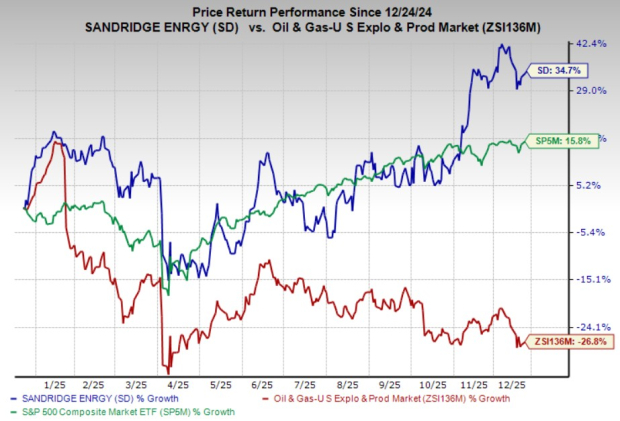

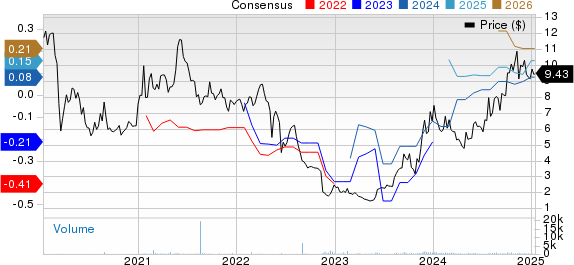

SandRidge Energy, Inc. (SD) reported a 34.7% gain over the past year, surpassing the industry’s 26.8% decline and the S&P 500’s 15.8% return. For the third quarter of 2025, the company achieved average production of 19 MBoe per day, a 12% increase year over year, with oil output rising by 49%. Total revenues reached $39.8 million, a 32% year-over-year growth, leading to a net income of $16 million, or 44 cents per share.

Key developments include the ongoing one-rig Cherokee development program, which has produced four wells with average peak production rates of 2,000 gross Boe per day. As of the end of the quarter, SandRidge held $102.6 million in cash, maintaining zero debt, and declared a dividend of 12 cents per share, payable on November 28, 2025. Notably, the company repurchased 0.6 million shares for $6.4 million in 2025, with $68.3 million remaining under its $75 million repurchase authorization.

Looking ahead, the 2026 outlook suggests weaker oil prices, with Brent crude projected to average $55 per barrel, while natural gas remains relatively strong at $4.01 per MMBtu. Despite the softer outlook for oil, SandRidge stands to benefit from increased natural gas demand supported by rising LNG exports.