RHP’s Generous Gesture: Declaring a $1.10 Dividend

Ryman Hospitality Properties announced a bittersweet melody on February 22, 2024 – a regular quarterly dividend of $1.10 per share ($4.40 annualized), echoing its previous payout. Enthusiasts must acquire shares before March 27, 2024, to partake in this harmonic dividend chorus. Shareholders in the record as of March 29, 2024, will march towards an April 15, 2024, payback.

The Dividend Yield Symphony

Symphony of numbers: At the current share price of $119.25 per share, the stock orchestrates a dividend yield of 3.69%. Five years of history play a role here – the dividend yield’s average over this period was a sonorous 3.75%, with lows at 0.44% and crescendos soaring to 15.77%. On this symphonic scale, the current yield modestly whispers just 0.03 standard deviations below the historical average, underscoring a sonata of stability.

Melodic Payout Prowess

The company’s dividend payout ratio harmonizes at a resonant 0.84, accentuating its melodic prowess. A payout ratio of one bespeaks a full distribution of income, while figures above one hint at a sour note of financial strain. Companies with growth potential often strike a musical balance between zero and 0.5, retaining earnings to compose a future opus.

The Fund Symphony

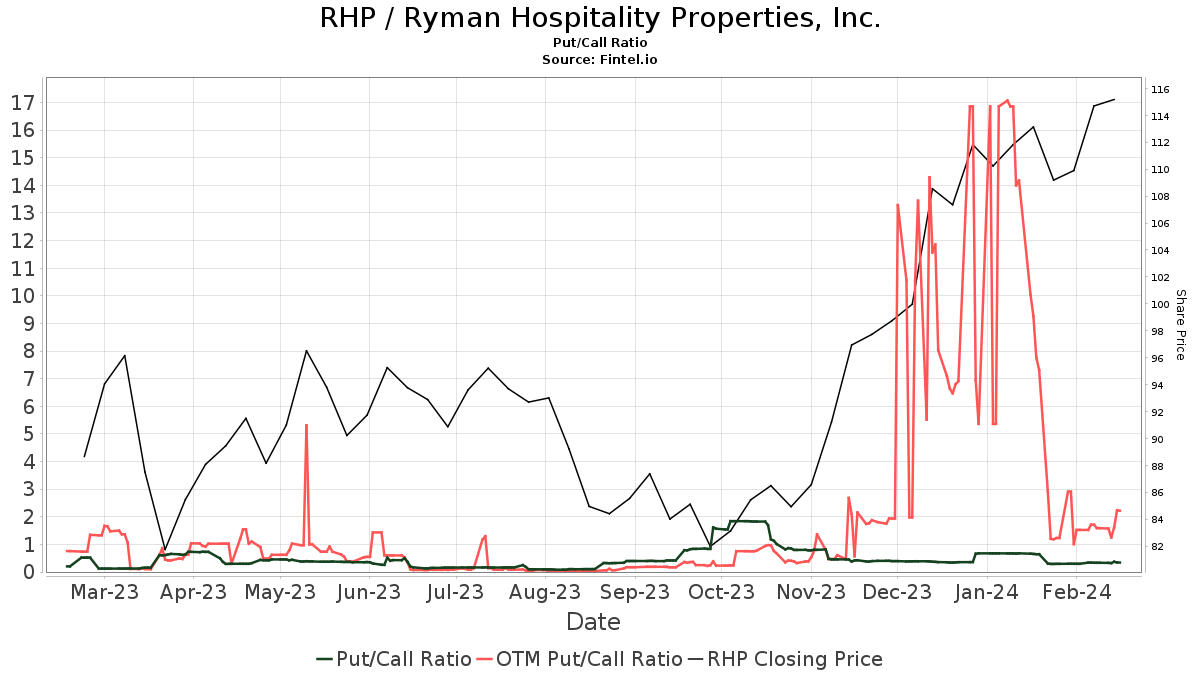

As 743 funds conduct an orchestration with Ryman Hospitality Properties, an uptick of 41 owners or 5.84% adds depth to this financial concerto. Dedications to RHP crescendo at an average portfolio weight of 0.37%, gaining 2.32%. The total institutional shares swell by 1.85% to a grand total of 66,388K shares, teasing a bullish outlook with a put/call ratio of 0.39.

A Forecast of Harmonious Growth

Seeking a cadence of optimism, analyst forecasts serenade a 7.11% upside with an average one-year target price of $127.73, attuned to the current symphony at hand. The company’s projected annual revenue tunes in at 1,968MM, a soft echo of 8.52% decrease, while projecting a non-GAAP EPS of 4.49, resonating a tune of quiet growth.

The Symphony of Shareholder Actions

Institutional stories intertwine in this symphonic movement. VGSIX – Vanguard Real Estate Index Fund Investor Shares, Wellington Management Group Llp, VTSMX – Vanguard Total Stock Market Index Fund Investor Shares, American Century Companies, and Jpmorgan Chase each add their instrumental notes to the shareholder melody. A tale of increases and decreases dances through their portfolio dances of harmony and divergence.

A Symphony to Be Remembered: A Glimpse into Ryman Hospitality Properties

Ryman Hospitality Properties, Inc. (NYSE: RHP) conducts a rich symphony in the realm of lodging and hospitality real estate investment trusts, harmonizing upscale convention center resorts and country music entertainment experiences. A melodic legacy resides in their core holdings, resonating with top-tier convention center hotels across the United States. Under the Gaylord Hotels marque, a vast network orchestrates a ballad of luxury, fortified by Marriott International’s stewardship.

The crescendo of Ryman Hospitality Properties reaches beyond hospitality, encompassing iconic country music brands such as the Grand Ole Opry, Ryman Auditorium, and WSM 650 AM. Weaving in modern cadences, partnerships like Ole Red and Circle complete this sonnet of entertainment. In the realm of business, a diverse medley awaits, calling investors and enthusiasts to witness this harmonic blend of financial dynamics.

Delving into Ryman Hospitality Properties unveils a kaleidoscope of financial compositions, each note carrying the weight of history intertwined with future promise. As the curtains rise on this financial symphony, investors and stakeholders find themselves enraptured by the orchestral interplay of dividends, forecasts, and institutional narratives. With each shareholder movement, a new verse unfolds, enriching the narrative and inviting all to partake in the enduring harmonic journey of Ryman Hospitality Properties.