“`html

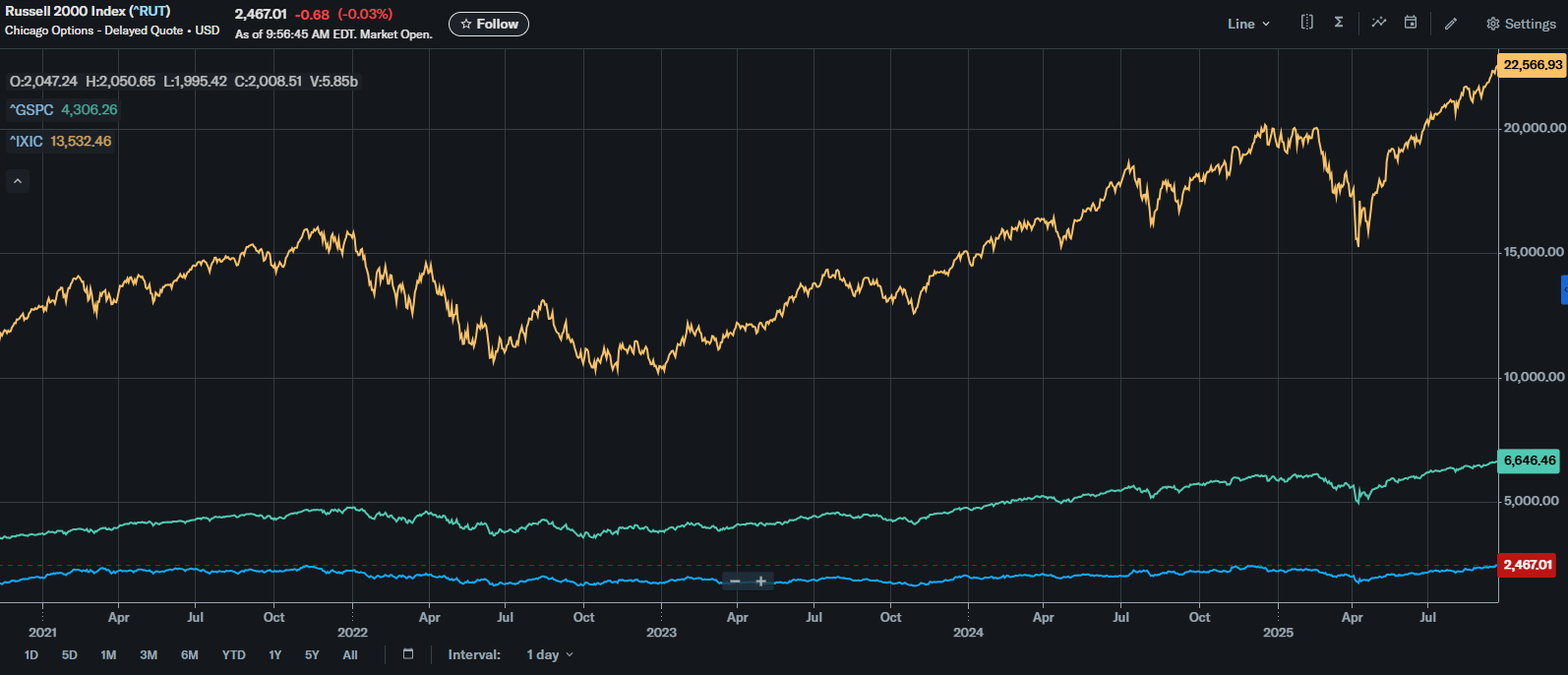

The Russell 2000 index surged over 2.5% to 2,468 this week, surpassing its previous record high of 2,443 set in November 2021. This breakthrough comes after nearly four years of stagnation, primarily due to economic pressures including high interest rates and tariffs. Key factors driving this significant change include recent rate cuts, stabilizing inflation, and decreasing tariff threats, signaling a potential economic recovery.

Historically, when the Russell 2000 hits a new all-time high after at least a year, the S&P 500 experiences gains in 10 out of 11 instances, averaging about 15% returns over the following year. This small-cap breakout could signal increased investor confidence and a broader market rally.

As small caps join the market rally, the tech sector, particularly AI stocks, is also expected to drive significant gains. Investments from major companies like Nvidia (investing $5 billion into Intel) and Microsoft (committing $4 billion to a new AI data center in Wisconsin) highlight the ongoing momentum in AI development. With the Russell 2000’s resurgence, analysts predict a strong year ahead for stocks.

“`