Understanding Wall Street’s Take on Schlumberger: Invest Wisely

Investors often turn to Wall Street analysts for guidance on stock decisions. The ratings from brokerage firms can significantly influence stock prices, but how dependable are these recommendations?

Let’s explore the outlook on Schlumberger (SLB) and examine the implications of brokerage ratings in making informed investment choices.

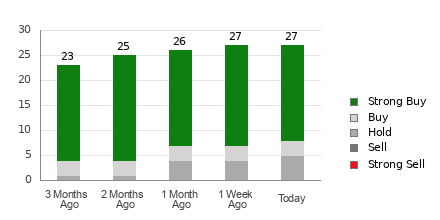

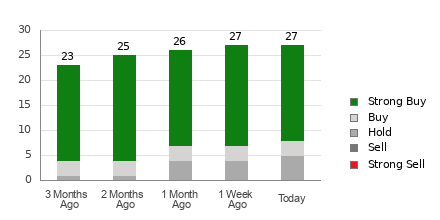

Currently, Schlumberger has an average brokerage recommendation (ABR) of 1.48 on a scale from 1 to 5, with 1 being Strong Buy and 5 being Strong Sell. This rating is based on the assessments from 27 brokerage firms, with an average rating of 1.48 suggesting a position between Strong Buy and Buy.

Out of the 27 recommendations, 19 are classified as Strong Buy, while three are rated as Buy. Altogether, Strong Buy and Buy recommendations account for 70.4% and 11.1%, respectively.

Evaluating Brokerage Recommendations for SLB

View Schlumberger’s price target and stock forecast here>>>

While the ABR leans towards buying Schlumberger, it’s advisable to not rely solely on this rating. Research indicates that brokerage recommendations often fail to guide investors toward stocks with significant price appreciation potential.

Why is there a discrepancy? Brokerage analysts often display a strong positive bias due to the interests of their firms. Studies show that for every five “Strong Buy” ratings, there is typically only one “Strong Sell” recommendation.

This suggests that retail investors might not always find alignment with brokerage perspectives, complicating predictions for a stock’s future performance. Investors are encouraged to use these ratings as a means to support their own analyses or tools proven effective for predicting stock price changes.

Zacks Rank, an in-house stock rating system with a verified track record, strings stocks into five categories from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). The Zacks Rank is often a solid indicator of a stock’s near-term performance. Hence, validating the ABR through the Zacks Rank may enhance investment decisions.

Distinguishing Between ABR and Zacks Rank

Despite both measures being rated on a scale of 1 to 5, ABR and Zacks Rank represent different concepts.

The ABR is derived from brokerage recommendations, usually presented with decimals (e.g., 1.28). In contrast, the Zacks Rank employs a quantitative methodology based on earnings estimate revisions, displayed as whole numbers from 1 to 5.

Analysts from brokerage firms often lean toward optimism, providing more favorable ratings than their research supports, which can mislead investors. Zacks Rank, driven by earnings estimate revisions, stands apart as it effectively correlates stock price movements with trends in earnings estimates, as research indicates.

Additionally, the Zacks Rank maintains balance among its five categories, applying different ratings uniformly across all stocks analyzed by brokerage research.

Another distinction is the timeliness of updates. The ABR might not always reflect the latest changes, whereas Zacks Rank promptly incorporates revisions in earnings estimates based on shifting business conditions.

Is SLB a Sound Investment?

Recent updates show that the Zacks Consensus Estimate for Schlumberger has decreased 9.3% to $3.38 this month.

This decline signals increasing analyst skepticism regarding the company’s profit outlook, which may point to a potential drop in stock price in the short term.

The significant change in the consensus estimate, combined with three other earnings-related factors, positions Schlumberger at Zacks Rank #5 (Strong Sell). You can see today’s Zacks Rank #1 (Strong Buy) stocks here>>>>

Given these insights, investors should approach the favorable ABR for Schlumberger cautiously.

Just Released: Zacks Top 10 Stocks for 2025

Discover the top picks for 2025, curated by Zacks Director of Research, Sheraz Mian. This select portfolio has delivered remarkable results, boasting a gain of +2,112.6% since its inception in 2012, far surpassing the S&P 500’s +475.6%. With careful analysis of 4,400 companies covered by Zacks Rank, Sheraz has selected the 10 best stocks for buying and holding this year. Get exclusive access to these newly released stocks with substantial growth potential.

Looking for fresh recommendations? Download 7 Best Stocks for the Next 30 Days for free.

Schlumberger Limited (SLB): Detailed Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.