Scotiabank Begins Coverage of Innoviva with Positive Outlook

Fintel reports that on March 7, 2025, Scotiabank initiated coverage of Innoviva (NasdaqGS:INVA) with a Sector Outperform recommendation.

Analyst Price Forecast and Revenue Projections

As of March 4, 2025, the average one-year price target for Innoviva is $19.38 per share, with forecasts ranging from a low of $19.19 to a high of $19.95. This average price target indicates a potential increase of 9.86% from the most recent closing price of $17.64 per share.

The projected annual revenue for Innoviva is $318 million, reflecting a decrease of 11.35%. The anticipated annual non-GAAP EPS is set at 0.79.

Fund Sentiment Overview

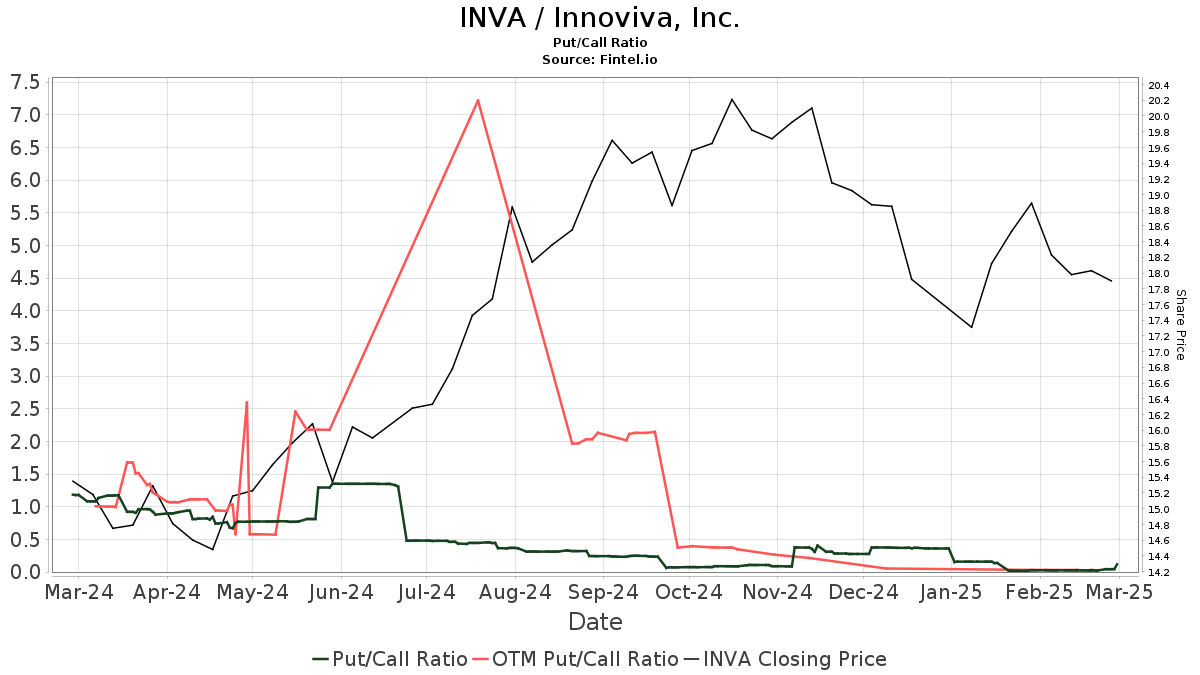

Currently, 548 funds or institutions are reporting positions in Innoviva, an increase of 22 owners or 4.18% from the last quarter. The average portfolio weight of all funds allocated to INVA is now 0.20%, showing a rise of 7.08%. Nevertheless, total shares owned by these institutions fell by 1.35% in the past three months, totaling 93,727,000 shares.  Notably, the put/call ratio for INVA stands at 0.05, indicating a bullish sentiment among investors.

Notably, the put/call ratio for INVA stands at 0.05, indicating a bullish sentiment among investors.

Institutional Ownership Changes

Sarissa Capital Management maintains a significant position with 7,277,000 shares, which represents 11.61% ownership of the company, showing no change over the last quarter.

Additionally, PHSTX – Putnam Global Health Care Fund holds 5,248,000 shares, equating to 8.37% ownership. This reflects a decrease from 5,311,000 shares previously reported, constituting a reduction of 1.20%. Notably, the firm increased its portfolio allocation in INVA by 7.45% over the last quarter.

Franklin Resources owns 4,432,000 shares, or 7.07% of the company, down significantly from 6,745,000 shares—a decrease of 52.18%. This decline corresponds to a 90.29% decrease in their portfolio allocation over the past quarter.

Renaissance Technologies holds 4,262,000 shares, which is 6.80% ownership, down slightly from their prior holdings of 4,330,000 shares—representing a decrease of 1.60%. Recently, they also reduced their portfolio allocation in INVA by 12.95%.

Lastly, the IJR – iShares Core S&P Small-Cap ETF holds 3,570,000 shares, representing 5.70% ownership, up from their previous holding of 3,511,000 shares, indicating an increase of 1.64%, despite a 10.11% decline in their portfolio allocation over the last quarter.

Company Profile: Innoviva

(This description is provided by the company.)

Innoviva, Inc. is a health-focused asset management company that aims to engage in the development, commercialization, and financial management of biopharmaceuticals. The company operates primarily in the United States.

Fintel serves as a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds.

Our extensive data covers global fundamentals, analyst reports, ownership data and fund sentiment, all contributing to informed investment decisions. Furthermore, our range of advanced, backtested quantitative models aims to enhance profits through exclusive stock picks.

Click to learn more.

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.