Scotiabank Initiates Coverage of Cogent Biosciences with Positive Outlook

Fintel reports that on March 7, 2025, Scotiabank began coverage of Cogent Biosciences (NasdaqGS:COGT) with a Sector Outperform rating.

Analyst Price Forecast Indicates Strong Upside Potential

As of March 4, 2025, analysts set the average one-year price target for Cogent Biosciences at $16.73 per share. This target reflects a wide range, from a low of $8.08 to a high of $25.20. Notably, this average suggests a substantial increase of 138.63% from its most recent closing price of $7.01 per share.

See our leaderboard of companies with significant price target upside.

Projected Revenue and Earnings

Cogent Biosciences anticipates an annual revenue of $15 million, indicating a remarkable increase of ∞%. The projected annual non-GAAP earnings per share (EPS) stands at -$2.18.

Institutional Ownership and Fund Sentiment

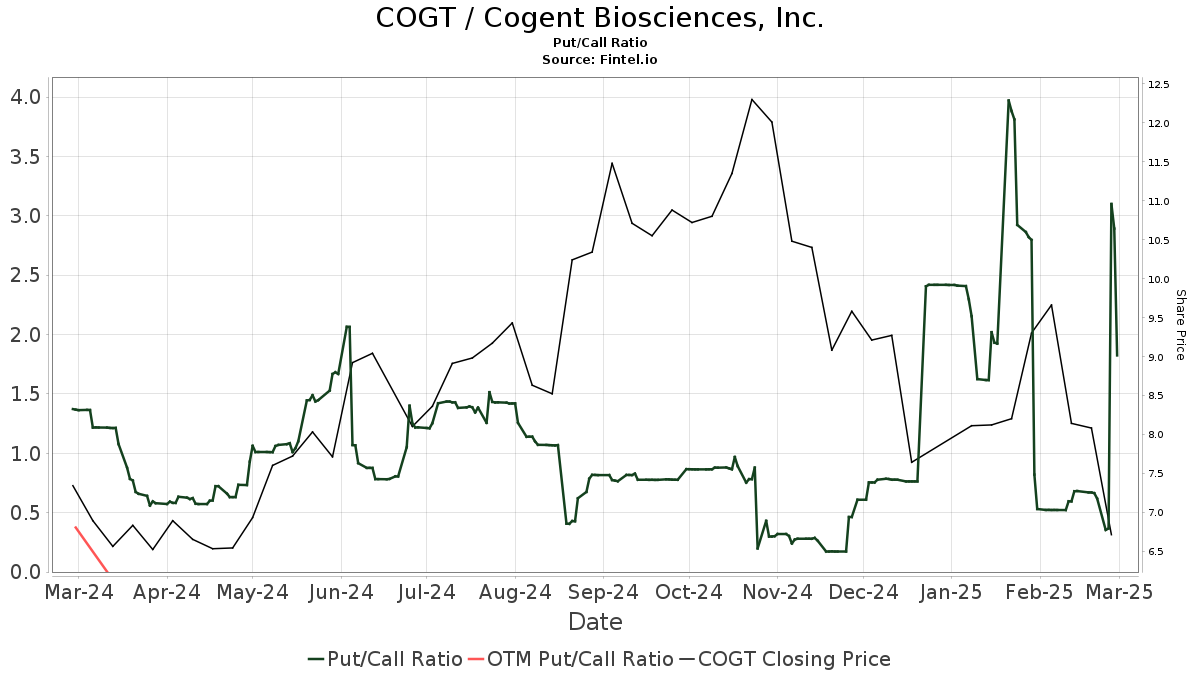

There are currently 346 funds or institutions with reported positions in Cogent Biosciences, marking an increase of 18 owners, or 5.49%, in the last quarter. The average portfolio weight dedicated to COGT across these funds is 0.20%, which reflects an increase of 8.88%. Total institutional shares increased by 0.15% over the past three months, bringing ownership to 130,357K shares.  The current put/call ratio for COGT is 1.48, signaling a bearish sentiment among investors.

The current put/call ratio for COGT is 1.48, signaling a bearish sentiment among investors.

Key Institutional Shareholders

Kynam Capital Management holds 9,105K shares, representing 8.24% ownership of Cogent Biosciences. This is a reduction from their previous holding of 9,240K shares, a decline of 1.48%. Their portfolio allocation in COGT has decreased by 45.13% over the last quarter.

TCG Crossover Management retains 6,964K shares, representing 6.30% ownership, with no change noted for the last quarter.

Commodore Capital owns 6,882K shares, or 6.23% of the company, down from 7,540K shares previously, reflecting a 9.57% decrease in ownership. Their portfolio allocation has reduced by 22.70% in the last quarter.

Fairmount Funds Management maintains its position with 6,226K shares, representing 5.64% ownership, unchanged from the last quarter.

VR Adviser holds 5,684K shares, equivalent to 5.15% ownership. Their holdings are consistent with their last report, but they decreased their portfolio allocation in COGT by 5.38% over the past quarter.

Background on Cogent Biosciences

Cogent Biosciences Background Information

(This description is provided by the company.)

Cogent Biosciences is a biotechnology firm dedicated to developing precision therapies for genetically defined diseases. Its leading clinical program, PLX9486, is a selective tyrosine kinase inhibitor aimed at effectively inhibiting the KIT D816V mutation and other mutations found in KIT exon 17. The KIT D816V mutation is pivotal in causing systemic mastocytosis, a serious condition due to the uncontrolled proliferation of mast cells. Additionally, exon 17 mutations are also implicated in advanced gastrointestinal stromal tumors (GIST), a cancer type that heavily relies on oncogenic KIT signaling. Cogent Biosciences is headquartered in Cambridge, MA.

Fintel provides a comprehensive investing research platform for individual investors, traders, advisors, and small hedge funds.

Our data spans global fundamentals, analyst reports, ownership data, fund sentiment, options market insights, insider trading, options flow, unusual options trades, and more. Additionally, our exclusive Stock picks utilize advanced, backtested quantitative models aimed at enhancing profitability.

Click to learn more.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.