Salesforce Stock Surges Driven by Market Optimism and Trade Deal

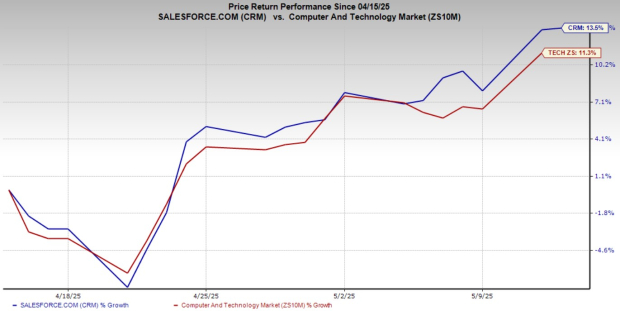

Salesforce, Inc. (CRM) has experienced a remarkable 13.5% increase in its share price over the last month, outperforming the broader Zacks Computer and Technology sector, which gained 11.3% during the same timeframe.

Image Source: Zacks Investment Research

This notable performance prompts the question: Should investors realize profits now, or continue holding the stock?

Factors Behind CRM Stock’s Rise

The recent rally in Salesforce’s stock can be attributed to an overall boost in market sentiment. Improved relations in U.S.-China trade negotiations have lifted market optimism since late April. Historically, prolonged trade tensions had dampened economic projections and corporate earnings forecasts due to rising tariffs and retaliatory actions.

Earlier this week, the United States and China announced a deal to temporarily reduce tariffs. The U.S. plans to lower its tariffs on Chinese imports from 145% to 30%, while China will cut its duties on U.S. imports from 125% to 10%, effective for 90 days.

This recent agreement suggests a reduction in tensions between the two largest economies and the promise of more fluid international trade. As investor fears around economic disruption eased, the equity market rallied, highlighting a brighter outlook for global growth.

Salesforce was not alone in benefiting from this market optimism. Other enterprise software firms, including Oracle Corporation (ORCL), Microsoft Corporation (MSFT), and SAP SE (SAP), also saw substantial gains, with shares rising by 21.2%, 16.4%, and 10.6%, respectively, in the past month.

Given Salesforce’s long-term growth potential alongside heightened investor enthusiasm, the stock appears worth holding at this time.

Salesforce’s Strong Market Position in CRM

Salesforce maintains its position as the leading provider of customer relationship management (CRM) software, outpacing key competitors like Microsoft, Oracle, and SAP. According to Gartner’s rankings, Salesforce holds the largest market share, a position unlikely to diminish in the near future.

The company has cultivated a robust ecosystem that effectively integrates various enterprise applications. Its strategic acquisitions — including Slack and recently the Own Company — reflect a long-term vision to expand beyond traditional CRM into areas like enterprise collaboration, data security, and AI-driven automation.

AI plays a significant role in Salesforce’s growth. Since launching Einstein GPT in 2023, the company has integrated generative AI across its platform, empowering customers to automate workflows, enhance decision-making, and improve customer interactions. As industries increasingly adopt generative AI, Salesforce is well-positioned to take advantage of this trend.

Further supporting Salesforce’s long-term outlook is rising global expenditure on generative AI. Gartner projects worldwide spending on generative AI to reach $644 billion by 2025, reflecting a 76.4% year-over-year increase. The enterprise software segment, crucial for Salesforce, is anticipated to grow even more rapidly, with a projected increase of 93.9%. Despite potential short-term spending slowdowns due to economic factors, digital transformation continues to be a critical priority for businesses, ensuring steady demand for Salesforce’s offerings.

Salesforce Valuation Appears Attractive

Despite the recent price surge, Salesforce stock is trading at a comparatively low valuation multiple relative to the Zacks Computer – Software industry. Currently, shares trade at a forward 12-month price-to-earnings (P/E) multiple of 25.24X, below the industry average of 31.77X.

Image Source: Zacks Investment Research

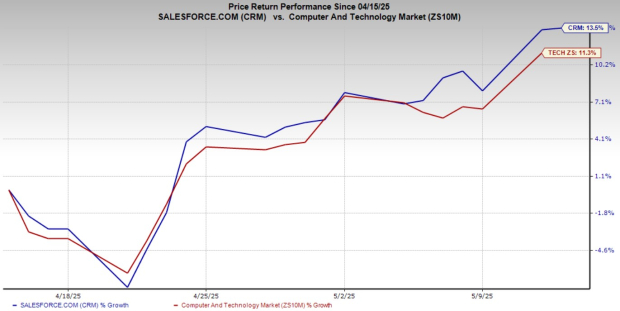

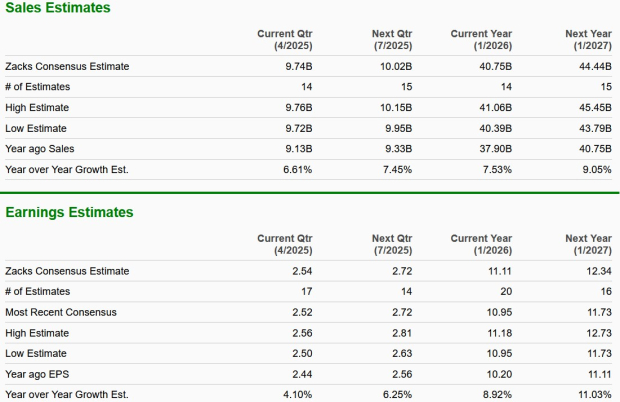

Slow Sales Growth Poses Challenges

While Salesforce’s longer-term prospects remain optimistic, the company confronts significant near-term hurdles. Revenue growth has slowed from its historical double-digit rates to single-digit increases in recent quarters. This deceleration reflects cautious spending among enterprises amid prevailing economic uncertainties and geopolitical pressures. Analysts forecast this trend will persist, anticipating mid-to-high single-digit growth for fiscal years 2026 and 2027.

Image Source: Zacks Investment Research

This slowdown indicates a shift in enterprise behavior, with organizations opting for smaller, incremental projects instead of comprehensive digital transformations. For Salesforce, adapting its approach will be crucial to remain relevant in the evolving IT spending landscape.

Conclusion: Maintain Position in Salesforce Stock

Salesforce continues to dominate the enterprise software landscape, with strong positioning in AI and CRM markets. Its current valuation appears attractive, and long-term trends such as AI adoption and digital transformation support its growth narrative. Although slowing sales growth is a valid concern, Salesforce is expected to rebound strongly once macroeconomic conditions and trade dynamics stabilize.

Therefore, for investors with a long-term perspective, holding the stock seems prudent. Currently, CRM holds a Zacks Rank #3 (Hold).

Insights from Zacks’ Research Team

Our experts have identified five stocks with high potential for significant gains in the near future. Among them, the Director of Research has singled out one stock expected to climb the highest.

This standout is noted for its innovation in the financial sector, boasting a rapidly expanding customer base and a versatile range of cutting-edge solutions. While not all selections lead to success, this one is considered likely to exceed previous Zacks stocks that achieved notable gains.

Microsoft Corporation (MSFT): Free Stock Analysis report

Salesforce Inc. (CRM): Free Stock Analysis report

SAP SE (SAP): Free Stock Analysis report

Oracle Corporation (ORCL): Free Stock Analysis report

This article is based on information from Zacks Investment Research.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.