Three Stocks to Consider Amid Recent Market Corrections

After two years of steady gains, the stock market is now facing one of its most significant corrections in recent history. Major US stock indexes have entered correction territory, with technology and semiconductor sectors—the same ones that previously drove the rally—leading the decline. This downturn has shaken investor confidence as uncertainty persists around tariffs and broader economic policy under the new presidential administration. However, it’s essential to view this market action within a larger context.

A correction of 10% is a normal occurrence in the US stock market, historically observed at least once per year. While these pullbacks can feel unsettling, historical trends show they rarely mark the beginning of a significant or prolonged downturn. Nevertheless, predicting the precise depth or duration of this correction is impossible, prompting many investors to pivot towards defensive stocks that offer more stability in uncertain markets.

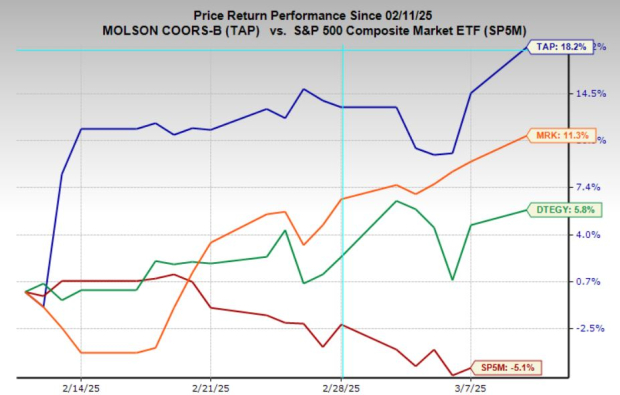

Defensive Stocks Showing Resilience

Among the stocks demonstrating stability, Molson Coors (TAP), Merck & Co. (MRK), and Deutsche Telekom (DTEGY) stand out. Each company possesses strong investment catalysts that extend beyond their defensive characteristics. Let’s explore why these stocks should be on investors’ radar in the current market climate.

Image Source: Zacks Investment Research

Molson Coors: Strong Position and Valuation

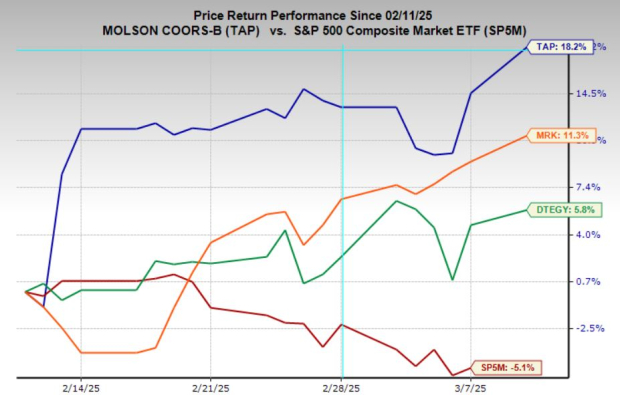

Molson Coors ranks as one of the largest brewing companies globally, offering well-known brands like Coors Light, Miller Lite, Blue Moon, and Molson Canadian. Its solid North American and European presence benefits from consistent consumer demand, even during economic downturns, positioning it as a reliable defensive play amid market volatility.

Currently, Molson Coors holds a Zacks Rank #1 (Strong Buy), supported by rising earnings estimates and positive analyst sentiment. Over the past month, earnings projections for the company have increased by as much as 9.4%, indicating growing confidence in its financial outlook.

In addition to strong earnings momentum, Molson Coors presents a compelling valuation with a forward earnings multiple of just 9.8x. This represents a considerable discount, both compared to the broader market and its historical averages, where the stock’s 10-year median forward multiple stands at 13.1x. With its value proposition and defensive stability, TAP remains an attractive investment in the current environment.

Image Source: Zacks Investment Research

Deutsche Telekom: European Stocks Surging

Deutsche Telekom ranks among the world’s leading telecommunications companies, offering mobile, broadband, and digital services throughout Europe and the United States. It also owns T-Mobile US (TMUS). Notably, Deutsche Telekom dominates major markets in Europe, providing a blend of high-speed internet, mobile services, and enterprise solutions. Moreover, European stocks are experiencing a surprising outperformance relative to US counterparts, representing a notable shift and potential advantage for DTEGY.

With a Zacks Rank #1 (Strong Buy) rating, Deutsche Telekom reflects a positive earnings revision trend. Projections indicate the company will expand its earnings at an annual rate of 11.3% over the next three to five years—a strong indicator for a mature telecom business.

As of now, DTEGY is trading at a one-year forward earnings multiple of 16.6x, slightly above its 10-year median of 14.7x and in line with the industry average. Given the recent outperformance of European equities and analyst upgrades for Deutsche Telekom, this could be a compelling investment for portfolio diversification.

Image Source: TradingView

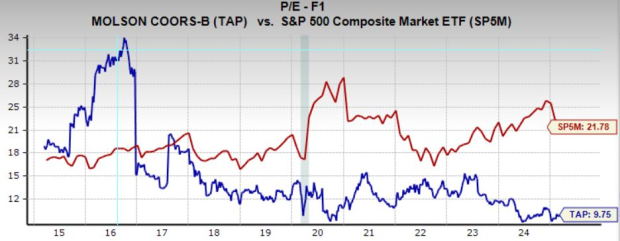

Merck & Co: Healthcare Stocks Poised for Growth

Merck & Co. is a leading global pharmaceutical firm with a wide-ranging portfolio of blockbuster drugs, vaccines, and treatments targeted at oncology, immunology, and infectious diseases. The company is particularly renowned for Keytruda, its leading immunotherapy for various cancers, which has significantly driven revenue growth.

Although Merck’s stock has faced challenges recently, it has surged 20% from recent lows over the last two weeks, indicating a recovery phase. Currently trading at just 10.5x forward earnings, the stock is well below the industry average and its 10-year median of 14.9x, presenting a possible buying opportunity.

Importantly, Merck’s earnings forecast is optimistic, with expected annual growth of 12.7% over the next three to five years. This gives the stock a PEG ratio of only 0.82, suggesting it is undervalued based on projected growth.

Given the strong defensive position of healthcare stocks and Merck’s discounted valuation, it represents an attractive opportunity for investors seeking stability and long-term growth potential.

Exploring Defensive Stocks: TAP, DTEGY, and MRK for Stability

Image Source: Zacks Investment Research

Investor Focus on Defensive Stocks Amid Market Volatility

As the market faces increased volatility, investors seeking stability may want to consider defensive stocks with solid fundamentals. Companies like Molson Coors (TAP), Deutsche Telekom (DTEGY), and Merck (MRK) present diversified opportunities, each with their own catalysts for growth.

Potential for Significant Returns: 5 Stocks to Watch

A Zacks expert has identified five stocks poised for substantial growth, with predictions of +100% or more in 2024. Notably, previous recommendations from Zacks have realized impressive gains, ranging from +143.0% to as much as +673.0%.

Several of these stocks are currently off Wall Street’s radar, hinting at a valuable opportunity for early investors to enter at a lower price point.

Today, discover these 5 potential home runs >>

For those keen on obtaining timely recommendations, Zacks Investment Research offers a free report featuring “7 Best Stocks for the Next 30 Days.” Click here to access it.

Stock Analysis Reports Available

Comprehensive analysis reports are available for investors interested in specific companies:

- Merck & Co., Inc. (MRK) : Free Stock Analysis Report

- Deutsche Telekom AG (DTEGY) : Free Stock Analysis Report

- Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

This article was originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.