Salesforce Prepares to Unveil Q3 Fiscal 2025 Results: What to Expect

Salesforce CRM will release its third-quarter fiscal 2025 results on December 3. The company anticipates total revenues between $9.31 billion and $9.36 billion, with a midpoint of $9.335 billion. According to the Zacks Consensus Estimate, expected revenues stand at $9.34 billion, suggesting a 7.1% increase from last year’s third-quarter earnings.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

For non-GAAP earnings per share, Salesforce expects figures between $2.42 and $2.44. The consensus estimate remains steady at $2.43, reflecting a 15.2% increase from the same period last year.

Image Source: Zacks Investment Research

Historically, Salesforce has outperformed the Zacks Consensus Estimate for earnings in its previous four quarters, achieving an average surprise of 3.8%.

Salesforce Inc. Price and EPS Surprise

Salesforce Inc. price-EPS surprise | Salesforce Inc. Quote

Here’s a look at what’s expected ahead of the release.

Key Drivers for Salesforce’s Third Quarter Performance

Salesforce appears set to deliver strong third-quarter results due to its focus on digital transformation and cloud services. As businesses globally continue to adopt digital tools, Salesforce’s alignment with customer demands may have contributed to revenue growth.

The rising interest in generative AI-integrated cloud solutions has been crucial for Salesforce. By incorporating generative AI into its products, the company enhances customer engagement and fortifies its competitive stance in the customer relationship management sector, which may have significantly impacted revenue this quarter.

Strengthening relationships with key brands across various sectors and expanding into new geographic markets has been vital to Salesforce’s growth strategy. Its increasing presence in the public sector also likely opened up new avenues for growth during this quarter.

The acquisitions of Spiff and Airkit.ai have enhanced Salesforce’s capabilities, diversifying its revenue streams. These additions are expected to have contributed to higher subscription revenues, especially within its core cloud services. Projected revenues for key cloud categories include Sales at $2.03 billion, Service at $2.24 billion, Platform & Other at $1.79 billion, Marketing & Commerce at $1.29 billion, and Data at $1.45 billion. Expected revenues from the Subscription and Support segment are around $8.8 billion, with $537 million from Professional Services.

Nonetheless, a decline in software spending by small and medium businesses due to ongoing economic uncertainties and geopolitical tensions may have hindered Salesforce’s revenue growth in Q3. Additionally, rising competition from Oracle and Microsoft, coupled with foreign exchange challenges, presents further obstacles.

On a positive note, the company’s cost restructuring efforts, including workforce reductions, are likely to enhance profitability. In the first quarter of fiscal 2025, Salesforce achieved a non-GAAP operating margin increase of 210 basis points to 33.7%, driven by improved gross margins and the benefits of its restructuring initiatives.

Salesforce’s Stock Performance and Valuation

This year, Salesforce shares have risen 25.5%, outperforming the Zacks Computer – Software industry, which grew by 16.9%. However, compared to peers, Salesforce has lagged behind SAP SE (up 50.2%) and Oracle (up 73.3%), though it has outpaced Microsoft (up 12.1%).

YTD Price Return Performance

Image Source: Zacks Investment Research

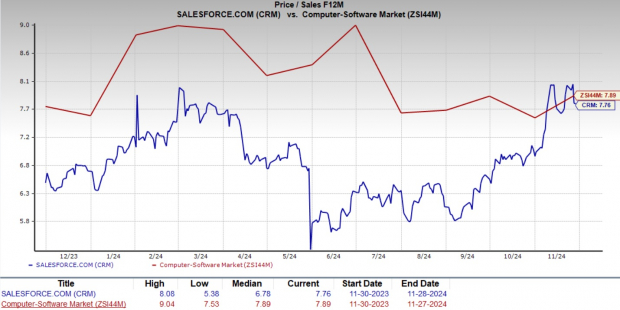

Currently, CRM stock is trading at a forward 12-month price-to-sales ratio of 7.76X, slightly below the industry average of 7.89X, indicating potential value for investors.

Image Source: Zacks Investment Research

Concerns Over Slowing Sales Growth

Salesforce, previously known for consistent double-digit revenue growth, is now facing significant challenges as sales growth slows. In the first quarter of fiscal 2025, growth was in low double digits, a stark contrast to the over 20% annual growth the company typically achieved until fiscal 2022.

This slowdown is not expected to be temporary; it highlights deeper issues within Salesforce and the overall market. Economic pressures and geopolitical issues have prompted firms to trim IT budgets, leading to delayed investments, which affect Salesforce’s growth potential.

Moreover, Salesforce has shifted focus from rapid expansion to improving margins. While this strategy has improved short-term profitability, it has restricted investments in key areas such as sales and marketing, potentially hampering the company’s long-term growth and innovation capabilities.

Current estimates suggest that Salesforce’s revenue growth may further decelerate, settling in the mid-to-high single-digit percentage range for fiscal years 2025 and 2026, which is significantly below its historical performance. This slowdown is anticipated to also impact earnings growth.

Salesforce Faces Slowing Growth: What Investors Should Know

Understanding Salesforce’s Current Challenges

Salesforce’s earnings per share are expected to grow at a compound annual growth rate (CAGR) of only 15.3% over the next five years. This marks a significant slowdown from the impressive 42.9% CAGR the company enjoyed in the previous five-year span. Given these challenges, investors might need to reevaluate their holdings in the tech giant.

Salesforce’s deceleration in sales growth is a noteworthy concern. The company currently carries a Zacks Rank #4 (Sell), indicating its struggles to keep pace with the broader market as well as its competitors.

For those considering their investment strategies, holding onto Salesforce stock may mean enduring a stretch of reduced performance. Investors aiming to enhance their returns might find it sensible to consider selling their shares at this juncture.

Exploring New Investment Frontiers: Nuclear Energy

As global electricity demand continues to surge, reducing reliance on fossil fuels like oil and natural gas has become increasingly urgent. Nuclear energy presents a promising alternative for this transition.

Recently, leaders from the U.S. and 21 other nations pledged to triple global nuclear energy capacities. This significant commitment could yield substantial gains for nuclear-related stocks, presenting a timely opportunity for savvy investors willing to act swiftly.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, delves into the key players and innovations driving this emerging market, spotlighting three standout stocks that are well-positioned to benefit the most.

Access your free report today: Atomic Opportunity: Nuclear Energy’s Comeback.

Interested in the latest stock recommendations from Zacks Investment Research? Download 5 Stocks Set to Double free today.

For more detailed analyses, see the free stock reports for:

- Microsoft Corporation (MSFT)

- Salesforce Inc. (CRM)

- SAP SE (SAP)

- Oracle Corporation (ORCL)

For further insights, click here to read this article on Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.