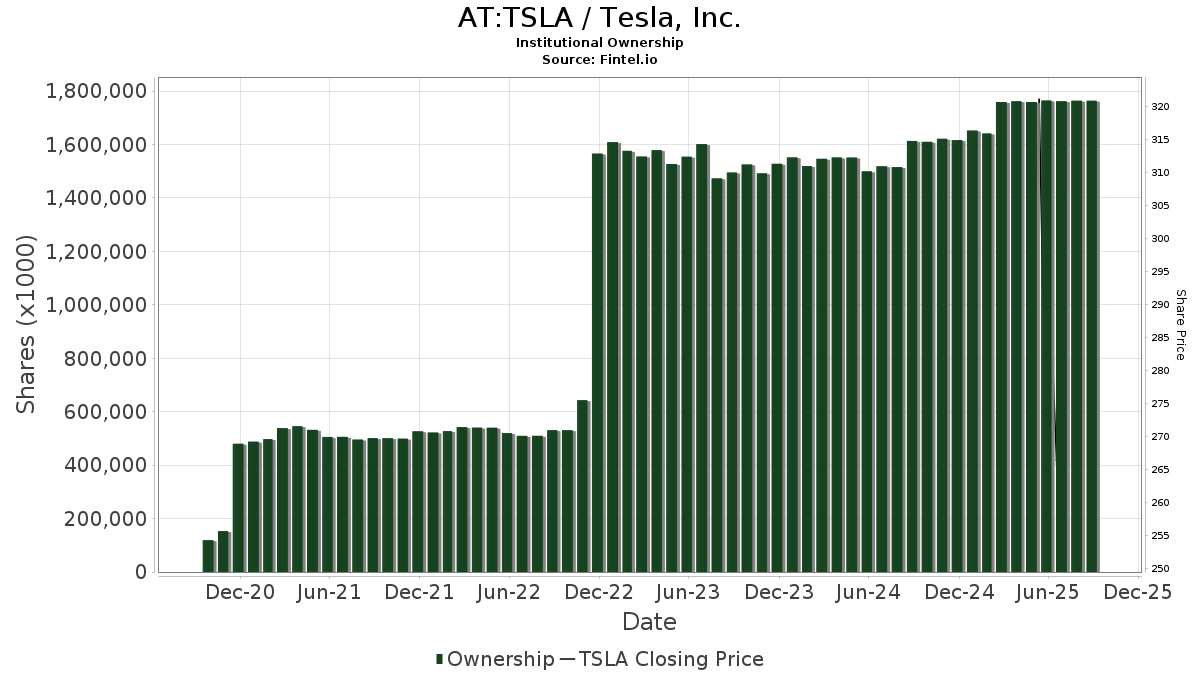

Institutional Interest Grows in Tesla

Fintel reports that on December 2, 2024, Roth MKM upgraded their outlook for Tesla (WBAG:TSLA) from Neutral to Buy.

What is the Fund Sentiment?

Currently, 4,449 funds or institutions hold positions in Tesla. This marks an increase of 271 owners, or 6.49%, from the previous quarter. The average portfolio weight of all funds allocated to TSLA is -10.78%, a staggering rise of 1,337.47%. Over the last three months, the total shares owned by institutions increased by 0.58%, bringing the total to 1,661,032K shares.

Recent Moves by Other Major Shareholders

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares now holds 86,079K shares, reflecting a 2.68% stake in Tesla. This represents an increase from their previous holding of 85,652K shares, showing a growth of 0.50%. The firm has boosted its portfolio allocation in TSLA by 24.80% in the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares reported holding 72,667K shares for a 2.26% ownership in Tesla, up from 71,212K shares prior, marking a 2.00% increase. The fund raised its allocation to TSLA by 24.16% over the past quarter.

Geode Capital Management currently owns 59,356K shares, or 1.85% of Tesla. This is up from 58,334K shares reported earlier, registering a 1.72% gain. This firm, however, reduced its portfolio allocation in TSLA by 35.03% this past quarter.

Capital World Investors holds 42,813K shares, translating to 1.33% ownership of Tesla. This shows a minor increase from their last holding of 42,709K shares, a 0.24% rise. This firm also raised its portfolio allocation to TSLA by 26.01% recently.

Invesco QQQ Trust, Series 1 maintains 36,359K shares, which accounts for 1.13% ownership. Previously, they owned 35,997K shares, representing a 1.00% increase. This firm enhanced its TSLA allocation by 30.63% last quarter.

Fintel is a premier investment research platform for individual investors, traders, financial advisors, and small hedge funds. Our extensive data includes fundamentals, analyst reports, ownership data, and fund sentiment, as well as insights into options sentiment and trading.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.