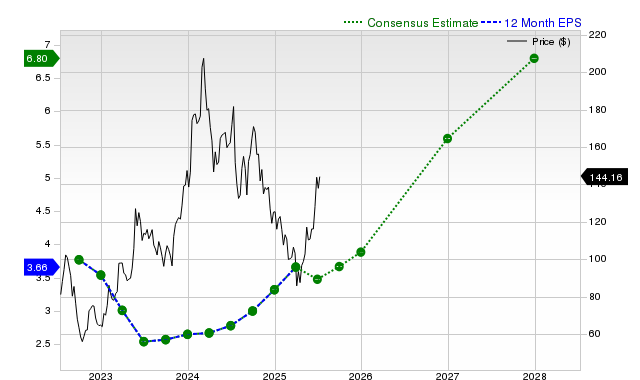

Royal Gold Inc (RGLD) launched new options trading today for December 2026 expiration. This includes a put contract at the $155.00 strike price with a current bid of $17.40, allowing sellers to potentially acquire shares at an effective cost basis of $137.60 — a 3% discount from the current trading price of $159.53. The odds of the put expiring worthless are estimated at 65%, which could yield an 11.23% return on cash commitment or 7.80% annualized.

Additionally, a call contract at the $180.00 strike price is available with a current bid of $18.30. If purchased, this would mean committing to sell shares at that strike price, yielding a potential total return of 24.30% if exercised. This call option has a 50% likelihood of expiring worthless, which would allow investors to retain both their shares and the premium collected, potentially providing an 11.47% return boost or 7.97% annualized.